It was a little over two decades ago at the Frankfurt Motor Show when a handful of Chinese auto brands showcased their offerings at this massive event.

The general reaction was one of gentle ridicule, condescension and raised eyebrows… visitors found the names funny and clearly the products on display were not a patch on powerful European brands to whom the Frankfurt Motor Show was their bastion.

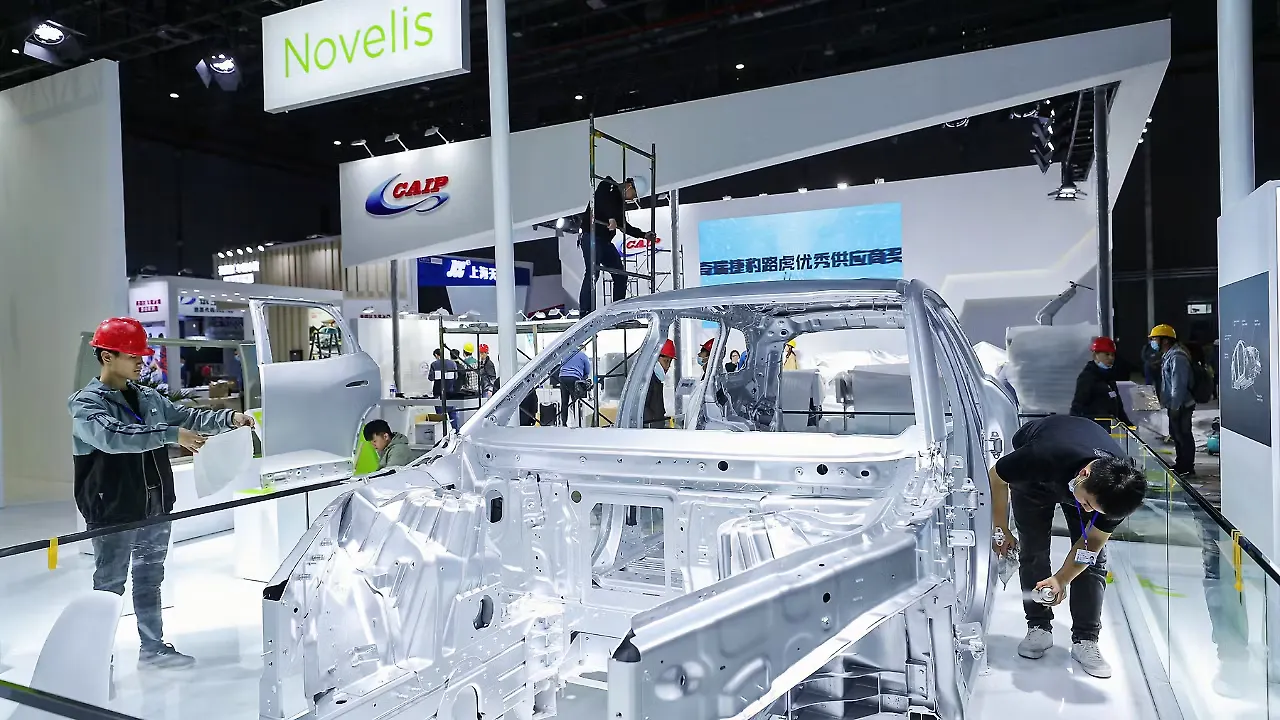

Now fast forward to the ongoing Shanghai Auto Show — Auto Shanghai 2023 — where the whole automotive world is completely gobsmacked with the array of Chinese brands on display. While the underlying message is clearly electric, there have been ‘oohs’ and ‘aahs’ on the styling and design too.

The Chinese have come a long way since the awkward Frankfurt days of the 1990s and have now sought to convey in no uncertain terms that they will call the shots in the future, especially as the automotive world goes electric.

What is even more significant about Auto Shanghai is that it has had pretty much all the global CEOs of the industry in attendance. This is after China attracted the ire of politicians in the initial days of COVID, when all fingers pointed to its involvement and the Wuhan virus became a buzzword of sorts.

Trade Wars

Then came its aggression versus India and Taiwan while there were huge tariff wars with the US when Donald Trump, who was then the President, made no bones about the fact that China was making the most of unfair trade practices. Xi Jinping, meanwhile, was growing from strength to strength and got the mandate from his party to be the monarch with no opposition to his status as President of China.

Even while the international community has now created the Quad comprising the US, India, Japan and Australia as some kind of a counterbalance to China, the latter does not seem remotely concerned. It has not condemned Russia’s attack on Ukraine and has, in fact, taken on the role of the stronger ally even while threatening to pull off something similar with Taiwan, which has been its constant bugbear.

From the automotive industry’s perspective, China still remains more than relevant given its stature as the largest producer of cars and SUVs, miles ahead of markets like the US. Even while India is touted for its potential, the fact remains that its overall output of automobiles is a tenth of China’s.

Strong Message

Auto Shanghai has sent out a clear message to the world that there is no stopping the Chinese automotive juggernaut especially in an arena where electric is the name of the game. Compare this to India’s own Auto Expo held in January this year which made the news more for the levels of absenteeism than anything else.

It may seem an unfair comparison especially in today’s world of hyper nationalism but the truth is that China is like a Gulliver in a world of Lilliputs. The scale and competencies it has in its electric arsenal are just a different ballgame and as a top CEO puts it, “It’s truly frightening to think how they have come such a long way and are only getting better by the day.”

One may loathe China for its policies but there is no getting away from the fact that it is now the centre of gravity of the global automotive world. More importantly, its own local brands right from established players like Geely, Great Wall, BYD, Changan and SAIC to a huge spread of start-ups that are out to charge the world with electric (clichéd as it sounds).

By recent industry estimates, five out of the 10 largest BEV sellers globally are Chinese. BYD, SAIC-GM-Wuling (SGMW) and Geely make up the top five with Tesla and VW.

Things have changed dramatically over the decades and the time of Detroit being the monarch of all it surveyed seems like a fond memory today. Old timers will recall wistfully the days when Ford, General Motors and Chrysler were the poster boys of the automotive world but the Lehman crisis effectively tilted the scales as Detroit went belly-up.

China To The Rescue

GM struggled to get back on track even while China remained its most important market and its ally, SAIC, actually played a key role in doubling up as a lifeline for markets like India. Chrysler, which had emerged bruised from a messy merger with Daimler, was now snapped up by Fiat, while Ford weathered the storm a lot more effectively thanks to its President, Alan Mulally, who took some decisive steps to keep the company going.

The Europeans were also not spread in the post-Lehman phase when the global slowdown caused companies like PSA of France to slam its brakes on new investments, which included setting up a new plant in India. As in the case of SAIC for GM, Dongfeng Motor of China helped PSA stay afloat and eventually got a lot stronger.

The French automaker has now evolved to its new avatar, Stellantis (the merger of PSA and Fiat Chrysler Automobiles) which also has Opel and Vauxhall in its fold. The real jolt, however, happened in 2015 with the diesel emissions scam, which had Volkswagen on the mat and, in a sense, paved the way for the transition to cleaner emissions.

It is here that China has quietly built its building blocks and is now set to fire on all cylinders across the world. There was a time when its own market had big global brands like VW and GM dominating the landscape but right now with new energy vehicles leading from the front, Chinese brands have taken charge.

Racing Ahead

BYD, for instance, is the world’s largest electric vehicle maker and has raced ahead of Tesla which was once the benchmark in this space. The American brand, led by Elon Musk, is still a huge draw but BYD has taken over the No 1 mantle and will only get stronger from here. Other Chinese brands, which showed their mettle at the Shanghai Auto Show, will similarly race ahead and this is what the rest of the world will now need to be prepared for.

Some top CEOs have already cautioned that Chinese auto brands retailed in Europe also need to be slapped with levies so that they do not end up dwarfing homegrown brands. Carlos Tavares, for instance, recently told Mobility Outlook at a roundtable in Chennai that China “has been very smart” in managing the regulations of their markets.

“They have created a space for leadership but what I can tell you is that we are ready for the fight and we are not going to step back in terms of mastering the technology on EVs,” said the Stellantis CEO.

The risk, however, lay in the fact that they would come to Europe under “very specific conditions” that “I am not enjoying when I go to their Chinese markets”. The key, according to Tavares, was that if Europe was to be kept open to Chinese auto brands, “I would like to see them enjoy the European market in the same competitive conditions as I do when we go to the Chinese market. Nothing more, nothing less”.

Level Playing Field

In the process, this would be a good level playing field for everyone concerned and the underlying message therefore was that Europe would have to impose the same duty levies on Chinese auto brands as what is applicable to cars imported into China (from Europe).

“In terms of technology, we are quite confident and are going for the fight,” said Tavares. The problem, however, could arise if Chinese automakers choose to subsidise their offerings and take a beating on profits as part of an aggressive approach to gaining market share in Europe and other parts of the world.

This has been a nagging concern globally especially in this new EV tug-of-war where the stakes are especially high for China which has taken a lead in this segment. “What is obvious is that we don’t know under which conditions of profitability they will go to Europe,” said Tavares.

For the time being, the models seem to be priced higher and their positioning is that their technology is better and, therefore, there is no need to be aggressive on pricing. This remains a moot point, however, for the Stellantis chief. “I don't think that is right… we love competition,” he reiterated.

It now remains to be seen if companies like Stellantis can actually walk the talk and compete with the Chinese in electrification. Pricing will eventually prove to be the decisive factor and with economies of scale clearly in their favour at least for now, auto brands from China seem to be on a stronger wicket.

Spreading Their Wings

The transfer of power is now effectively in place with Chinese auto brands now eager to grow their presence across the world. The heady days of Detroit and the giant fuel guzzlers are now a thing of the past. Likewise, the Japanese have seen better days and even while Toyota is still the world’s largest carmaker, not everyone is convinced that it can continue its invincibility in electric.

On the contrary, there are concerns that it is procrastinating on the issue and this could have serious implications going forward. These are early days yet but Toyota has its work cut out even while it has a strategic alliance with BYD to manufacture electric cars in China with speculation rife that this alliance could have interesting ramifications for India too.

And, finally, when it comes to relations between India and China, they continue to be tense with the latter still indulging in needless provocation with the latest salvo relating to Arunachal Pradesh, which it continues to claim as its own. This has had its fallout on proposed investments of Chinese automakers in India where the first casualty was Great Wall Motors.

India, China Tensions

The company was set to take over the GM plant near Pune but had to drop the plan when relations between India and China took a nosedive and have remained fragile since 2020. India is also pursuing a self-reliance strategy and there are attempts to pursue a ‘China Plus One’ roadmap even while obvious limitations exist when it comes to scale. Further, in a global scenario with trade linkages across countries, being a solo player is easier said than done.

“China may not have many friends across the global community but when it comes to electric cars, it is in a league of its own. The only other country that comes close right now is South Korea thanks to Hyundai and Kia. And with electrification now the way forward, the Chinese have made clear their intent to dominate the space in the coming years,” declares a top automotive CEO.

Then there is the German major, Volkswagen, which with its ID. series – a portfolio of purpose built electric vehicles – currently captures close to 8% of the global EV market share.

Auto Shanghai has literally seen the Chinese auto industry throw down the gauntlet to the rest of the world. The grandeur of the event is also contrary to common belief that auto shows have run their course. There is clearly a sense of exhaustion setting in for events at Geneva, Paris and Frankfurt with even Delhi in dire need of a makeover. In this backdrop, Auto Shanghai has come out with all guns blazing clearly showing that the Chinese mean business!

Also Read