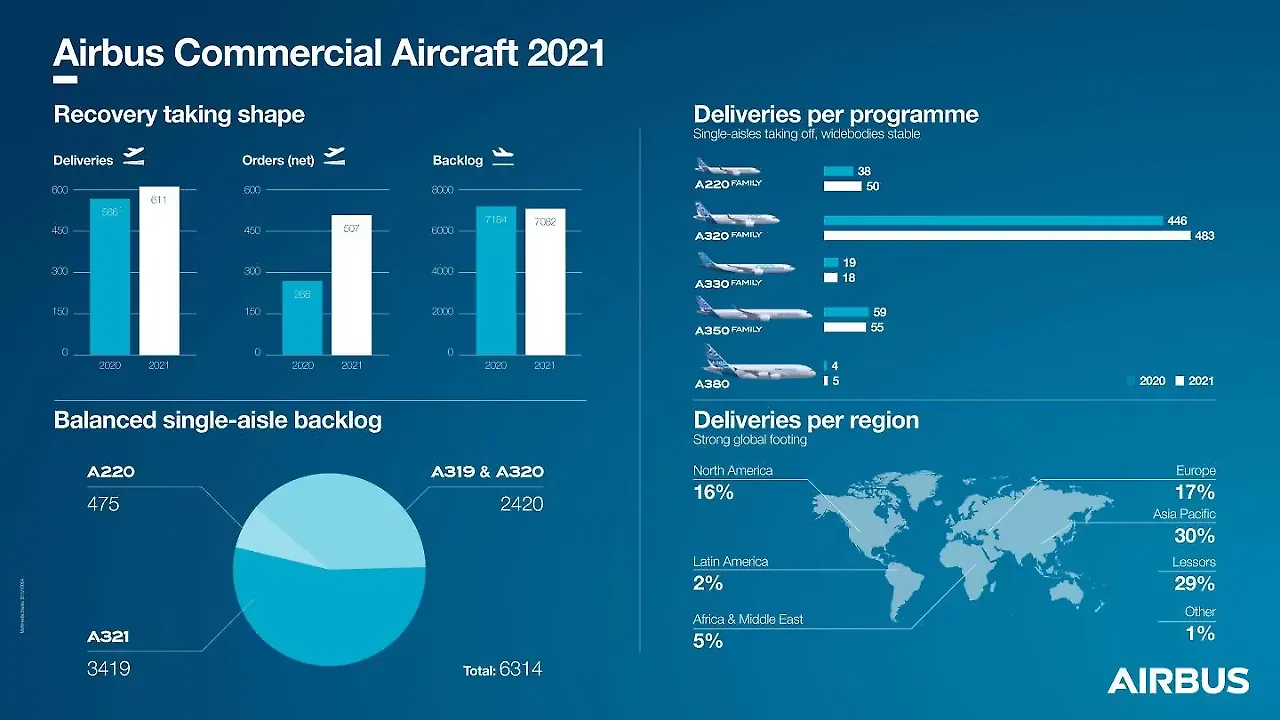

European airframer Airbus is well placed to grow commercial aircraft deliveries in 2022, increasing its lead over US rival Boeing. Airbus announced deliveries of 611 commercial aircraft to 88 customers in 2021 compared to 566 aircraft in 2020. In a sign that it has left the pandemic behind, Airbus bagged 771 gross orders from 29 customers (507 net) for its jetliners, ending 2021 with an order backlog of 7,082 aircraft. Airbus doubled its gross order intake in 2021 compared to 2020.

“Our commercial aircraft achievements in 2021 reflect the focus and resilience of our Airbus teams, customers, suppliers and stakeholders across the globe who pulled together to deliver remarkable results. The year saw significant orders from airlines worldwide, signalling confidence in the sustainable growth of air travel post-COVID,” said Guillaume Faury, Airbus Chief Executive Officer. “While uncertainties remain, we are on track to lift production through 2022 to meet our customers’ requirements. At the same time we are preparing the future of aviation, transforming our industrial capabilities and implementing the roadmap for decarbonisation.”

In January, the company announced that it will look to make around 6,000 new hires worldwide across the entire group to prepare the future of aviation and implement its roadmap for decarbonisation.

Compared to Airbus, Boeing is slowly recovering from the aftermath of the grounding of the 737 MAX, coupled with production delays on the 787 and developmental delays on the 777-X. Boeing could only deliver 340 commercial aircraft in 2021, out of which 99 were delivered in Q4.

Leadership Position

Airbus’ A320neo Family alone won 661 gross new orders in 2021, with the smaller A220 (erstwhile Bombardier C Series) bagging 64 firm gross new orders. Airbus delivered 483 A320 Family jetliners in 2021, as compared to 446 in 2020. However, with weak demand for international air travel, Airbus could only eke out 46 gross new orders for its widebody jetliners, including 30 A330s and 16 A350s (including 11 for the newly launched A350F). Catering for COVID-19 norms, Airbus resorted to an “e-delivery” process to hand over approximately 25% of its commercial aircraft orders in 2021.

Airbus will have another blockbuster aircraft in its portfolio when the A321 XLR enters service in 2023. Since the A321 XLR programme’s formal launch in 2019, Airbus has received nearly 500 orders and commitments for the aircraft.

IndiGo is one of the customers for the new aircraft, which will operate on its long-haul sectors. The airline is to start taking deliveries in 2024, and the aircraft can seat up to 244 passengers and fly up to 8,700 km.

Making Up For Lost Time

Boeing will seek to claw back lost ground by ramping up production of the 737 MAX. It plans to increase the production rate to 31 aircraft per month in early 2022 compared to 19 in October 2021. Boeing also seeks to complete development and certification efforts on the 737-7, 737-10 and 777X. It is also evaluating the timing of a freighter version of the 777X.

Boeing is ramping up deliveries of its 737 MAX airplanes, delivering 62 aircraft in Q3 2021 (the most since Q1 2019). Since the FAA's approval to return the 737 MAX to operations in May 2021, Boeing has delivered over 200 aircraft, and more than 200 previously grounded airplanes have been returned to service by airlines, safely accumulating well over 500,000 flight hours.

Akasa Air’s order for 72 MAX jetliners (737-8 and high-capacity 737-8-200) in November 2022 was a significant boost to Boeing in India. Akasa Air, a brand of SNV Aviation, plans to start commercial operations this summer with the brand new aircraft.

Freighter Forward

Boeing is also increasing freighter production and conversion capacity to meet the fast-growing demand for air cargo, primarily driven by the surge in e-commerce. In fact, 2021 was a record year for Boeing in its annual freighter order tally. The company forecasts a requirement for 1,720 freighter conversions over 20 years; 1,200 of these will be for standard body conversions, and nearly 40% of this demand will be from Asian carriers.

Boeing’s 737-800BCF is the standard body freighter market leader, with 19 customers having placed orders and commitments for more than 200 aircraft. According to Boeing, the 737-800BCF offers higher reliability, lower fuel consumption, and lower operating costs per trip than other standard-body freighters.

Boeing announced in 2021 that it would create additional 737-800BCF conversion capacity at several sites, including with existing supplier Guangzhou Aircraft Maintenance Engineering Company (GAMECO), and with new suppliers Cooperativa Autogestionaria de Servicios Aeroindustriales (COOPESA) in Costa Rica, KF Aerospace in Canada, and Boeing’s London Gatwick MRO facility in the UK.

In 2022, Boeing is to add two 737-800BCF conversion lines in China. In Q1 this year, the first line is slated to be ready at Taikoo (Shandong) Aircraft Engineering Co, with the second line expected to begin conversions by midyear. It will have a total of seven conversion lines dedicated to the 737-800BCF by the end of 2022.