With technological innovations occurring each passing day, the automotive industry has witnessed rapid transformations. Earlier, auto manufacturers used to try hard to install vehicles with advanced technology. But the level of technology and tech-enabled services in today’s models is such that the ecosystem is witnessing a realignment. This change has opened new avenues for the industry as smart technology shifts towards battery-operated vehicles.

The automotive industry is undergoing a paradigm shift, attempting to make a quick transition to alternative energy sources. India, being part of the same league, has been making several attempts to move ahead with modern policies to deal with the accompanying growth in automobiles and shift to electric mobility after considering various factors such as the hassle of oil imports, global climate change issues, scarcity of natural resources, attainment of sustainability, pollution, and others.

The Government of India has proposed several changes to the Central Motor Vehicle Rules, 1989, to encourage electric mobility in India. India aspires to become a significant global vehicle market, with several automakers and start-ups working on relevant segments and tech-enabled gears.

EV Adoption

In India, the growth of e-mobility requires the mandatory installation of EV charging stations. However, the charging infrastructure is a critical factor in determining the country’s EV adoption possibilities. Since EVs run on batteries, the massive operation of the vehicle leads to the requirement of recharging the batteries. This also depends on the size and capacity of the battery.

As a result, charging stations are essential for the long-term operation of electric vehicles. In one of its reports, NITI Aayog has estimated a high possibility of India having a high level of electric vehicle penetration by 2030.

While the transformational push for electric vehicles is a great initiative adopted worldwide, it brings with it a plethora of opportunities and challenges. There are a lot of global manufacturers, who have already taken their first move to make the transition to EVs a reality on a large scale. These industry giants have expressed optimism about the growth of electric vehicles and charging stations in India.

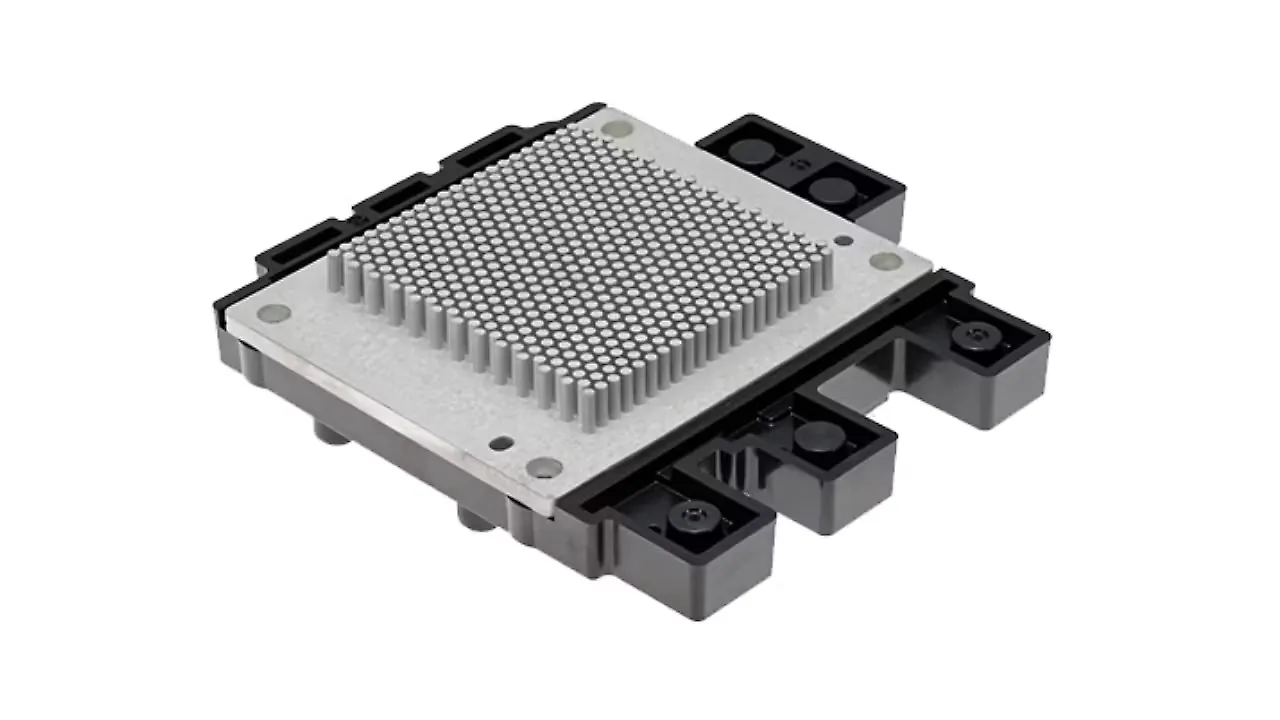

Role Of Power Semiconductor

Based on recent developments, India is gradually catching up with the rest of the EV charging ecosystem, considering the manufacturing part of the ecosystem and automotive components, which must meet stringent vehicle safety standards. This ultimately has created a high demand for power semiconductor modules developed by power semiconductor manufacturers, which provide more reliability than industrial equipment modules.

These power semiconductors are undoubtedly a key to the energy efficiency and fuel economy of Hybrid Electric Vehicles (HEV) and EVs. The invention of power electronics technology has made it possible to increase the driving mileage, thereby enhancing fuel economy and efficiency in HEV/ EVs.

HEV power system, drives, controls, or any application heavily depends on high power switches. The cost, efficiency, comfort, and driving range improves with an increase in hybridization, which ultimately means that there are more applications with power electronics.

Common electric batteries rely on dated technology, limiting their performance. As a result, EVs can suffer from high costs and short life spans. But new semiconductor innovations offer the potential for longer and more efficient battery life. Semiconductor chemistries like Gallium Nitride (GaN) and Silicon Carbide (SiC) allow EV batteries to operate at higher voltages than traditional silicon wafers.

According to a report, the power semiconductor market for EVs is expected to take a steep jump. Between 2020 and 2026, the market will be three times the size of the current usage and demand, growing at a rate of 25.7% CAGR to $ 5.6 bn, driven by a major technology battle between insulated-gate bipolar transistor (IGBT) and silicon carbide (SiC) modules.

Nowadays, many semiconductor players are targeting SiC modules for EV applications, due to which the SiC module market is expected to reach 32% of the total EV/HEV semiconductor market by 2026. If such is the case, there’s no denying that the power semiconductor market will soon have a stronghold on all major industries.

About the Author: Yogesh Bhatarkar is Manager, Semiconductor EV Business at Mitsubishi Electric India