Suresh KV is currently the President and Head of Region India for ZF, which is part of the Germany-headquartered ZF Friedrichshafen AG. He is responsible for the governance and overall growth of businesses in line with the strategy that ZF has laid out for the India Region. Suresh began his career with Asian Paints, and his professional exposure includes stints with Bajaj Auto, Visteon India and Philips.

Can you briefly tell us about your six-year journey as the head of ZF in India?

It's been a great journey when I came over from Coimbatore and took over the reins in Pune. In 2018, India was carved out as a separate region for ZF; prior to which it was part of Asia Pacific. In the same year, we presented, for the first time, a strategy for ZF India, which included two parts – one, for India to be looked at as a new market and second, to look at India as a platform or a hub for supporting other entities either through material sourcing or through engineering or business services.

In 2020 we started looking at the strategy, and we are in the process of creating a strategy for ZF in India on the same lines.

What is the current status? Have you identified the platforms or the hubs that India will be responsible for and which segments to cater to?

From the revenue market perspective, Commercial Vehicles (CV) will be our focus. We had three product lines before the Wabco acquisition, including transmissions, chassis components and shock absorbers. The only missing items were bus axles and clutches, which are also being looked at as to how we can introduce them into the Indian market.

With Wabco, the product line has expanded to a much bigger canvas. Today, we are a total systems supplier, and hence the customers are also looking at us as a partner, who can deliver systems to them – be it AMT or braking systems. There is a little bit of a wait and watch game on the passenger car side because, while Western Europe and the advanced economies are moving towards more and more in electrification and ADAS, India is still in the well-known technologies range. We are looking at when and how the e-mobility trend picks up in India. At the right point in time, we will get into it.

Coming to the India hub, we have taken significant steps in two major areas. Firstly, it is sourcing materials out of the region. In 2016-17, we conducted a vendor meeting, where we projected exports of about €100 million from this region to various ZF entities. I am happy to inform you that we have crossed that as per our timeline, and are now expanding it to a much bigger canvas. We want to make sure that India becomes a critical market from which significant amounts of material are being sourced out for the various ZF entities.

What are the challenges in accomplishing these objectives?

The path is not easy because we need to handhold all the suppliers. We are doing that by ensuring that many people are working as SQEs (Supplier Quality Engineers). The second and more significant contribution from India is also coming from our Tech Centre. In 2017, we had hardly 100 engineers, but today we have over 2,500 engineers working out of the Hyderabad facility and growing every month to a much bigger number. It has become a software hub for us, where in addition to software development we do some amount of mechanical engineering development as well.

We are also integrating Wabco’s Tech Centre into ZF, which will include both manufacturing and technical centre integration. In parallel, we are also looking at integrating back offices functions like finance, HR, etc. However, we will create a back-office at some point in time, wherein we will be supporting more and more talent and tools for ZF entities with the backend services.

How will the fusion of two tech centres support ZF globally?

We are building these as competence centres with a very clear mandate of local for local, but the majority will be employing talent for the global requirements. The engineering community at both the tech centres are part of the global R&D and software development network. The assignments directly come from the divisions. We also utilise them to do benchmark activities for the Indian market. I would say up to 80% of the activities are part of the global domain.

Intelligent mechanical systems have been part of ZF's portfolio for decades, and these are transforming into mechatronics. How is this influencing ZF?

Wabco is the pioneer in this; they have their fleet management services. We have even acquired a small start-up in Bengaluru, supporting us with a lot of these developments. While we make significant inroads into the braking systems with Wabco, the other important activity is that these actuation systems are moving from mechanical to mechatronics. We will be riding on Wabco's capability to bring in more intelligent systems, especially for CVs.

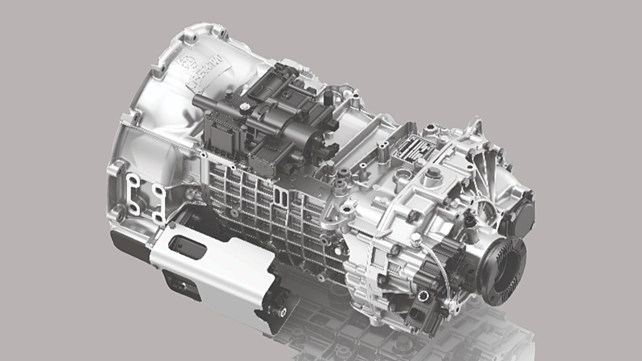

A classic case would be the AMT – Automated Manual Transmission, where we have the transmission from ZF, and the actuation system from Wabco. Together, it will be an integrated system, which will be the right solution for any OEM as they do not have to look at the systems' integration. Something like this can be applied across the product.

The new vehicle architecture, which focuses on Service-Oriented Architecture (SOA), has opened up new opportunities for the entire automotive industry. How is ZF leveraging the emerging trend?

Wabco is involved in hardware and support in developing intelligence systems within the vehicle, which includes capturing data related to the running of their vehicle, and the issues that have been faced, etc. So, the development of architecture and software helps us create the linkage between the mechanical products and the driver or the vehicle itself. It will help us to improve the product lines.

Cost economics is a huge challenge in emerging markets, including India. How is ZF India managing it?

I will turn it around a little bit and say that we are a value-based market. It is also essential for us to look back at our positives and identify the areas we need to improve on. ZF has always been seen as a technology player in the niche portfolio. When it comes to cost competitiveness, generally, it doesn't come in the top two or three suppliers.

One of the big activities that we took up in the last five years has been to make ourselves more cost-competitive. If we can’t beat customer expectations, at least we must try to meet their expectations. And we have been partially successful. I'm only saying that we are on the path, and we will get there. Wabco has been able to do a lot; their cost competitiveness and applicability has always met customer expectations. I think that's a great example, and we would like to follow it when it comes to ZF's future in India.

In the case of tech centres, there is an increased focus to increase engineering in India at the manufacturing level to ensure that we can meet the customer requirements and adapt the products to ensure that they meet the performance at the right cost. In the last three years, I have seen a significant increase in the engineering strength in India. We are increasing engineering here to ensure the adaptation of the products to the Indian market and ensure that we are in the same time zone to speak with the engineering folks of the customer.

What are the opportunities you see in electrification?

We are watching this space. We are definitely in cooperation and already working closely with customers in their electrification of buses. We feel that buses and two/three-wheelers will see electrification coming up fast. We think that city buses and school buses could be the ones which will get electrified first.

Do you see plugin hybrids as an interim solution?

I think plugin hybrids should be the intermediate. While vehicle electrification is one part of it, the charging infrastructure – not only in the highways, but also in houses, factories and parking spaces – is also critical for a completely electrified product to become successful. So, as we build up the infrastructure, which I see that the government is doing, I feel that a plugin hybrid would be the right approach.

Do you see opportunities to provide solutions to customers on ADAS?

We are developing in a big way in Europe. Today, we are working with many customers, and that's where we are gaining experience. By the time India is ready for implementing ADAS, we will have the technology. How do we adopt and adapt it for the prices that the customers would expect would be the challenge.

What are the opportunities you could identify during the crisis in 2020?

From an Indian perspective, I would look at being more local. We were creating many disruptions for the customers because of our imports. It drove us while we were looking at localisation.

The other opportunity is flexibility. We cannot be dependent on skilled manpower, and have to create active processes that are not manpower dependent. The migrant labourers, who went off during the outbreak of the pandemic could not get back. We got into training issues, and that was a story that many others faced.

The most significant opportunity is digitalisation. We managed meetings, communication, and KPIs digitally. Power BI became a standard in our laptops and mobiles, wherein we can regularly look at all the numbers. Therefore, the opportunities were more in the internal processes.

Finally, I would like you to spell out your plans for the next five years?

We are working out a big strategy for ourselves. We want to become one of the top two players in the Indian market. We want to grow our Tech Centre to become a critical factor in software and engineering development.

I am looking at two things – how ZF can become the player of choice with all the customers from the revenue market and how can India become a matter of choice, when it comes to ZF's backward integration in terms of services or manufacturing. If we can do that, then I'm sure ZF in India will become a critical factor both in the industry and in its own space.