As rates of vaccinations rise and the festive season beckons, India’s automotive industry is looking upbeat too. Most Original Equipment Manufacturers (OEMs) have started building up inventories looking at an increased demand for vehicles in the coming months — a positive sign for the entire ecosystem. Based on current trends, several top auto industry financiers are predicting a robust recovery for the sector.

Data shows that sales of two-wheelers have been registering an upswing for a few months now after having taken a dip for almost two years. Passenger vehicle demand is also up. A similar pattern is being observed in the three-wheeler segment. Tractor exports were at an all-time high in August this year, with the unit trade crossing the 10,000 mark thrice.

However, there was a decline in domestic market sales. With the monsoon looking good along with favourable macro-economic factors and positive farmer sentiments in effect, more sales are expected in the coming months.

Current Challenges

While the good news is that demand is projected to be high, the road to recovery is far from easy. Challenges still exist. These include traditional problems such as infrastructure scarcity, demand-supply issues, scaling-up output, and newer issues such as accessing world-class tech, being cost competitive and obtaining cost-effective capital.

Making matters even trickier is the commodity cost going up, shortage of semiconductor chips, lack of skilled manpower, port congestion and higher logistics cost.

Government’s Booster Shot

The Union Cabinet’s approval of the Production Linked Incentives (PLI) scheme for the auto sector is a welcome step. This could help speed up the post-Covid economic recovery process. India’s government has been trying to boost vehicle demand by enacting new policies and easing liquidity. This will benefit the bearings industry too. According to the Centre, the PLI scheme is expected to create new investments of more than INR 42,500 crore and boost incremental production to over INR 2.3 lakh crore.

The PLI scheme primarily focuses on electronic vehicles (EVs), hydrogen fuel cell vehicles and their parts. The scheme will help with adoption of new technology. This push is likely to make way for more talent towards EV start-ups and manufacturers and ultimately help India gain a foothold in the global auto industry. Data suggests that the current share of advanced auto technology in India is only 3% compared to the 18% that exists globally. This market is expected to double in the coming decade.

Industry Outlook

The long spells of COVID-led lockdowns across the globe have taught us how digitalising supply-chains, capacity building and localising manufacturing are critical to reducing our dependency on imports. In the current climate, being Atmanirbhar is the only real choice to exercise.

Along with self-reliance, sourcing also needs to be diversified. Until recently, most imports for raw material for OEMs were restricted to China, but post-COVID it is essential to look out for newer domestic avenues. Enhancing localised production of automotive parts will reduce our dependency on other countries and also streamline supply-chains, reduce costs, and further exports.

While boosting domestic manufacturing is essential to growth, our focus also needs to be on international sales. To become market leaders, Indian industries need to increase exports. Expanding India’s global footprint is also an important goal. Therefore, looking out for merger and acquisition opportunities is key. These integrations are essential as they help expand businesses and diversify product range. These strategic partnerships will help take the Indian industry closer to the international consumer and give us a bigger playing field.

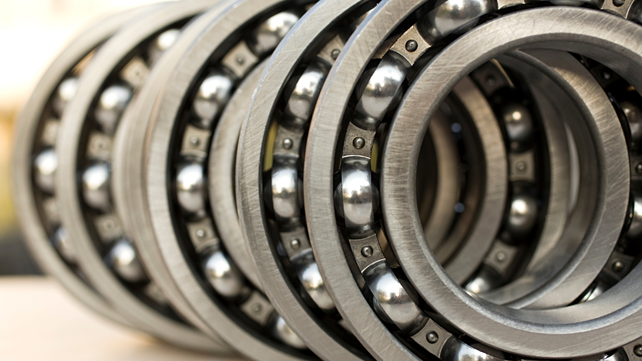

Another crucial element is keeping pace with changes happening in the industry. New research and development initiatives should be focused on adapting cutting-edge technologies. With the electric vehicle market witnessing an evolutionary change, the requirement for high RPM and light-weight bearings is also expected to grow substantially. As per an analysis by Data Bridge, a market research firm, the sensor bearing market could expand from its earlier projected value of $ 4.97 billion in 2018 to $ 7.61 billion by 2026.

For bearings manufacturers, the auto industry will continue to be a large consumer. Its aftermarket business is also substantial; with ever-increasing vehicle numbers in India, there is huge potential in areas like pre-owned automobiles, spare parts, servicing and supporting the chain. There is also a lot of untapped scope for makers of bearings in the industrial segment. Inroads in the space and defence sectors, cross collaborations, and knowledge exchange can be defining partnerships for the segment.

To summarise, automotive is among the most essential sectors in the country, making up 7.1% of India’s GDP and employing over 37 million people. This massive scale gives us opportunities for expansion in the future. There is work to be done to make the nation’s industry self-sufficient & technologically capable, but exciting times lie ahead for the auto world and India’s biggest bearings exporter.

About the Author: Rohit Saboo is President & Chief Executive Officer at National Engineering Industries.