The approved Production Linked Incentive (PLI) scheme for the auto sector with an outlay of INR 26,058 crore has undoubtedly repositioned the focus from making the sector self-reliant to bolstering the adoption of technology-driven indigenous production of vehicles and components.

The draft includes four major schemes – component champion, vehicle champion, global sourcing and product-linked incentives – which have been aligned to a similar goal of making the Indian auto sector ‘Aatmanirbhar’ or self-reliant with technological advancements.

With the updated draft of this scheme, the government has been transparent with its intention to provide financial incentives to boost domestic manufacturing of advanced automotive technology products and simultaneously attract investments in manufacturing value chain.

The scheme would allow overcoming cost disabilities, creating economies of scale and building a robust supply chain for products that are technologically advanced. However, original equipment manufacturers (OEMs) and component manufacturers would need to invest first to avail the incentives.

Need To Increase Capital Expenditure

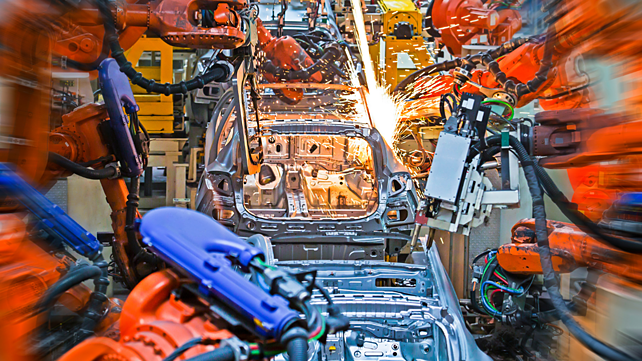

With the scheme focused at transforming the country as a manufacturing hub, the auto and auto-component manufacturers are expected to increase capital expenditure to meet revenue commitment under the scheme and avail the incentives. The first and foremost step taken by OEMs, therefore, should be in line with increased capital expenditures that would allow them to move up the value chain with higher value-added products.

To facilitate for the new tech vehicles and its components, research and development (R&D) investments also need to be expanded. The investments in R&D (especially for component makers) needs to be aggravated, as the current investments are relatively on a lower-end.

Financing the scheme will not only generate employment, but will also expand the potential for exports, making indigenous products eligible for international markets. The government has projected fresh investments of over INR 42,500 crore along with an incremental production of over INR 2.3 lakh crore. These investments in capital expenditure are expected to be made from global players/ new entrants in the market along with domestic stakeholders.

With transition to e-mobility space, India can reposition itself in the global automotive industry and become one of the largest markets for electric vehicles (EVs). To attain this status, component manufacturers should look at global EV manufacturers and find out ways to add value to manufacturing in India.

For component manufacturers, Tier II and Tier III would need to maintain quality and come at par with components manufactured on a global scale. Going forward, this should remain uncompromised. Similarly, the onus of leading the Tier II and Tier III suppliers to maintain product quality and ensuring its technological advancement falls primarily on Tier I.

Meeting such expectations would allow OEMs, component makers and non-automotive companies in the ecosystem to avail incentives.

Incentives At A Glance

- For auto OEMs, global group revenue should be a minimum INR 10,000 crore, whereas the global investment of the company or its group companies in fixed assets (gross block) of INR 3,000 crore.

- For auto component manufacturers, global group revenue should be a minimum INR 500 crore, whereas the global investment of the company or its group companies in fixed assets (gross block) of INR 150 crore.

- Under champion and component incentive scheme, INR 2,000 crore and INR 250 crore needs to be made, respectively, over the next five years.

While The Scheme Looks Promising, Roadblocks Persist

Though the PLI scheme remains optimistic for creating global manufacturing hubs in India, it is more favourable to large entities with huge domestic and export turnover. Other companies with a limited product range and constraints on capacity would find it difficult to fit into the strict eligibility criteria. Considering the Indian automotive landscape, many start-ups have been trying to grab the market share of developing EV ecosystem, however, it is likely they would fail to avail incentives under the PLI scheme due to failure in meeting the eligibility criteria.

Moreover, auto giants in the sector would need to plan their investments accordingly for latest technologies in the EV space. A majority share of vehicle plying on Indian roads are still internal combustion engine (ICE) powered. As per a Bloomberg report, India would still need another decade to reach 30% electrification.

Despite major schemes and policies, the share of investment for e-mobility in India is extremely low on the back of scalability and infrastructure constraints and it is largely confined to the two-wheeler segment. While impetus to establish a complete EV ecosystem is being given, manufacturers cannot completely do away with ICE for the next few years.

About the Author: Saket Mehra is Partner and Automotive Sector Leader at Grant Thornton Bharat.