Kamal Bali is currently the President & Managing Director of Volvo Group India. He has been spearheading reputed Indian & multi-national organisations as President & CEO for two decades now. He has had an illustrious career spanning 40 years, mainly in the automotive and engineering industry. In December 2019, Bali was Knighted and awarded one of Sweden’s highest honours in the Royal Order of the “Polar Star: Commander” by Their Majesties, the King and Queen of Sweden, for his untiring support to the Swedish commerce & industry in India.

What’s your view on the current trend in the commercial vehicle segment? When do we see the light at the end of the tunnel?

I would say the commercial vehicle industry has gone through a real roller coaster. The industry hit its peak in 2018, when it touched approximately 450,000 units (five-tonne plus segment), and in 2019, it went down to about 340,000 units. In 2020, it went further down to 175,000 units. We expect 2021 to end close to 300,000 units, which could be a decent 40-50% jump over a very low base of last year.

We believe that over the next two to three years, our industry is going to bounce back for two reasons. One, it is at a very small base, and we will still take a couple of years to reach the peak of close to half a million vehicles of the above five-tonne category of CVs. The second, all other aspects of the economy and manufacturing are responding pretty well. And a lot of our CV industries is linked with the GDP growth in the manufacturing sector.

So there is positivity now, but of course, we have challenges within CVs, especially on buses, which represents 10-15% of the total CV industry, and is still facing a huge challenge. I think the capacity utilisation is still low, and the fleet utilisation is still maybe around 60-70% of the pre-COVID levels.

What about the other divisions of Volvo Group India?

The construction equipment industry is doing exceedingly well, and the market is booming. The segment also hit its peak in 2018, and it is likely to hit the peak once again. The current year is going almost at that rate or maybe slightly lower than the peak, but in 2022 it will definitely hit the peak of 2018. This is for the industry, and Volvo follows the same. If the industry goes up, our volumes will also go up.

We have a good range of products, and are bringing in many more products. For example, for the road construction sector, we brought in pavers, compactors and excavators. We are very bullish about that sector.

What about the Volvo Penta division?

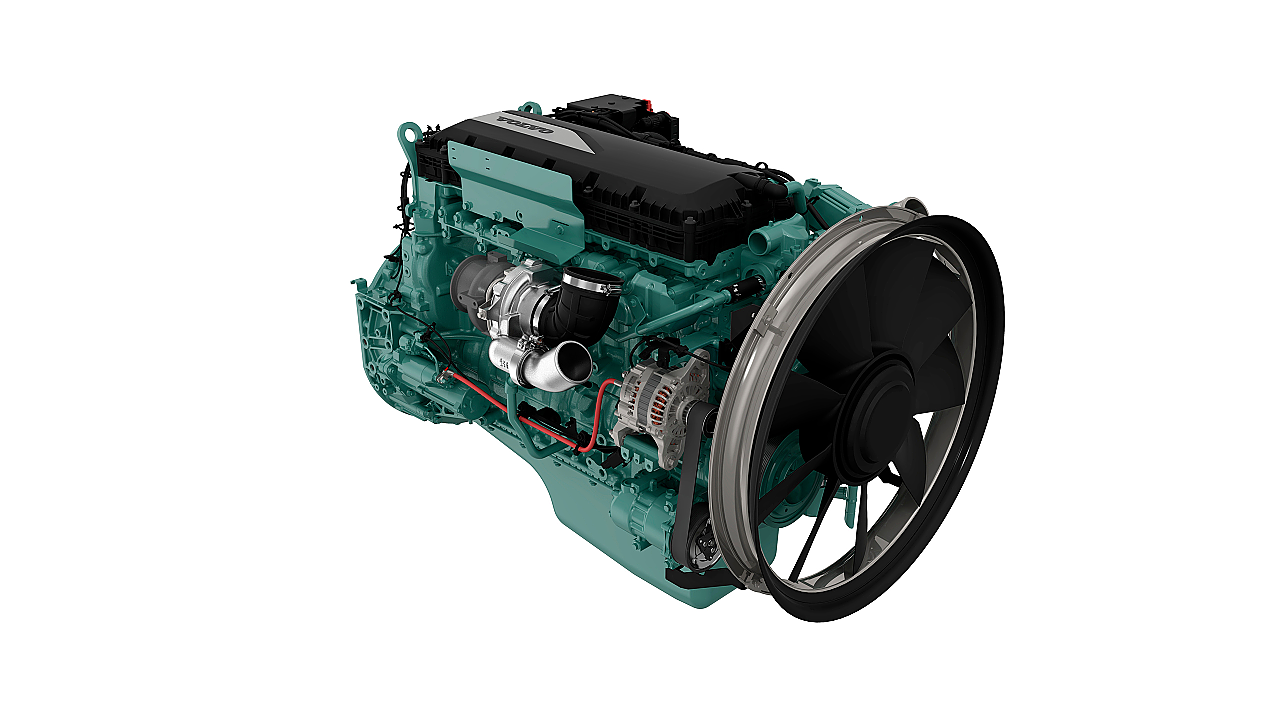

We are opening up new market segments. Earlier, the division focused only on genset and marine applications, and now we are opening up versatile engines used in sugarcane harvesters and other segments of marine applications.

Within Penta, we have started manufacturing 5-8 litre engines in our joint venture plant in Pithampur. It will open up many more opportunities in marine applications, including various boats, compressors and high horsepower tractors.

We are bullish on Construction Equipment, Penta and Trucks divisions as the market is growing from a lower base.

Where do you see Volvo Group India positioned in the next five years?

We are pretty optimistic about the next five years. Volvo’s footprint in India is in three parts – the first part is our Volvo manufacturing units in Hosakote (trucks), Peenya (construction equipment) in Bengaluru and Pithampur (Penta engines). In all these areas, we are in the premium segment; therefore, the volumes are not humongous but decent, and they will grow.

The second part is our joint venture with Eicher, which is critical as it gives us the mainstream market. We are very proud to say that it’s a very successful joint venture.

And the third and the most important piece is our global competency centres, which work for the entire global organisation, accounting for almost 3,000 people. The group is basing a lot of focus on that in India, and I am also personally looking at it in a very big way. It encompasses technology, accounting services, IT services, connected solutions and many more.

Has the bus division completely going to Eicher created any vacuum for Volvo Group India?

It’s not a vacuum because there are a lot of other opportunities that we are looking at. The Eicher strategy is part of a very well thought out plan. It is because we have a twin-brand approach. So, there is a good opportunity for synergies coming in where Eicher can move up the ladder, and Volvo can also get economies of scale.

I don’t think it’s a vacuum; it’s a very well thought-through strategy. Otherwise, both were in different silos. Now, we are collaborating and partnering to see how we can have better economies of scale and learn from each other.

But don’t you think, for the headquarters, the India operations are minuscule?

No, it’s very big because we look at this from three footprints. What the 3,000-plus people do at our GCC – Global Competency Centre – is humongous. It can’t be seen in terms of revenues. It is the impact they are creating and the work they’re doing. So that’s one major piece. The second piece is our deep engagement and JV partnership with Eicher through VECV, which has been consistently doing well and it continues to be one of the top players in the Indian CV industry. And the third piece is Volvo trucks. So, it’s not about the revenue, but the overall impact that we create in the global organisation.

How is Volvo looking at India in increasing its contribution to the headquarters?

One is the competency services or the global technology services including IT, accounting and others. While other places are not adding many people, we are adding about 400 people in global technology services. So, that’s one area where we are growing.

The second area is construction equipment, where we are adding more products. The third is, India operations becoming the global hub for medium-duty engines. As a result, we are exporting medium-duty (5-8 litre) engines to the entire world.

We are also looking at Volvo Trucks for long haul applications. That’s going to be the new application area, which we are trying to enter. Right now, 90% of Volvo Trucks go into mining. So, we’re also trying to open up new use cases for Volvo Trucks.

When can we see these initiatives in action?

We have already started, and we have a couple of customers who have taken some fleets from us, and they’re pleased. And these are new-age logistics companies that are trying out our products.

In which tonnage are these trucks deployed?

These are typically between 20- to 45-tonne categories, mainly in tractor-trailer configuration.

Is there a need to expand operations here in terms of capacity?

No, as, fortunately, we made the investments at the right time. We made substantial investments in the previous five years to double our capacities of trucks and buses.

Any more investments coming to India?

Future investments will be in the technology side – digital transformation, technology partnerships and such things. I think this is what is going to be the key.

Some global OEMs have huge testing labs in India to support their headquarters by leveraging the inherent potential. Would Volvo look at something from the testing point of view?

We already have the hub for testing and validating compactors. We are part of the global team, where we do all the activities together.

Are you looking at setting up a lab here so that the assignments from Gothenburg and other locations can be offloaded?

We have our labs here, and we are part of the global product development, especially from a verification and testing point of view, to ensure the functions are proper. Volvo’s theme is to provide the entire solution.