BorgWarner is in talks with customers across segments right from commercial vehicles to passenger cars for supplying parts meeting different fuel requirements.

Hermann Breitbach, Vice President – Engineering, BorgWarner Morse Systems, told Mobility Outlook, “We don’t have a crystal ball and don’t know what the future will bring. We need to prepare ourselves with Morse Systems (a division of BorgWarner) working on electrification and the fuel system team on hydrogen.”

Companies such as Deutz in Germany have already announced that they will go with hydrogen. BorgWarner is working on injection systems for hydrogen ICE where commercial production will begin this December.

These, according to Breitbach, are critical components for hydrogen propulsion since they have a substantially lower density than diesel or gasoline. BorgWarner is developing solutions for low, medium and high-pressure applications.

He added that series production of parts for the first vehicle, with a hydrogen combustion engine, will be for an off-highway application in Europe. The company has developed its own demonstrator, with a light commercial vehicle from Stellantis, where it converted the conventional diesel engine into hydrogen. This is now operating as a prototype.

Expanding Product Portfolio

According to Chandra Krishnamurthy, Global Engineering Director, Power Drive Systems, BorgWarner, electric mobility will be the future while hydrogen as an emerging technology falls in the propulsion segment. This is precisely why the company wants to move into electric mobility and ICE as well.

Breitbach envisages a whole lot of challenges in hydrogen propulsion. As the fuel is in the gaseous state, it comes dry and clean which means making durable injectors is key. With the technology still evolving, having the product ready is a huge plus for BorgWarner.

“We had experience with direct injection of natural gas and this will be used as a baseline. Hydrogen is more challenging from the durability standpoint on the injectors for natural gas,” he added.

There is no major change in the engine but modifications are needed in the injection & oil systems, variable cam timing (VCT), turbocharger etc. The company is working on the modified VCT and timing chain. “There are a lot of activities at the moment,” said Breitbach.

Opportunities For Morse Systems

According to him, the ‘Charging Forward’ strategy aims at getting 25% of sales in 2025 from businesses relating to electric vehicles, against 3% in 2020. “We already have confirmed orders to meet the 2025 target. By 2030, we would like to have 45%,” he said.

One part of the growth strategy included acquiring companies involved in electrification. “While building capabilities, some of our products are transitioning from the existing ones. For instance, our power-drive systems always had electrical elements like electric four-wheel drive, DTS transmission system and others,” explained Breitbach.

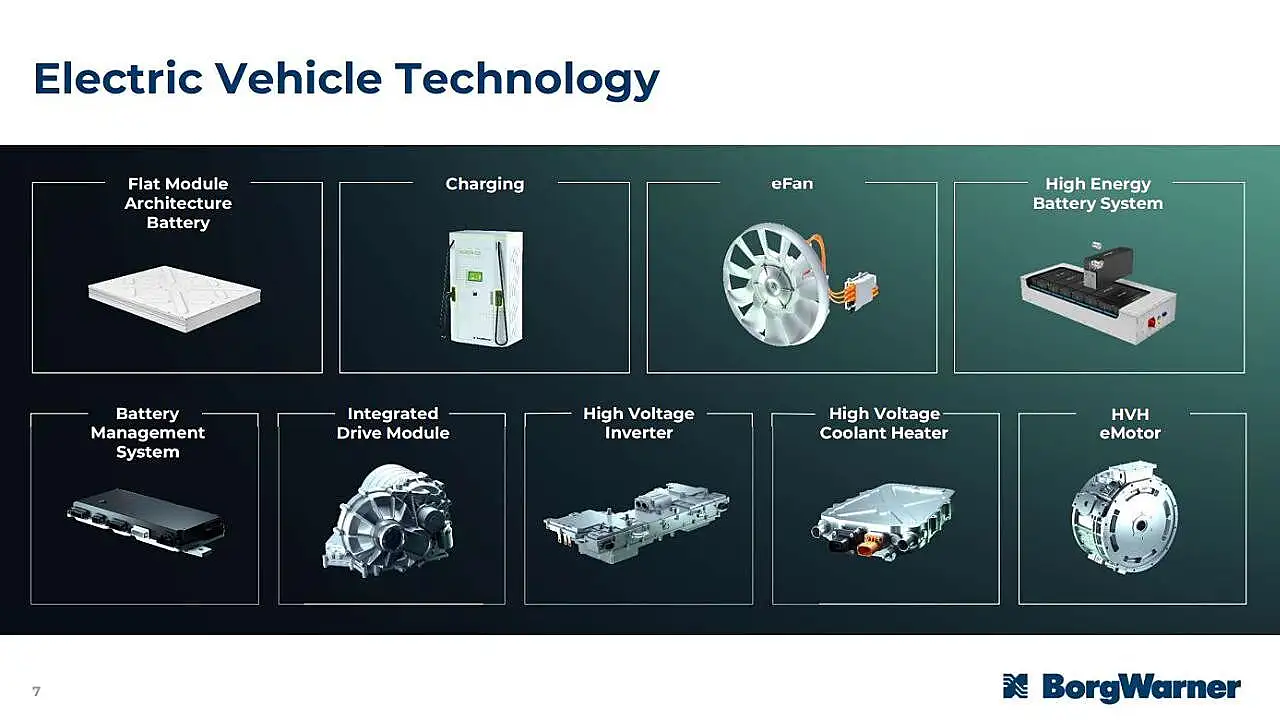

The company’s EV technology offerings include flat module battery architecture, eFans, charging, high-energy battery systems, BMS, integrated drive module, high-voltage inverters, high-voltage coolant heater and HVH motor. Its key focus is commercial vehicles.

Leveraging its industrial background, BorgWarner has developed inverters and recently won a few businesses in India for auxiliary drives deployed in air conditioning, brakes pressure systems etc for EVs. It is looking at supplying cooling plates developed by the team from EGR coolers as well as power modules. However, no decision has been taken on making cooling systems for motors and air-conditioning, said Breitbach.

Other Avenues

According to Krishnamurthy, the power inverter can play a significant role and with the orders in hand, BorgWarner can become the leading supplier of non-captive power inverters worldwide by 2027. It has stated that it is also the first to market 800V silicon carbide-based inverter technology.

Beyond this, it has power components capabilities which enable it to design and manufacture power switch requirements based on silicon carbide and power modules with heatsinks.

The power switch occupies a lot of space inside the inverter. As OEMs come with tight specifications, providing solutions by optimising all aspects is challenging.

For instance, OEMs in Europe do not source the entire e-drive but opt for a piecemeal concept which involves sourcing motors and gearboxes separately. The inverter is then mounted either on top or beside the assembly.

Space requirements of vehicles and packaging of these modules necessitate unique shapes and dimensions of inverters. Having control over power modules that occupy space gives BorgWarner a hold over the entire module, said Krishnamurthy.

The company also makes application-specific integrated circuits that combine multiple functions in a single chip. This is true for power supply and inverter controls which meet the needs of OEMs. With its command over all these elements of the modules, the company is uniquely placed in this space, he added.

Unique Needs

OEMs are also seeking unique needs integrating different modules. Some ask for a 3-in-1 combo unit, combining OBC (onboard chargers) and DC-DC converters coupled with a PDU – power distribution unit, while others demand OBC and DC-DC converters coupled with a cabin heating function, depending on their architecture.

If they “have three or four functions in the same geography of the vehicle”, it helps the OEM optimise space and weight. BorgWarner has developed different integrated systems on e-drive and charging & power conversion. Krishnamurthy said these initiatives have helped surpass the 2025 target already.

Breitbach added that the components of the electric powertrain – battery, motor, inverter etc — are over fourfold in value compared to fuel systems, engine and exhaust systems in ICE vehicles.

The ICE engine is far more complicated from the mechanical perspective than an e-motor while the battery of an EV is, likewise, more complicated than a fuel tank in an ICE vehicle. In EVs, the overall complexities are increasing despite the reduction in the number of parts, signed off Krishnamurthy.

Also Read:

BorgWarner Opens India Propulsion Engg Center In Bangalore

BorgWarner To Form ‘NewCo’ For Fuel Systems, Aftermarket

BorgWarner Morse Systems India Thinks Flexibility With New Plant