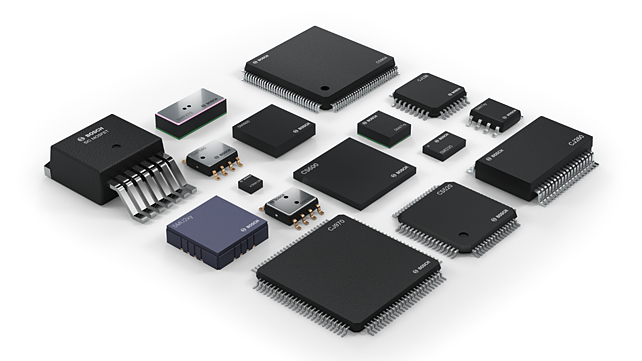

Chips influence nearly every aspect of our lives today. What is common among seemingly unrelated products such as smartphones, bank ATMs, medical equipment, laptops, bomb detectors, digital infrastructures that run internet, vehicles & trains, washing machines, electric rice cookers and much more is that all of them require semiconductor chips as a key building block.

What is a semiconductor? A conductor is a substance that carries electricity and an insulator is a substance that does not. Semiconductors are substances that are in between and can switch between their conducting and non-conducting stages, which makes them extremely useful in a multitude of applications.

During COVID-19, with people stuck at home and with work from home becoming a norm, demand for consumer electronics such as laptops zoomed. Later, as the economies opened up, other industries, where chips are also used commonly, such as automobiles, began to scramble for the same raw material.

As demand soared and the supply of semiconductor chips could not catch up, what was unheard of during the pre-pandemic times – a shortage of consumer durables and vehicles – ensued. During the rest of this decade, the fastest-growing demand segment for semiconductor chips are expected to be automotive electronics, including wireless communication with growing investments in Internet of Things (IoT), artificial intelligence as well as industrial demand from sectors such as medical devices.

Policy Support

It is on this backdrop of the worldwide shortage of semiconductor chips, that the Indian government has announced a production linked incentive scheme of INR 76,000 crore to attract global and local industries to set up design and manufacturing units in India.

Given that the semiconductor industry is one of the most capital intensive industries and one that benefits significantly due to economies of scale as production is ramped up, government support of up to 50% of the project cost is the main incentive. The broader aims of the policy are to reduce India’s dependence on imports and to generate much-required direct and indirect jobs.

If we take government cash support for granted, what are the other crucial ingredients in setting up a thriving semiconductor industry ecosystem? Fulfilling complementary conditions would be especially important at the current juncture given that other governments including the European and United States too have announced a strategic ambition to raise their share in the global semiconductor industry over this decade.

With the competition to attract the global players hotting up, semiconductor giants are going to decide the location of their future plants based on their projection of profits. A recent McKinsey study[1] also shows that the gap between the profit margins of the top players and the rest in the industry has widened over the years – due to differences in cost competitiveness, pricing capabilities, customer base and ability to develop innovative business models.

Production Process

The production of semiconductor chips has several stages that need to run smoothly and efficiently. In recent years, the industry has split its high capital investment costs with specialised companies servicing each stage of the production process. It starts with R&D to create a chip design either for general purpose use or specific use. These companies are known as fabless.

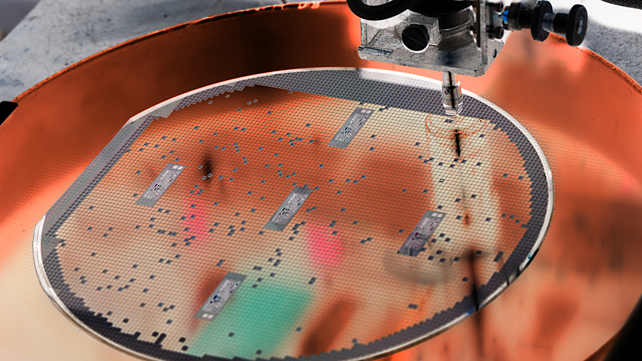

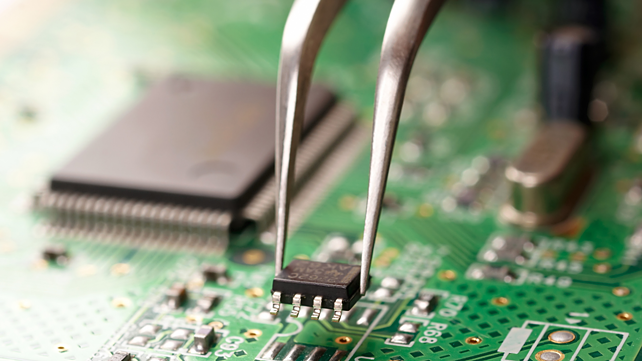

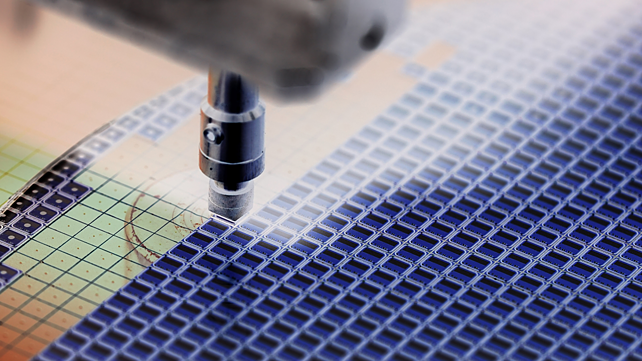

Then, the front-end manufacturing companies or foundries, where silicon and other material used in the production goes through a series of complex processes. Then comes the back-end manufacturing process by Outsourced Semiconductor and Assembly Test (OSAT) companies, which assemble and package the chips.

Finally, the chips are integrated into the end products. Every company in the semiconductor supply chain has a unique role and its success depends on creating a strategic position in the supply chain. There are only a few companies that have integrated design, manufacturing and assembly units.

Attracting design companies would require top R&D capabilities with a stable pool of engineering talent along with world-class infrastructure and a stable policy environment. Going ahead, with technology changing fast and the demand for cutting edge and customised chips rising, the design requirements would only rise. The local employment gains, especially low-skilled jobs, out of attracting design companies, however, would be limited, unless manufacturing units are also located in India.

The manufacturing process of semiconductor chips consists of numerous steps requiring precision, expertise and varied inputs. Semiconductor production is energy and water-intensive and uses different types of heavy metals, acids, alkalis, and chemicals. Ensuring stable and high-quality power and water supply, as well as the supply of material inputs including imports at attractive prices, would be needed to help manage competitiveness.

Further, the environmental issues related to the industry need to be amicably discussed with a resolution agreed upfront so that there is no policy backlash later on. The government of India intends to work with state governments to ensure the smooth functioning of the produces process.

In Conclusion

Overall, setting up semiconductor production units would be just the beginning. Successfully running them would require good quality public institutions and a stable policy environment. It is for this reason, the potential companies looking to setup a unit would also be carefully comparing the state-level competencies. Locating a unit in a state without the advantage of the above complementarities would bring in added difficulties.

Finally, while the industry is going through a severe shortage today, there would inevitably be periods of oversupply in the future given that a number of governments are providing incentives for semiconductor chips production. The risk of cyclicality, therefore, remains high. Setting up a thriving ecosystem takes time and by the time the incentives get translated into actual production and revenues, it may be difficult to withdraw the financial support after six years, as currently planned.

In sum, as the Indian policymakers are aware, a holistic approach to the development of the semiconductor industry would be required if we are to become a world-class hub that the latest policy envisages. The central and state governments’ co-operation on the policy priorities and execution would be central to achieve it.

Reference:

[1] https://www.mckinsey.com/industries/semiconductors/our-insights/value-creation-how-can-the-semiconductor-industry-keep-outperforming

About the Author: Vidya Mahambare is Professor of Economics at the Great Lakes Institute of Management in Chennai.