How was the year that went by for Gulf Oil India?

Gulf Oil India witnessed a drop in sales from the end of March, and we started picking up from May. We have seen 7% growth in Q3 and 16% in Q4 of calendar 2020. The demand has picked up, but obviously, the losses of Q1 carried on. The market has de-grown by more than 10-12%. Gulf Oil India will do better than the market, and we will have to wait for the last quarter results to be announced. We saw a lot of demand going up across segments, starting with agriculture, two-wheelers, infrastructure, commercial vehicle, etc. There has been a lot of growth in the last six months.

Which are the product groups that fared well, and what are the key reasons?

The tractors did very well beginning mid-May. As there is a growing need for personal mobility due to COVID, there has been growth in this space from the second half. This has been a trajectory that Gulf is focusing on. If I look at December as a pointer, all the segments had done well. After December, we have seen even the OEMs doing very well.

What were the pain points?

Certainly we had a few pain points. As a company, we have very high fixed costs, and the challenge is to bring it down and maintain the morale of the people. We have retained all our people, but we had very low investments in the brand. We did start with IPL in September.

Work from home and movement restrictions were challenges. Getting the supply chain intact and maintaining the morale of people were challenges. We stood by our people, and therefore, the morale was very high, and we saw that converting into excellent traction for Gulf Oil, when the market demand picked up.

The recent challenge has been on raw material prices. In the last few months, the prices have gone up substantially for the base oil and additives. We are managing by announcing price revision. COVID continues to pose a challenge with the recent rise of cases in few states, including Maharashtra. We continue to grapple with it, but we have emerged quite strong based on our business model and our people's motivation.

How do you see FY22 pan out for Gulf Oil India?

In FY22, we expect the demand for lubricants, which has been minus 10-12%, to go positive because GDP is expected to be around 7-10%. Typically, lubricant growth is estimated to be half of GDP. So, if the market goes up by 3-4%, Gulf Oil normally would grow two to three times, as this has been our decades-long experience. We will continue to look at revenue, more based on the market and demand conditions that are moving forward. All in all, it's going to be a growth year.

What are the factors that will help the company to move forward?

It has to be all-around economic growth. Obviously, the main factor is now going to be hinged around handling the second wave of COVID, which should allow the market to open. We hope that the automobile industry will do well; infrastructure and other projects as committed will do well. Automatically this year, with better penetration of vehicles and the agriculture sector, the economy will do well. I think these are the normal factors. Also, personal mobility continues to grow. We have seen some industries, including cement, injection moulding etc., growing as well. In fact, some of them had not done well for the last few years.

What are the new products from Gulf Oil to support the mobility industry in India?

We have launched the complete range of BS-VI products. We are now getting into the other vehicles’ future requirements, which are non-automotive. We are also bringing forth our EV fluids for the passenger car segment, which are already available globally. We will also be looking at products that can add more value as we have been pioneers in long drain interval lubricants.

We have recently launched an upgraded motorcycle oil, which provides better protection and longer life and gives better acceleration. So, our focus is to offer value-added and environment-friendly products. We also manufacture and market AdBlue for BS-VI vehicles. At present, it is manufactured in our Silvassa plant. We will soon commence manufacturing AdBlue at our Chennai facility.

Gulf Oil International has also announced an investment in Indra Renewable Technologies, a charging technology company based out of the UK. It already has close to 5% market share in the home charging market in the UK. We will be bringing the products to India.

Can you tell us about your OE supplies? What are the prospects for you to sign in?

During the COVID period, we added a number of OEMs, starting with AdBlue supplies followed by engine oil. We have had a very strong relationship with many OEMs, including Ashok Leyland, Bajaj, and Mahindra, to name a few. We have not only retained and grown with these OEMs, but we are now adding new ones. Recently, we began supplying Force Motors. We are also supplying AdBlue to Korean OEMs. We are also exporting to some of these OEMs out of India. Our aim is to add at least two to three OEMs every year, which has gone very well during COVID.

Can you tell us about your presence in the aftermarket – how many touchpoints you have at present?

We are number two in the aftermarket now, and we believe that distribution is the only way we can further tap this brand awareness level. We have focused on reach in urban, semi-urban and rural areas during the last five years. We now have 300-plus automotive distributors and about 1,000 rural stockists. We have more than 50 industrial distributors, 8,000 Gulf Bike Stops and over 2,000 Gulf Car Stops branded independent garages. In addition to that, we service OEM dealerships for many OEMs. Overall, we have 70,000-plus retailers today and we want to increase our customer bases and touch points to leverage our top two brand equity metrics.

What about exports to both aftermarket and OEMs?

We export OEM products to many countries right from South America to Asia and neighbouring countries. We also ship some of our products to other Gulf Oil entities in Asia. We are now planning to start some exports to Sri Lanka and look at a few more OEMs in Asia and neighbouring countries. Export business has gone very well. Our Chennai plant capacity is now available, and therefore, we can expand our export customer base. Earlier the share of exports was around 2%, and now it is higher than 6% of our sales.

Can you tell us about your manufacturing facilities?

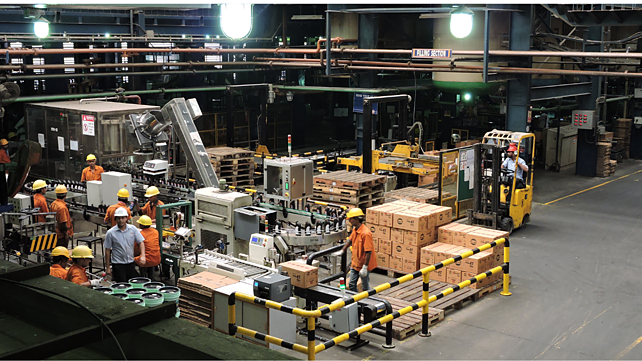

We have plants in two locations – Silvassa and Chennai, and the latter is about five years old. The state-of-the-art facility has automated and semi-automated manufacturing lines and automatic storage facilities. I would say this is one of India's most modern plants, having a capacity of 50,000 kl per annum on two shifts basis, which can also be enhanced. Currently, it is at about 60% capacity utilisation. So, there is a lot of growth expected. Some of the new OEMs that we have added will be catered to from the Chennai facility. We plan to add AdBlue line in Chennai shortly.

We have also upgraded our Silvassa facility in terms of the storage and packing lines and adding some more industrial grades there. The current capacity is 90,000 kl per year, again on two shift basis. Both these plants are well poised for growth that we plan in the next three to four years.