If it is any indication that India’s passenger vehicle connected services sector is booming, one only had to attend India Auto Expo 2023. The focus on electric models apart, all eyes were on the growing list of connected cars, features, and platforms being offered by automakers, ranging from Hyundai’s BlueLink and MG Motors’ iSmart to Tata Motors’ Intelligent Real-time Assist (iRA) and Kia’s UVO Connect.

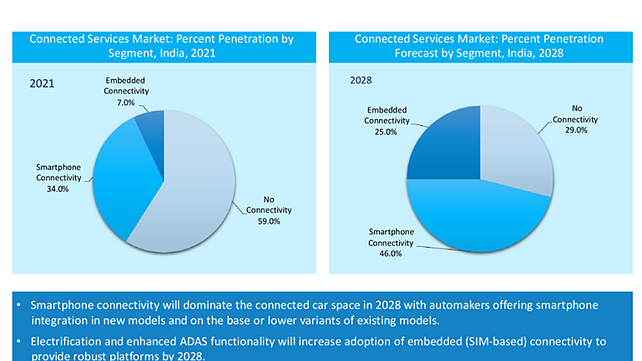

Over the last few years, the number of connected cars in India has risen sharply. Most OEMs have adopted smartphone integration solutions, such as Apple CarPlay and Android Auto. A few have embedded connectivity platforms that offer services related to safety, security, infotainment, maintenance, remotely controlled functions, navigation, convenience, and driving.

While premium automakers have been providing smartphone connectivity/ embedded connectivity as a standard, volume OEMs are also increasingly looking to tap into the consumer willingness to pay for advanced connectivity solutions.

In general, embedded connectivity in India is available free during an initial 3-5 year trial period before charges are levied on an annual subscription basis. Frost & Sullivan analysis reveals that in 2021, renewal subscription rates for connectivity platforms after the free trial periodaveraged around $33 annually.Automakers are mulling the idea of either lowering subscription prices or extending the free trial period, with the aim of attracting India’s sizeable population of young, tech-savvy consumers.

Delivering On Customer Demands

Frost & Sullivan analysis underlines that India’s connected services sector offers considerable growth potential, estimating unit shipments to increase from around 243.3 K to 1,016.1 K over the 2021-2028 period. A clutch of factors will drive revenue and unit growth.

Firstly, OEMs are moving to address the growing customer demand for vehicles integrated with feature-rich connected technologies that support enhanced comfort and convenience. Connected safety services that let first responders such as the police, fire brigades, and ambulance know where the vehicle is located and facilitate rapid emergency response are also a priority for Indian consumers.

Secondly, a flood of new entrants with technological expertise has come into the Indian connected car services sector, offering a wide range of connected car services. This has motivated OEMs to fast-track the introduction of similar solutions in their new models.

Demographics are also fuelling sector development. Tech-savvy consumers are asking for and getting cars with smartphone integration. This enables the car to function as a part of the consumer’s extended digital lifestyle since it supports seamless use of the smartphone on the head unit, such as through Apple CarPlay and Android Auto. The rising clamour for more features such as digital assistants and voice recognition is set to add further impetus to sector growth.

Meanwhile, the expanded implementation of 5G will facilitate timely over-the-air (OTA) updates to human machine interface (HMI) software, OS, apps, user interface (UI), and maps. The increasing coverage of 5G networks across the country will promote improved connectivity, better app performance, and easier addition of advanced connected services.

Limited Knowledge, Awareness

While such trends will drive India’s connected car services sector, participants will still have to contend with major challenges. For instance, both dealers and consumers continue to have relatively limited knowledge and awareness about the full scope of connected car services.

Another issue relates to the price-sensitivity of the Indian consumer. Typically, OEMs pass on the cost of incorporating new features to the end customer by hiking the retail price of the vehicle. However, in some cases, customers are unwilling to pay for such features rationalising that they are unlikely to use them regularly.

Notwithstanding the many benefits of vehicle connectivity, consumers continue to be apprehensive about data privacy and protection. On the one hand, connected cars promote greater personalisation, whether in terms of making digital payments/ transactions, synching emails, or linking car-to-home and home-to-car.

On the other hand, this increases the threat of cyber-attacks where sensitive personal data can be accessed. To build customer trust and encourage uptake, sector participants will need to work towards strengthening data security and privacy.

What Next?

To retain customer interest, OEMs should offer connected car features on more model variants either as standalone products or as part of a suite of services. Moreover, connectivity-enabled advanced OTA updates can be incorporated into the vehicles’ infotainment systems to make upgrades to apps and services.

OEMs should focus on raising customer awareness about the full range and benefits of connectivity features and the role they play in enhancing driving experiences.

To reach tech-savvy consumers and generate new revenue opportunities, OEMs should offer a gamut of advanced in-vehicle-connected features, each with distinct functionalities. Simultaneously, data generated by these in-vehicle services should be monetised; either by the OEM itself by using the data to create personalised services or by transferring it to third parties. In parallel, they should collaborate with regulatory authorities to introduce stringent regulations on data privacy, collection, and usage.

OEMs should follow the subscription-based connected services model to generate continuous, long-term revenue sources. In addition, the global shift to electric vehicles (EVs) presents a related revenue opportunity, wherein automakers can introduce connected features related to charging stations and charging range information.

In Conclusion

As competition from new entrants intensifies, OEMs should interchange models/ platforms and offer them under different brands. This has been effectively done by Maruti Suzuki and Toyota with the Baleno and Brezza being rebranded as the Glanza and Urban Cruiser, respectively. Both brands have been selling simultaneously and offer the same set of connected services under the Suzuki Connect and Toyota i-Connect embedded platforms.

Ultimately, partnerships, joint ventures, and acquisitions between OEMs and disruptive new players will result in strengthening of complementary competencies, while yielding improved connected services for the end customers.

With inputs from Amrita Shetty, Senior Manager – Communications & Content, Mobility, Frost & Sullivan

About the Author: Manish Menon is the Global Program Manager – Autonomous & Connected Vehicles, Mobility at Frost & Sullivan.

Reference:

[1] https://store.frost.com/growth-opportunities-for-passenger-vehicle-connected-services-in-india-2022.html#

Also Read:

Global Connected Car Market To Grow At 16.44% CAGR Till 2027

Towards Seamless Edge Computing in Connected Vehicles – Part 1

Towards Seamless Edge Computing in Connected Vehicles – Part 2