With the auto components industry anticipated to touch the $200 billion (bn) mark by 2026, localisation of production of auto parts and ancillary supplies appears to be an ideal goal before Indian manufacturers. And with the government’s ‘Atmanirbhar Bharat’ and ‘Make in India’ push underway, it is the right time to build our capabilities inwards.

The COVID-19 pandemic had its share of lessons to offer across industries. It taught every country to reduce its dependency on imported products and in parallel develop a robust local supplier ecosystem.

Increasingly, global OEMs are also now considering a “China plus one strategy” to develop alternate suppliers. And it is only right that India’s industries work on planning production, preparing their buffer inventories, forecasting demand, and rebuilding supply chains at optimised costs. It is also essential to work on evaluating improved or alternate supply-chains for important suppliers.

Data suggests that the Indian auto components industry grew at a 6% CAGR over FY16-20. The industry size touched $49.3 bn in FY20 and is estimated to hit $200 bn by FY26. The sector accounts for 2.3% of India’s GDP. Moreover, India is projected to be the third biggest auto component producer in the world by 2025.

Data from Automobile Component Manufacturers Association (ACMA) shows that the Indian auto component exports were worth $14.5 bn in FY20, which could rise at 23.9% CAGR to $80 bn in five years’ time. Crucially, a McKinsey report showed that the auto component sector has the possibility to localise and substitute imports of up to $12 bn.

These crucial data points suggest that it is a ripe time for Indian auto component manufacturers to invest on systematic research and development to maximise benefits from the globalisation of this industry.

Speed Breakers, Challenges Along The Way

While India’s potential is huge (owing to the continued rise in world-wide demand), there are challenges preventing 100% localisation. These constraints are limited not only to technology, but production costs as well. Unavailability of certain raw materials, and capability limitations and economies of scale are other challenges facing the industry.

The Centre’s production-linked incentive (PLI) scheme for auto and auto components businesses to help the COVID-hit sector enhance production will likely benefit micro, small, and medium enterprises (MSMEs) but the auto parts industry needs more continued assistance. It will be vital for the government to ensure that there is ease of doing business, ready availability of capital at lower rates for industries alongside internationally competitive logistics, coupled with low energy costs – all pre-rudiments to safeguard the interests of the industry.

There is also a demand from prominent sections of the auto industry for the government to offer support through reducing GST and incentive-based scrappage policy.

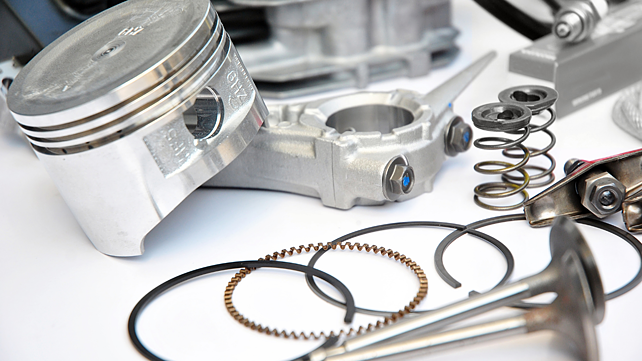

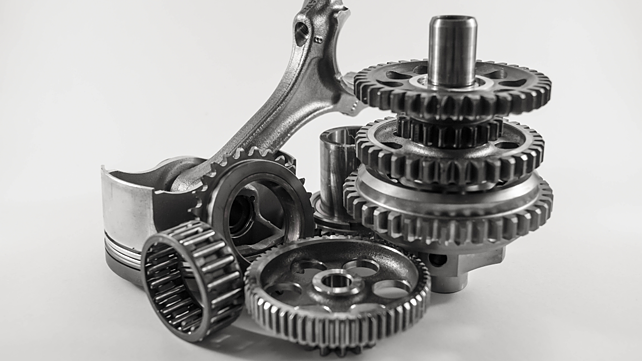

For India to become a world class manufacturing hub, it is imperative to tap on the low hanging fruits. The manufacturers could lay thrust on localising automated parts like the forged and machined components and lightweight polymer-based components. Other components like steering and drive transmission, engine, and electronic components, which currently account for over 75% of auto part imports, could realistically be locally developed.

The production for all bearings needed for the automotive segment could also be multiplied manifold to cater not just locally but also meet global demand. Thereby, gradually making a shift to emphasise quick wins and then cautiously moving to bigger and more critical parts will be key.

Transition to electric vehicles in India is still in a budding stage. Transformational changes and significant investments must be made in research and product development, both on the automobile and battery technology platforms. For the sector to be a winner in the global race and succeed, it is crucial to assess the EV market and plan in accordance to be future ready.

India has long depended on other Asian countries for automotive components and this reliance cannot end overnight. A long-term well-defined roadmap to build domestic capabilities is an imperative requirement for the time being.

Being an essential pillar of the auto industry, auto component manufacturers can play a defining role as a critical cog of the wheel and help maximise India’s potential on the global stage in the years to come. That is, if we start working on a plan now.

About the Author: Rohit Saboo is President & Chief Executive Officer at National Engineering Industries.