The COVID-19 pandemic is not a new topic for anyone at this time. Everyone on the planet is discussing it and will continue to do so for the foreseeable future. The pandemic has not spared any industry. Lockdowns, shutdowns, and production stoppages have led to problematic situations for all.

The automobile industry has also faced significant challenges due to COVID-19. The problems did not start with the pandemic. In fact, the industry was already experiencing a slowdown, but the pandemic was a substantial blow to automotive OEMs and suppliers [1].

Before the pandemic, auto sales were already in a slump, mainly due to the overall slowdown in the economy, the increase in third-party insurance and road tax, and the consequent hike in the cost of acquisition and the liquidity crunch.

Another significant factor was the uncertainty arising from inventory liquidation before the BS-VI transition and expectations of a possible GST reduction. The BS-VI was a substantial movement in the Indian automotive sector. People were excited about it, comparing it to the Euro Norms.

I know a handful of people, who put off buying a car or motorcycle just because of BS-VI being implemented in the coming months. This meant BS-IV inventory was being sold at heavy discounts, but nobody was ready to buy it. Maruti Suzuki, India's biggest automobile manufacturer reportedly wrote off INR 125 crore worth of cars and spare parts, which were not BS-VI compatible [2].

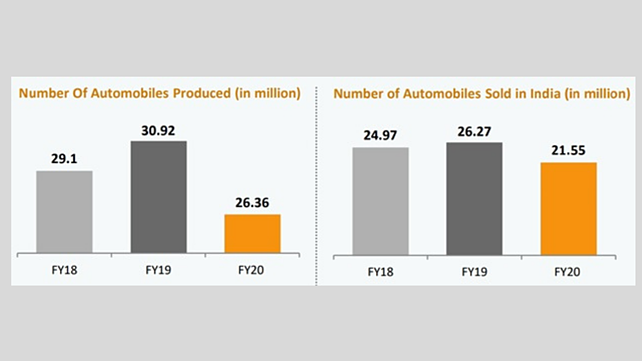

The automobile industry is the backbone of the Indian manufacturing sector. India is the 4th largest vehicle market in the world, and hence when the automobile sector is in a slump, the whole economy slows down. In light of this already slow economy, the pandemic could not have come at a worse time, where the industry was expecting to recover. COVID-19 lockdowns ensured that wasn’t the case.

In FY19, the industry produced roughly 31 million vehicles, which then reduced to 26.3 million vehicles in FY20 as shown in the appended figure.

Massive losses

According to a parliamentary panel report submitted to M Venkaiah Naidu, Chairman, Rajya Sabha during the first wave of COVID-19, the Indian automotive industry suffered as much as INR 2,300 crore loss per day. The estimated job loss in the sector was about 3.45 lakh, according to the same report [3].

These numbers are not small by any stretch of imagination, and the automobile industry has felt the brunt of the pandemic. Some OEMs fared better than others during the time, some used their plants for helping fight the pandemic, but overall, it has been a bad couple of years for the industry. The pandemic directly affected automobile manufacturers due to loss of production and is now affecting the industry in indirect ways.

Effect of parts shortage

We have all heard about the semi-conductor shortage affecting automobile OEMs now. Semi-conductor companies first diverted their production efforts towards the industries booming in the pandemic. They ramped up production for chips being used in medical devices and laptops – commodities in demand during the pandemic and due to the onset of 'Work-from-home' – and reduced supplies to automobile OEMs.

When the automobile industry is recovering and production has started to crawl back to pre-COVID times, a semi-conductor chip shortage has begun. Chip manufacturers like TSMC and Intel foundries are still focused on the PC market, and nobody has chips for the automobile industry.

The aftermath of the pandemic is something that nobody expected – semi-conductor shortage affecting automobile OEMs. The problem is significant enough for manufacturers to develop new business ideas or think about producing chips for their cars, which is a long-term solution.

Even India’s top OEMs like Maruti Suzuki have stated that it is making some adjustments in its models due to the ongoing chip shortage and doesn't see the crisis subsiding for another six months. However, it added that the “customers have been quite accommodating” [4]. Mahindra & Mahindra too have said that the chip shortage is a pressing issue, while declaring its March 2021 annual results, and companies like Ford needed to stop production for some time due to this [5].

Conclusion

We see that the last few years have been harsh on the industry, not only due to the pandemic but as stated earlier, it was a considerable blow. The aftermath of it does not seem to subside soon. However, most of the hardships and challenging times for the industry are in the rear-view mirror, and the industry is bouncing back as you read this.

References

- Sharma, N. (2020, April 13). Slowdown + Lockdown: India’s Auto Sales Log Worst Slump In March. Retrieved June 3, 2021, from Bloomberg Quint: https://www.bloombergquint.com/business/indias-auto-sales-log-worst-slump-in-march-as-lockdown-adds-to-slowdown-pain

- Venugopal, A. (2020, May 19). Maruti BS4 car parts worth Rs 125 crore – Registered as write off. Retrieved June 3, 2021, from Rush Lane: https://www.rushlane.com/maruti-bs4-cars-unsold-losses-rs-125-cr-12361956.html

- PTI. (2020, December 15). Lockdown Effect: Indian automotive industry suffered Rs 2,300 crore loss daily. Retrieved June 3, 2021, from Financial Express: https://www.financialexpress.com/auto/industry/lockdown-effect-indian-automotive-industry-suffered-rs-2300-crore-loss-daily-oems-shutdown-factories-production-facility-cars-bikes-scooters/2150591/

- Saxena, R., & Amin, H. (2021, May 4). Maruti Suzuki may halve production capacity as lockdowns hit sales. Retrieved June 3, 2021, from Business-Standard: https://www.business-standard.com/article/automobile/maruti-suzuki-may-halve-production-capacity-as-lockdowns-hit-sales-121050400807_1.html

- Phadnis, V. (2021, April 19). Auto industry grappling with semiconductor shortage. Retrieved June 3, 2021, from Deccan Herald: https://www.deccanherald.com/business/dh-wheels/auto-industry-grappling-with-semiconductor-shortage-976078.html

- India Brand Equity Foundation (2021, April). Growth of Automobile Industry in India - Infographic. Retrieved June 3, 2021, from IBEF: https://www.ibef.org/industry/india-automobiles/infographic

About the Author: Dr Shameem S is Assistant Professor at Great Lakes Institute of Management, Chennai. Kartik Chopra, MBA student at Great Lakes Institute of Management, Chennai co-authored the article.