Digitalisation across the aviation value chain will enable relevant stakeholders to maximise the utilisation of their existing assets, enhance planning capabilities, and reduce workforce and energy wastages.

To create a profound impact on their sustainability initiatives, the global aviation ecosystem will have to invest in projects such as carbon offsetting, carbon capture and removal, and sustainable aviation fuels (SAF). These investments have already begun but are at a nascent stage. The investments, technology, and regulatory guidelines will mature over the medium term.

Carbon Offsetting

Carbon offsetting is a practice that is gaining prominence across industries. Simply put, it’s a practice where an organisation offsets its carbon emission from its daily operations by investing in another area, where an equivalent quantity of carbon emission is reduced, or an appropriate amount of clean energy is generated. For an airline, each ton of carbon emitted from its flight operations can be offset by investing in afforestation, developing alternate energy sources, and investing in carbon capture technology, which will potentially compensate for their negative environmental impact.

Carbon Offsetting: Schemes and Instruments

Aviation specific schemes such as Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) and national Emission Trading Schemes (ETS) such as EU-ETS (European Union) enable organisations to trade carbon emissions. The emission trading systems that are being piloted in several countries deal with greenhouse credits, in most cases carbon.

There is a cap on emission levels that regulators set based on industry. If an organisation requires going beyond this limit, it will need to purchase credits from firms with lower carbon emissions. At a given period, the organisation is required to pay the regulators for the net positive credits purchased. EU ETS is the first such emission trading system and has enabled a reduction in greenhouse emissions (of the involved companies) by more than 30% in 14 years (2005-2019).

CORSIA was developed under International Civil Aviation Organization (ICAO) to provide a uniform approach to carbon offsetting in aviation. Instead of different stakeholders investing in various offset projects, CORSIA provides a common standard for aviation carbon offsetting. Also, it provides benchmarks and high-quality projects that deliver on greenhouse gas emission reductions. CORSIA estimates that this scheme can reduce emissions by more than 2 billion tons and generate over $40 billion.

Carbon Offsetting: Criticism and Debate

Carbon offsetting is a recent concept that is constantly refined to achieve its full potential. Independent investigations into specific projects have found certain flaws in the credit provision mechanism. The agencies that provide credit often overstate the benefits of particular projects and award a sum of carbon credits to the client that may not be an exact compensation for the ground reality.

As per Frost & Sullivan’s analysis, the modelling and methodologies for carbon credits require being more robust and transparent and requires high levels of collaboration between carbon credit agencies, project owners (NGOs), purchasing company (airline), regulators, and governments.

At present, carbon offsetting is a tiny market (less than $1 billion), and aviation will contribute to a share of this market. But, this is a gradually growing market, as companies increase their investments to offset their emissions. These investments will be a key pipeline for climate finance that will be reutilised for critical projects such as afforestation, reducing land clearance, and conserving water bodies and forest areas.

Sustainable Aviation Fuel (SAF)

SAF is derived from biomass and waste. This waste is collected and stored at suitable locations and chemical processes at factories convert it into low-carbon fuel that has sufficient power to thrust an aircraft. This output is mixed with traditional jet fuels that are then fed into the aircraft engine.

Sustainable Aviation Fuels are already in utilisation to power some aircraft. But, it still requires to be blended with traditional jet fuel for operations. The blending process and refuelling capabilities can be built on existing fuel infrastructure. The collection, storage, and processing of waste is another additional investment requirement. But these capital expenditures can be sustained by many aviation stakeholders.

The key challenge for widespread adoption is the significantly higher costs of traditional fuel. This cost hinders demand, and the cycle leads to low production from suppliers, thus keeping prices high. Norway is a country that has mandated 0.5% of its overall aviation fuel supply to include SAF. A few other countries are following up with such mandates. This may reduce the emissions to a certain degree, but at higher operational costs for airlines.

As per Frost & Sullivan’s analysis, SAF is a clear alternative that can fill the need for alternative fuel for the industry. And until that time, airlines will be required to increase the use of SAF to reduce their emissions significantly.

Carbon Capture Technology

This is a nascent field that is gaining attention and investments for its carbon emission potential. Companies are attempting to attain carbon sequestration solutions in multiple ways. This developing market will require collaborative investments from the aviation sector, governments, and other industries to make significant progress.

Three key bottlenecks are halting the introduction and scaling of this nascent technology:

- Pricing: As per the industry experts, the current estimates for capturing a ton of CO2 are within $1,000. But the pricey component is the investment in infrastructure and research.

- Scaling: To address the growing carbon emissions, there will be a requirement for large-scale expansion of such plants globally. Expanding the plant base and associated power requirements will come at a steep price.

- Business Model: Who will foot the bill of each CO2 captured in different parts of the globe? Companies will have to look at developing a strong business case to drive investments and develop a robust revenue model with the collected carbon.

The table below highlights a few cases where aviation stakeholders have made investments in medium-term sustainability projects.

| COMPANY | AVIATION SEGMENT | MEDIUM-TERM INVESTMENT | INVOLVED STAKEHOLDERS | PROJECT BRIEF |

| Lufthansa Group | Airline | • Carbon Offsetting • SAF | Compensaid: Developed by Lufthansa Hub in 2019. Enables passengers to monitor their emission levels & compensate accordingly | • Passengers can pay an additional charge for investing in SAF. • Or, they can invest in Lufthansa’s climate partner, myclimate, a climate support organisation. |

| San Diego International Airport | Airport | Carbon Offsetting | The Good Traveller: Offset programme that started at San Diego International Airport | • Accurately estimate carbon emissions for a trip and purchase relevant offsets.• Projects such as enhanced forest management. |

| AAR Corp. | MRO | Carbon Offsetting | Fortress Transportation and Infrastructure Investors | • Joint initiative between two firms to purchase verified carbon offset (CORSIA standards) and provide them to customers. |

| Airbus | OEM | Carbon Capture | Project 1PointFive: JV of Oxy Low Carbon Ventures & Rusheen Capital Management | • Airbus purchased 400,000 tons of carbon removal credits.• This is a pre-purchase for the capture and permanent sequestration of 100,000 tons of CO2 annually for four years, with future purchase options. |

| United Airlines | Airline | Carbon Capture | • Industrial-sized direct air capture plant to sequester 1 million tons of CO2 annually. • Multi-million dollar investment from the airline. • Estimated to offset 10% of airlines’ annual emissions. | |

| Source: Lufthansa, San Diego International Airport, AAR Corp., Airbus, United Airlines, Frost & Sullivan | ||||

Conclusion

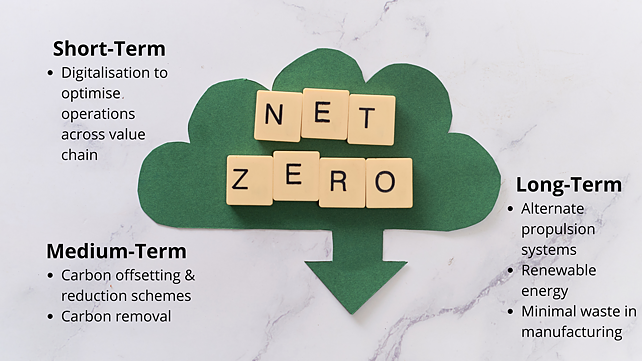

Companies need to be aware of the projects they invest in, their quality of work, and their credibility. Purchasing carbon credit is an innovative way to offset operational emissions, but this should only be a stop-gap investment. Primary investment pipelines must be directed to solutions that can enable aviation to attain net-zero emissions in the industry. We will look at the potential focus areas and activities in this area in the next article.

Note: This is the third article in the four-part article series by Frost & Sullivan on sustainability in the aviation industry.

About the Author: Abhilash Abraham is Senior Research Analyst, Aerospace & Defense Practice at Frost & Sullivan.