Mohan Nagamangala Srinivasan (NSM, as he is referred to) is a techno-commercial professional with over 35 years of professional experience in the automotive and engineering industry in India and abroad. Starting his career at MICO (Bosch), he moved to Visteon after 15 years with the company, where he grew to become Operations Director for the Interiors Division, Managing Director of a JV with Maruti Suzuki and was the Country head and Managing Director of Visteon in Thailand.

In his next stint with Hansen Transmissions/ ZF, NSM was instrumental in setting-up and commissioning a € 150 million factory to produce gear boxes for wind turbines at Coimbatore and later as COO of the company at Belgium, was managing plants in the US, Europe, China and in India. On his return from Belgium, NSM has been associated with Suprajit Engineering initially as President and currently as the Group CEO and Managing Director.

What opportunities could you get in FY21, when the whole industry was engulfed in poor performance due to COVID?

Though FY21 began on an extremely bad note, the aftermarket and exports surprised us for both product offerings – cables and lamps. Due to the demand for vehicle servicing, the primary demand went up, which could not be catered to at the distributors’ level. This, coupled with constraints in the unorganised sector, wiped out the grey market. Therefore, organised players like us were benefited.

It is a bit more complex on the export front, and therefore, we thought it could lead to more disruptions. But again, it surprised us. Europe did exceptionally well for us, and I am not able to ascribe a specific reason. We thought that the OEMs would pull back on the new model launches, affecting us because we had won many businesses. Again to our surprise, there were launches but with some delay. Overall for the Suprajit group, the markets surprised.

How do you plan to mitigate the challenges on account of the second wave of COVID?

The second wave has got its own different set of dynamics. I don’t think the governments can afford any complete lockdown. There could be micro containment zones that would mean that the market will not have the level of disturbance that we saw last year.

Secondly, we are also now talking about extremely low or almost nil base (during last year), and by that measure anything could be a bonus. So, technically it won’t be right to compare it with Q1 FY21; rather, we should compare it with Q1 FY20.

But overall, there seems to be some amount of headwinds, mainly in the two-wheeler industry. Exports continue to be strong.

What is the reason for headwinds in the two-wheeler market?

The rural market, which had some passion ignited into the market, slowed down now. There is a general tendency that whatever was supposed to be pent-up demand or rural demand has settled down, and urban demand is not there. The urban demand is going to go down further. Because of the second wave, people are afraid that they might lose jobs, preventing buying new vehicles. Therefore, the urban market is not going to be great; the rural market will depend on monsoon.

How has the geopolitical situation favoured Suprajit?

Overseas market dynamics have become more complex and more complicated. China is still fresh in people’s minds, and particularly more in the US and to some extent in Europe, with an idea to de-risk from the country. Therefore India is figuring in their minds.

What is creating more disturbances in the market is the container shortage and shipping disruptions. The average time for the shipment to reach either the US or Europe has gone up tremendously. But still, the transit time increasing by two to three weeks can be managed. It will mean additional float in the pipeline, which I still think we can absorb.

What is more critical is uncertainty. Business does not like uncertainty; we cannot predict how much time it takes for a ship to sail and berth and container to be taken out, de-stuffing, land transportation, etc. There are ports in the US and Europe, which are congested due to COVID restrictions. It is not a matter of extended time, but a matter of uncertainty that is causing palpitations in all those buyers, particularly in the US and Europe. Business will pick up only if there is a certain amount of certainty coming into the supply chain.

For Suprajit, our focus has been to see how we can supply out of our plant in Mexico to the US customers and how we can use our Slovenian facility in Europe mainland much better.

Would these issues not inflate logistics costs and impact bottom line?

Definitely yes.

How many plants do you have outside India?

In the US, we have a plant in Kansas. We have another facility at Juarez in Mexico, which is just across the border of El Paso, Texas. In Europe, it is in UK, at Tamworth, Birmingham and because of Brexit we have picked up another location in Slovenia near a port called Koper.

Where do you see opportunities to grow further?

There is still growth potential for cables in the overseas market. More and more people would be ready to source cable, which is an easily shippable commodity. Therefore, as a commodity, it is very easy to outsource it. Secondly, it is extremely labour intensive and the ability to automate it is restrictive. And given that condition and with the kind of arbitrage that we have, I see that there will be more traction on that for us.

Our major play in bulbs is now becoming more and more aftermarket driven. I would say it’s more tilting towards 70% aftermarket and 30% OE because of LED penetration. The global players will start trying to wean down their non-LED capacities, which would mean somebody needs to step in to fill the gaps in the global aftermarket. Therefore, we look at domestic and overseas markets, and I am confident that we will be doing good.

After we took over the Osram facility in Chennai, we got Osram as our customer, not just for their Indian but also for their global requirements. Our overall capacity utilisation in a COVID year, despite losing one quarter, is close to 70%. So, that in itself speaks volumes that is there is a market out there. We started selling to China and Russia. The markets are there, it is for us to go and take them.

Do you see a drop in sales for cables with new mobility inching in?

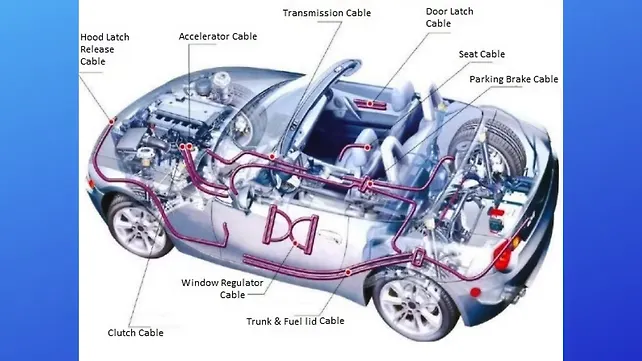

What is getting changed in EVs is the drivetrain, as the IC engine is getting replaced by an electric motor and its subsystems. Cable has no relevance to powertrain, except the one used for clutch and accelerator. Otherwise, cables are used in all kinds of vehicles for door locks, window regulators, opening bonnet/hood and seats – for several features, including lumbar support etc. These are necessary not just from a convenience point of view but also from a safety perspective because, in case of a power failure or a power disruption inside the vehicle system or subsystem, it is necessary to have a safety measure through a mechanical device to operate these areas. Therefore, I don’t see any threat. To give you a classic example, Tesla cars have got cables. Therefore, I do not see much of a threat.

Do you foresee drop in sales for your lamps business as there is surge in LEDs?

It is inevitable; technology is moving towards LED. However, there is a question of affordability to embrace this feature, especially in entry-level segments in a two-wheeler. For example, one of India's key OEMs had introduced an LED-based headlamp in an entry-level scooter. They found reluctance in the rural market; therefore, they had to revert to a halogen bulb-based headlamp, and now they have in the same model two variants available – with LED and regular halogen lamp.

The urban segment seeks the LED variant, whereas the rural segment prefers halogen because they are more comfortable with lights. Lights are also cheaper to replace. Would there be a transition to LED? The answer is definitely yes. For us, what is essential is that we need to capture the world aftermarket. While the market for conventional lamps is going down, we should be growing.

What are the opportunities to expand your product portfolio?

We have constantly been innovating in terms of bringing out new halogen bulbs. That is again to cater to different markets, including Russia and China. On the cable segment, we are looking at both ends of the cable, where there are mechanisms. Therefore, we are transforming to more as a solution provider rather than a cable manufacturer.

We are also slowly transitioning from being a cable manufacturer to a control system solution provider. We are already supplying rotary sensors to the non-automotive market in the US through our subsidiary Wescon Controls. We are planning to bring it to India also. Therefore, electronic controls systems would be an area, where we will be present.

Other than that, we were manufacturing mechanical instrument clusters, and now we are transitioning to electronic speedos. We have a new division set-up within Suprajit to cater to electronics, specifically sensors and actuators and instrument clusters for two-wheelers. We have developed sensors related components and showcasing it to the customers now. This will give additional business, when some cables are eliminated.

Do you need to expand your plant or set-up a new plant anywhere in the country or outside?

Well, within India, I think by and large; it will depend upon what the customer wants. The latest plant that we put up was on the outskirts of Bengaluru where HMSI has a factory. As we quickly filled it up, we had to go in for a capacity expansion.

What about expanding capacity at your plants overseas?

That would be a continuous exercise; as and when potential assets become available and a strategic fit to us, we would like to look at those assets that make business sense going for inorganic growth. Apart from that, we will continue to look at organic growth at our Wescon facilities.