Vineet Sahni oversees the entire operations of Lumax DK Jain Group. A veteran in the automotive industry with over 33 years of experience, including 20 years in the automotive lighting sector, he has been instrumental in promoting self-reliance in technology for Indian engineers. He began his career with Tata Motors, and have held various senior positions at other major players in the auto components industry.

During the last couple of years, Lumax has signed a lot of JVs. What is the current status of your association with New Ananda Drive Techniques, China?

Lumax group has been working on a model of partnership for the past three decades and more. One of the partnerships that we have is with Stanley, which is around 35 years old for lighting and electronics. So, based on that successful model, we have signed other joint ventures also. The second successful one is with Mannoh Allied Technologies. We have signed many more post that. Some are still fructifying as it takes time in the auto industry for the business to bloom.

We had signed an MoU with Ananda Drive Techniques intending to go into electrical or EV component space. Due to the current pandemic we had to put it on hold. We will review the situation as time passes.

What are the prospects for you to expand your telematics portfolio in your JV with Ituran from Israel?

Telematics as a business is tougher than it looks. It usually appears to have a huge market potential, but when we get into it, there are many fine nuances of this business, which are pretty complex, including cybersecurity. There is perceived misuse of the data in the system. We struggled around a year to put our acts together.

However, we could recently make a big breakthrough by getting Daimler India Commercial Vehicles as our customer. With this base, we will also be expanding to other OEMs. The idea is to do our quality business at a particular price point, and our partner is also very supportive. The current requirement is for low spec, while a lot can be done in this. The market is slowly graduating to the complex requirement of telematics where we pitch in. We see a good potential; however, we will have to do much work towards that. The market also has to graduate to the level that we are working.

Will DICV be using the solutions only for the domestic market or for exports as well?

It is also for their exports. We will have to work it out step-by-step, qualify for a particular level, get customer comfort and then go to the next level. But yes, it will be of global quality.

Is this your first business for telematics from the CV segment?

That’s right. We already supply to the passenger car segment.

Are you getting enough business for your JV with JOPP from Germany for transmission products?

This JV helped us in the integration of the gear shifter with our current products (gear mechanism and knobs for AMT) made by us along with Mannoh Allied Technologies. We have already started supplies to some of our OEM customers. We see a good potential in JOPP going forward, as the market graduates to the next level of gear shifter mechanisms.

In this particular business, Lumax is dealing with two JV partners Mannoh and JOPP. How do you handle two companies?

This is a little different as we have partners from Japan and Germany. Interestingly, we can satisfy the Indian customers, which I think is more important. We have been able to act as a bridge between these two partners. Both partners also have very good relationships; businesses are discussed together, and then we execute it. I think it will become a successful model in the future.

Can we construe that it would be a unique combination of German engineering with Japanese lean manufacturing, and delivering products at Indian cost?

Yeah, you can say that. Actually, that is what is happening. There are requirements in terms of technology, system and price by the customers and it is not so easy to fulfil all these requirements. But when you connect all the dots, you get what you want.

Are you not pulled apart in different directions?

I think that is where management bandwidth comes in. But you are absolutely right. The way the market is progressing, suppliers will have to manage such complex positions. Our market requirement is very different as Indian consumers expect the same technology at probably one-fifth of the cost. Nothing right or wrong about it, and that brings in frugal engineering and innovations. It also brings in what you just said – getting pulled apart by various quarters. But, gradually, when the market gets more regulated, the price points will also change.

There is a value attached to everything. For instance, safety – if the end-users of vehicles want higher safety, they have to pay for them. This realisation was not there with Indian consumers; neither were we regulated so much earlier. With global regulations coming in, consumer knowledge is going up, safety and the value of life will become more important. Things have started changing; therefore, our preparation as a supplier must be for the market’s future.

Many products, which are low cost but unsafe, may go away very soon from the market because people would pay for safety. Especially after the pandemic, I am sure everyone is going to realise the value of life absolutely.

Lumax also has a JV with Yokowo, Japan for onboard antennas. What are the opportunities you have with vehicles becoming connected?

There are five prominent positions in a car – four corners and the roof. Fortunately, we occupy all five now and connecting all of them is telematics, which is also something that we have with us. Now, how to convert that into a good business model for our customers is the key. We are still thinking and working because, ultimately, the lighting is also becoming intelligent with a lot of electronics going into it.

The antenna is getting more into communication, including between vehicles. Now that we have all these pieces of business with us, we have to work into a good solution that we can provide to the customer, which has the synergies of all these businesses. This could be our future; it is just a thought in mind. But we work on these activities.

Does this mean there are a lot of prospects within the vehicle with all your JVs put together?

Yes, indeed. Now it’s up to us as to how we position our product, what innovations we do, and how cost-effectively we give a solution to our customers. We need to get our engineering and management ready for such a business in future.

Do you see prospects to expand your product portfolio with Stanley and Cornaglia?

We see a good business prospect with Cornaglia that makes emission systems. Despite lockdowns, we made better sales in FY21 than in the previous years because of growth in business and the new products that we are working on. It will grow exponentially in future. We will be investing more into this business as we see high potential.

Our JV with Stanley too has a bright future, especially with our expanded agreement to include electronics and all other products that partner company makes or would make in the future.

What kind of products can come out of this expanded JV agreement?

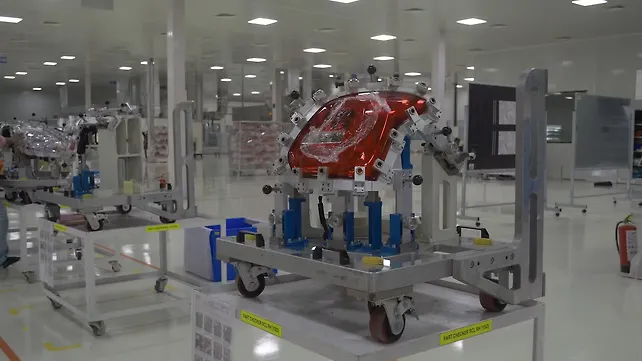

We have signed a JV for electronics, and we are setting up a plant to make Printed Circuit Board (PCB) now. We will get into HVAC panels. In fact, we have already decided to get into manufacturing, and from 2024, we should be starting supplies to our customers. The arrangement will also help us to localise certain products. Stanley is also into making touch panels.

When will the PCB facility be operational and what kind of flexibility will you have?

The PCB plant will be operational in September this year. I don’t know whether I should use the word flexibility, but I think it gives me a rigidity on quality. That is the purpose because each of the PCBs gets populated with hundreds of small components, and it is very important that the quality of those components are controlled. That is where Stanley and our electronic facility comes in.

With an in-house design centre and PCB manufacturing, do you see scope for standardisation, which can give economies of scale?

Absolutely. We can also play around on standardisation to some extent.

The Lumax group per se has many products. What are the opportunities in the adjacent areas? What is the roadmap for you to take the company to the next level?

I think there are two targets: first, to fructify the new JVs to the right level, i.e. reach a business of INR 100-200 crore. Secondly, I would like to explore adjacent areas and evolve into a system supplier.

You have R&D centres and a design centre. What are the key megatrends that drive these centres to make the Lumax group increase content per vehicle?

About four years ago, we ventured outside India to set up our R&D in Taiwan. Till then, we were pretty much focused on India. The decision was beneficial as we get a lot of electronics input from there; our tooling is managed well. We are now setting up an R&D centre in Europe, located in the Czech Republic.

We were about to set up a centre in the US as well, but we have delayed it because of the slowdown, but eventually, we will have it. We are probably the only supplier to have these diverse R&D inputs from three continents, where technology is being driven. Bringing it down to Indian costs is the challenge, but it will help in standardisation if managed well.

The technology developed for passenger vehicles can come into commercial vehicles and further transferred to two-wheelers. With incremental efforts, we can bring similar technology to different segments.

For instance, we are the first ones to change the trend in the tractor industry. We brought in LED lamps in tractors. Around five years ago, we set up a team dedicated to this industry. Today, tractors come with LEDs, projector lamps, etc., and customers want even more.

Two-wheelers too have gone into LEDs, while passenger vehicles are going into more complex LED solutions. The Indian OEMs in the CV segment, however, are yet to change. In the next two to three years, we will see a significant change in that area.

When will the R&D centre in the Czech Republic be operational, and what will be its focus?

It will be operational in Q3 FY22. The Indian market is a blend of Japanese, Korean and European technology products. So we have a clear Japanese product because of our JV with Stanley. We have Korean technology through our company SL Lumax, which supplies to Hyundai and Kia; and with the European Centre, we will get the European technology and give solution to our customers. So that’s the first significant objective.

Secondly, the Cezch centre will help us improve the skills of our people in R&D in India. Thirdly, it will bring some innovations into India because Europe is known more for innovation than any other country. So, we have to get innovations in our culture.

Do you see these centres become a centre of excellence going forward?

They will; for example, I see the European facility becoming a centre of excellence for optics and electronics. The Taiwan centre is for mechanical design and tooling, and India for manufacturing of electronics, mechanical design and certain simulations. Eventually, the centres will take that shape.

Are there any pain points to be addressed on the manufacturing side, considering diverse locations?

Yes, we are in too many locations and therefore, keeping the control right remains a challenge because it is too fragmented. So, the management has to be pretty strong, and we have been doing it successfully. In future, we may have to see whether we can consolidate some facilities. But we’ll have to see at the appropriate time. When the markets are growing, the focus on such activities goes down.

What is your Capex for FY22?

We had planned around INR 250 crore for this year. We will commission the electronics plant this fiscal, which was stalled last year. We are expanding the facility in Gujarat to cater to new orders that we have already received from the customer. In addition, there will be some regular operational Capex that is required to run the business.