Maxson Lewis, Founder and Managing Director of Magenta Mobility, boasts a two-decade career spanning Automotive, Power Sector, Clean Energy Solutions, and Management Consulting. Previously leading Accenture Management Consulting's Power and Project Management Practice, he managed global consulting assignments in power projects and system design. Lewis also played a pivotal role in establishing Bosch's sales and distribution network and contributed to product development and sales in the automotive industry at Saint Gobain.

What are Magenta Mobility's core business offerings and contribution to the EV ecosystem?

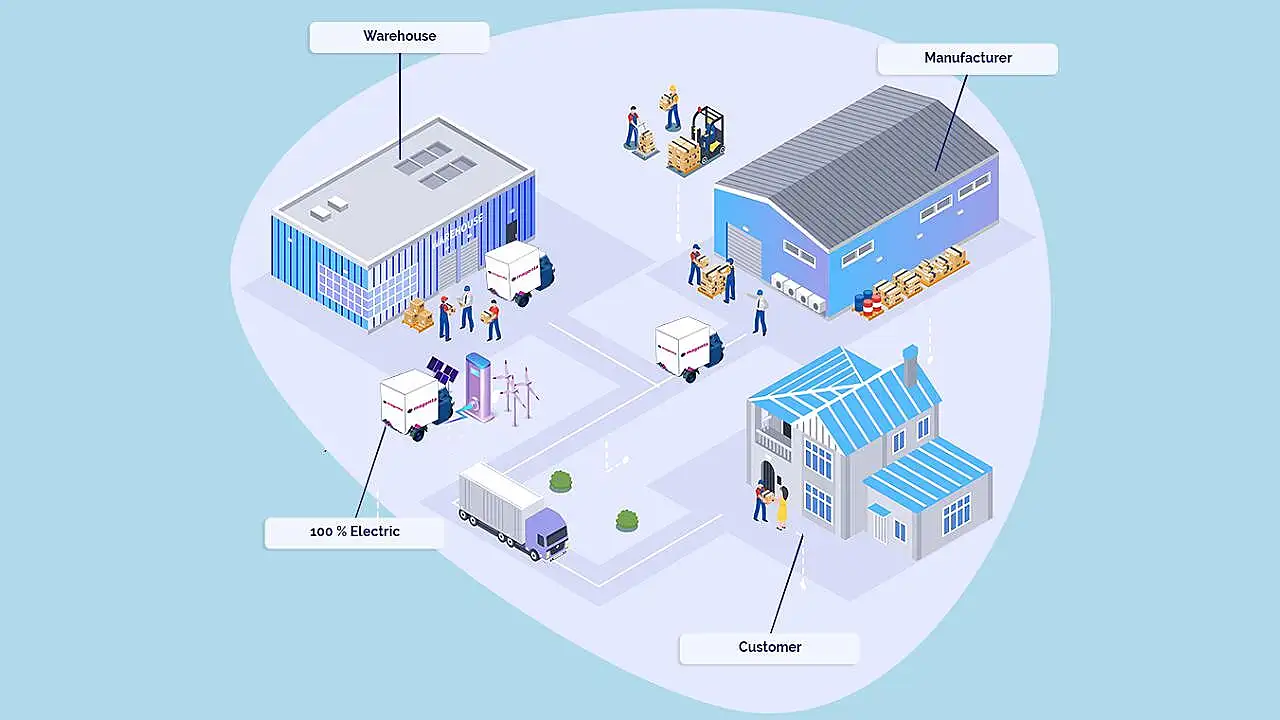

Magenta Mobility is an integrated electric mobility service provider distinguished by its three core business verticals. Firstly, under the Magenta Logistics vertical, we facilitate the transition from traditional internal combustion engine (ICE) transportation to electric mobility; we own and operate one of India’s largest fleets of electric cargo and provide last and mid-mile delivery services. It is our largest and spearhead business.

Secondly, under ChargeGrid, we develop EV chargers and embedded technologies. We have been at the forefront of designing intelligent AC chargers for electric vehicles based on the Open Charge Point Protocol (OCPP) since early 2019.

Lastly, the Infomatics vertical develops Software Technology to efficiently manage, monitor and monetise our electric fleets, charging stations and other assets, ensuring seamless integration and optimal performance.

How has 2023 been in terms of growth? Highlight some of the recent developments.

In 2023, we experienced remarkable growth and innovation across our business areas. Our footprint expanded from eight to fifteen cities, and our fleet grew from 500 to 1,800 vehicles. Another significant achievement was the patent grant for our revolutionary ‘Plug & Play’ AC chargers, combining versatility, efficiency, and user-friendliness. We also developed one of the world's first 12-in-one chargers named PLENT.

We also collaborated with various vehicle OEMs to develop advanced fleet telemetry and MDVR-based video telematics, enhancing our Driver Monitoring System for increased safety and efficiency. We could move 100% of our processes to the digital platform, including integration with the government-supported DigiLocker.

Our workforce grew substantially, with driver strength soaring by 400% and employees by 65%. Additionally, a new office in Gurugram was established to serve the Northern India market better, and we welcomed over 20 new clients into our expanding clientele.

Can you explain the interoperability of PLENT and tie-ups that the company has with energy providers at residential and public charging stations?

PLENT, a groundbreaking electric vehicle charging technology, derives its name from ‘PLENTY,’ symbolising its capacity to charge 12 vehicles simultaneously in parallel. Its Central Control Unit coordinates seamlessly with 12 Dispensing Units, streamlining charging stations and ensuring continuous operation during electrical phase downtime.

We have collaborated with residential complexes, fleet operators, and charge point operators nationwide, tailoring PLENT to meet unique requirements. This full-stack OCPP-based charger prioritises interoperability, seamlessly integrating with any Charging Station Management System for versatile deployment.

While there has been a growing trend in EV vehicle purchases and usage in the country, how will this scenario expand in the rural and sub-rural regions, especially when you talk about covering first to last mile and support?

Magenta Mobility is already working on extending the electric vehicle revolution into rural and sub-rural regions. We are driven by our EV chargers installed at multiple OMCs (oil marketing companies) from Kashmir to Kanyakumari.

Our Logistics platform has increased its presence to 17 cities (as of January 2024) and surrounding areas, which includes Tier-2 cities and rural hubs. We work closely with some gram panchayats, where our captive charging depots are located in remote locations.

As we continue to grow, we are committed to addressing the unique challenges of rural communities and fostering sustainable electric mobility solutions for the first to last mile.

Can you share the fleet size that the company has with vehicles across segments such as LCVs, 2-wheelers and pickup trucks?

We have over 1,800 (as of January 2024) electric cargo commercial vehicles with a plan to end FY23-24 with 2,000 EVs. This fleet encompasses three-wheelers and four-wheelers.

We are already piloting initiatives for heavy-duty and multi-axle vehicles. We have refrained from deploying two-wheelers due to concerns related to safety, rash driving, and other associated issues, which we did not want to support or be a part of.

Our vehicle selection aligns with a steadfast dedication to ensuring the utmost safety standards in operating last-mile and quick commerce services.

How many charging stations and locations does the company have today?

Since June 2018, we have been operating Public and Captive EV charging stations. Presently, spanning across the 17-city network, we strategically manage approximately 65 charging depots. Each charging depot’s location is strategically chosen to accommodate a substantial number of vehicles, ranging from 30 to 70, ensuring widespread accessibility. What sets us apart is our commitment to innovation, with in-house developed chargers and software technology. This internal synergy gives us unparalleled control over data, encompassing chargers, charging sessions, and vehicle analytics, providing valuable insights into vehicle health and operational efficiencies.

Tell us about the economies of using the EV fleet over ICE for commercial transportation.

The shift towards EVs is gaining momentum in commercial transportation, particularly in India. While e-buses and passenger cars currently maintain a higher Total Cost of Ownership (TCO) than their ICE counterparts, a noteworthy trend is emerging in the electric two-wheelers (e2W) and three-wheelers (e3W) segments, where the TCO is nearing parity and, in some cases, surpassing the cost-effectiveness of their ICE counterparts. In a typical daily usage scenario covering 100 to 120 kilometres, the TCO for e3Ws is approximately 12-15% lower than that of ICE autos due to the FAME-II subsidy, creating a conducive environment for achieving break-even.

This economic landscape reflects a compelling case for businesses to transition to electric three-wheelers, contributing to environmental sustainability and unlocking cost savings and efficiency gains. As technology advances and infrastructure support grows, the economic advantages of embracing EVs in commercial transportation are expected to strengthen further, solidifying electric mobility as a strategic and economically viable choice for businesses.

Can you talk about the safety compliances required for setting up grids, and is the company planning to look at Green Grid as an option to power its charging stations?

Ensuring safety at every level is paramount in the setup of EV charging grids, involving meticulous consideration for vehicles, chargers, electrical installations, and various facets such as earthing, fire prevention, device interlocking, vehicle connectors, cable insulations, mechanical switching, operating temperatures, and emergency disconnects.

Chargers are carefully selected with TUV Nord certification, mandatory EMI/EMC testing, and compliance with IEC standards. Charging stations must align with IS standards, and all electrical equipment must adhere to CEA safety and compliance standards.

In our commitment to sustainability, we are actively engaged in discussions with relevant authorities to implement solar-based Power Purchase Agreements (PPAs) to power our charging stations. We were at the forefront of successfully demanding the reduction in open access to 100kW from the original 1MW and above mandate. This strategic initiative aims to enable the transportation of green power to our charging stations, aligning with our vision for a sustainable and eco-friendly future.

How do you ensure sustainability while abiding by the BWM Rules?

In the case of Battery Waste Management, we have a two-pronged approach. First, we extend the usable life of the batteries by deploying them as energy storage devices at our charging depots. Second, we work closely with the OEMs on battery tracking from supply to end of life. We have also developed an e-waste management cell where not only batteries but all e-waste are tracked and managed.

Please share insights into the EV battery technology suitable for commercial usage and its future.

We are not limited to just one technology; since we are not an EV manufacturer, our approach is EV battery technology agnostic. We acknowledge the potential of lithium-based batteries while anticipating significant advancements in the coming years. We foresee promising developments in technologies such as solid-state batteries, sodium-based, and aluminium-based batteries, all of which contribute to the dynamic and evolving landscape of energy storage for commercial usage in the future.

What is the plan for 2024 in terms of grid and fleet expansion?

In 2023, we took a ‘get it right’ approach to city operations. For 2024, we will be approaching city expansions with a ‘scale-up’ mindset, prioritising a path to profitability. Our plan for 2024 is to surpass the previous year's growth, targeting a fleet size of 7,000 EVs nationwide. This year will significantly focus on expanding and scaling up our fleet and charging operations, particularly in Tier-2 and Tier-3 cities, contributing to the broader e-mobility landscape in India.

Additionally, our plans encompass exploring new vehicle form factors, including heavy-duty vehicles, and venturing into mid-mile and first-mile logistics solutions.

Also Read:

Magenta Mobility, Altigreen, Exponent Partner For Rapid EV Charging