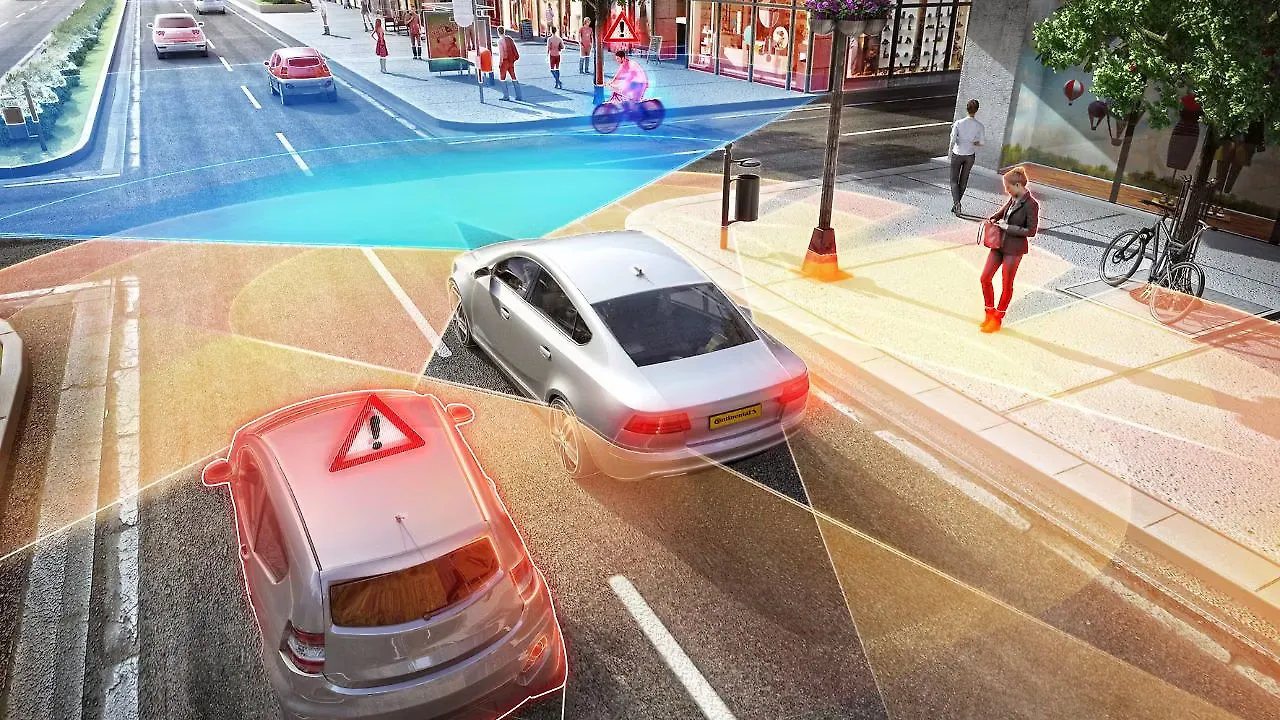

The automotive sector is on the brink of a major transformation, largely fueled by rapid advancements in Advanced Driver Assistance Systems (ADAS). The growing stringency of global vehicle safety regulations is a key driver behind the rise of ADAS technologies. From adaptive cruise control to automatic emergency braking and blind-spot detection, these systems are becoming essential features in new vehicles. Moreover, the luxury vehicle sector, which often leads in adopting advanced technologies, is swiftly integrating these systems to enhance safety and comfort for both drivers and passengers.

Despite the promising growth, the high costs associated with implementing advanced ADAS systems, along with concerns over environmental impact and data security, present significant challenges for market players. Although expensive, end-consumers seek these technologies for their capabilities. Therefore, companies like Continental face the challenge of developing and offering solutions at competitive costs, not only in India but globally.

Addressing these cost challenges, Ismail Dagli, Head of the Autonomous Mobility Business Area at Continental AG, noted that new technologies for mass markets have advanced tremendously over the past few years, from Level-2 Plus to Level-4 automation. There are solutions available in the market ranging from $100 to $500. However, higher automation levels, such as those required for autonomous trucking or Robo taxis, involve different applications and may not fall within this price range due to the need for additional backups and other complexities.

Although many new technologies are emerging, obsolescence remains high. A critical question is whether companies can fully monetise these technologies. Dagli noted that this challenge has persisted for several years. He recommended a scalable approach, allowing companies to reuse core system components and leverage economies of scale.

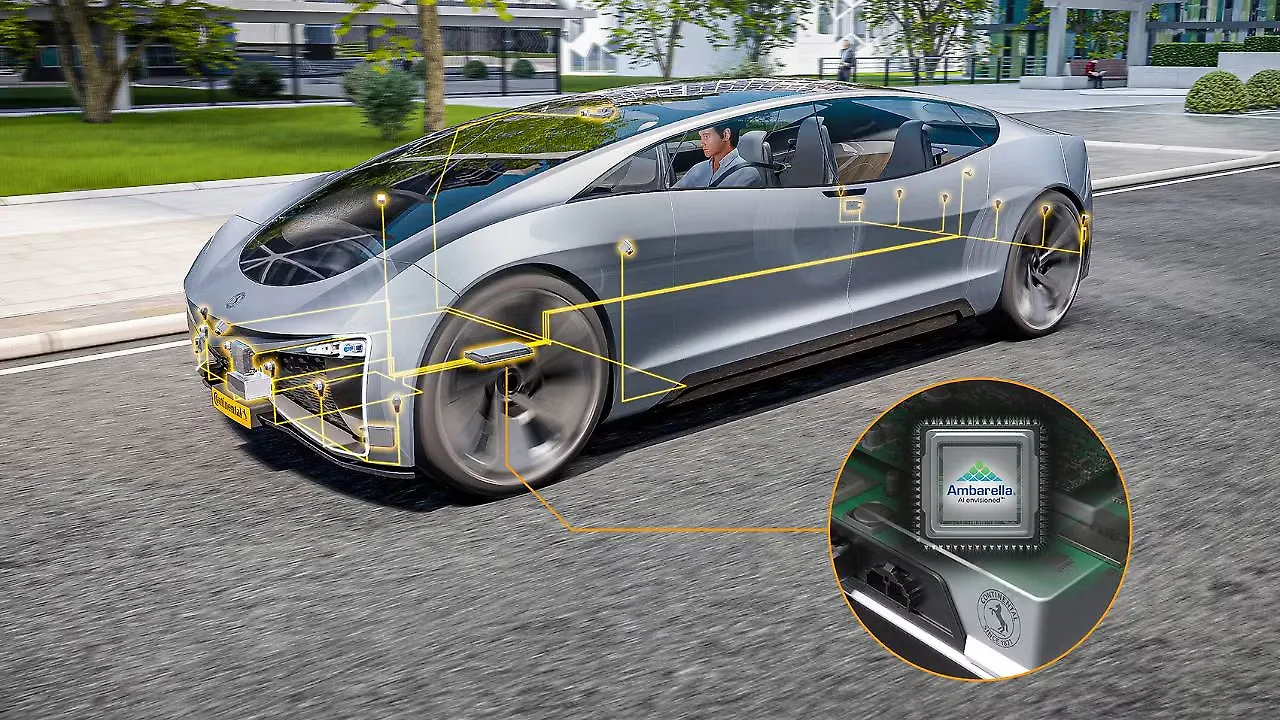

Flexibility is crucial as customers require tailored solutions specific to market conditions. Therefore, it is essential to have an open and scalable architecture. Continental, supported by its partner Ambarella, utilises cost and power-efficient chip technology for neural networks and large language models, ensuring scalability. The entry-level chip targets the mass market, while the high-end chip serves the premium segment. 'This approach,' Dagli said, 'is key to avoiding disruption after three or four years and enables scaling the solution across many platforms. This will be a key success factor in the future.'

Certain safety technologies are not regulated by the Government, but companies like Continental are proactively developing them to achieve their Vision Zero objective. Discussing these non-mandated technologies, Dagli explained that companies are committed to implementing all mandated features. Continental is also open to adding functional features that enhance safety, even if they are not required by regulations. OEMs are very much interested in these solutions, provided they are cost-effective. While safety may not be a differentiating element, it becomes state-of-the-art once implemented universally. However, there can be no compromise on safety.

Transforming Vehicle Architecture: From ECUs To High-Performance Computers (HPCs)

The traditional vehicle architecture is evolving rapidly, with HPCs replacing numerous electronic control units (ECUs). Dagli views this transformation in two ways. He notes that new-generation companies (greenfield) have more freedom to act and can define centralised architectures from the outset, creating efficient integrated systems.

On the other hand, traditional companies (brownfield) come from existing architectures and require different roadmaps to transition to centralised computing. 'We assist our customers with a variety of products for traditional architectures, while also bringing expertise in Software Defined Vehicles (SDV) and centralised compute architecture,' Dagli explained. 'We help our customers efficiently define their roadmaps, ensuring the business case is viable and the transition happens quickly and cost-effectively. This is where our value addition lies, as we are strong in traditional architectures and possess the necessary components, including central compute electronics and operating systems through our subsidiary Elektrobit, the ADAS stack, and various vehicle functions. We can support our customers in their journey towards future architecture,' he added.

Adapting To Consumer Demand

Driven by consumer preference, many companies are transitioning from mass production to mass customisation. While software can manage some of these challenges, hardware customisation presents greater difficulties. Dagli recommends scalability, with customisation occurring primarily through software. Mass production remains vital and is a key success factor. It is crucial to globally manufacture high-quality products, especially electronics-based mechatronics, with consistent quality and low cost. 'This will be a differentiating factor,' Dagli stated. 'These architectures will also allow us to define the user experience and vehicle features throughout its lifecycle via software updates. It's not about choosing one approach over the other; both mass production and customisation will coexist. Succeeding in both realms will be crucial for Tier-1 suppliers in the future' he opined.

Also Read:

Continental Thrives On India's Skilled Workforce, Market Importance

Continental Advances Server-Based Vehicle Architectures With Zone Control Units