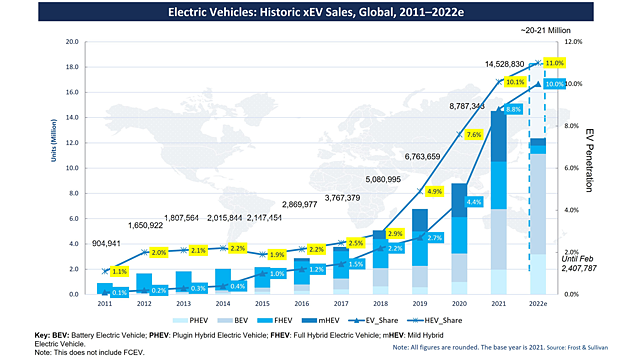

The pandemic and its impacts notwithstanding, 2021 was a good year for the global electric vehicle (EV) market, with sales and penetration levels more than doubling from 2020 levels. Over 6.7 mn EVs were sold in 2021, equating to a 108% year-on-year growth; penetration rates rose from 4.4% in 2020 to 8.9% in 2021.

Among the available alternatives – battery electric vehicles (BEVs), plug-in hybrid EVs (PHEVs), mild hybrids, full hybrids, and fuel cell EVs (FCEVs) – BEVs reinforced their dominance, driven by a combination of strict emission norms and attractive incentives for EVs with long-range or larger battery capacity.

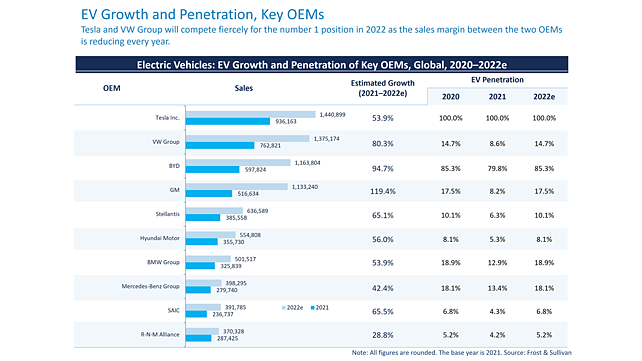

The Chinese juggernaut continued to roll on, with Germany, the US, the UK, and France rounding out the top five countries in terms of EV sales last year. Meanwhile, Norway, Iceland and Sweden spotlighted Scandinavia as the leader in most EVs per capita. On the competitive front, Tesla found its leadership position in jeopardy as automakers like Volkswagen ratcheted up the pressure.

Looking ahead, how will the landscape transform for EV stakeholders in 2022 and beyond? Which key trends will shape market dynamics? What strategies will EV ecosystem participants have to adopt to stay ahead of the game?

Market Outlook

Frost & Sullivan’s Global Electric Vehicles Outlook for 2022 [1] projects a 64.7% growth rate, with estimated sales of 11.1 mn units. As a further indication that the future of the transport industry is electric, EVs are set to account for just shy of 15% of total passenger car sales in 2022. BEVs will dominate, capturing more than 70% share of the total EV market, with the remaining split between PHEVs and FCEVs.

The tussle between Tesla and Volkswagen for supremacy could intensify in 2022. The rivals, which collectively account for a quarter of the global EV market, currently have less than a 1% difference in sales margin between them. The end of the year could herald a change in the number one ranking.

The success of EVs is inextricably linked to an enabling ecosystem. In 2021, a total of 251,400 MWh was delivered, almost 80% higher than in 2020. Our research indicates total installed battery capacity will reach between 400,000 to 410,000 MWh by the end of 2022. Charging infrastructure has also developed strongly. EV charging point installations, which crossed 1.5 mn points in 2021, are expected to achieve the two-million milestone in 2022 at a ratio of one charging connector for every 10 EVs.

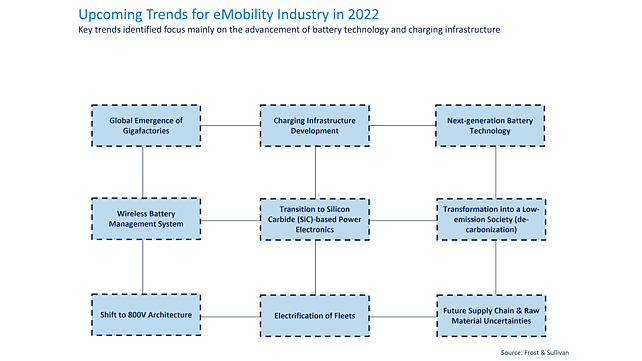

Key Trends in 2022 and Beyond

Frost & Sullivan has identified nine major trends shaping the e-mobility journey in 2022 and beyond.

The first major trend will be the emergence of global gigafactories for battery production. Such gigafactories will support economies of scale, while allowing OEMs to rapidly fulfil burgeoning global and regional demand for EVs. Leveraging this strategy, it is anticipated that a small cohort of 80-85 battery manufacturers will account for nearly 95% of the market share by 2030. By 2025, there are likely to be almost 118 gigafactories that will support a projected threefold growth from 960 GWh production capacity in 2022 to 2,639 GWh by 2030.

The second defining trend will be the significant progress in charging infrastructure. OEMs are set to shift to advanced charging systems, such as bi-directional charging, which enable functions such as vehicle-to-grid (V2G). This will open the network to other players, including utilities, grid operators, and EV manufacturers. Market participants will respond to this trend with over-the-air (OTA)/ vehicle diagnostics, the integration of charging stations, automated scheduled charging, and automatic tariff and billing services.

Next-generation battery technology will underline a move toward alternate battery structure (cell to pack) and chemistries like solid-state and hybrid chemistry, such as lithium iron phosphate (LFP) and nickel manganese cobalt (NMC). Module-less battery packs will gain in appeal due to their characteristics. They will be lighter, have greater energy density, and demonstrate superior performance and efficiency compared to traditional equivalents.

Meanwhile, wireless battery management systems (wBMS) will eliminate 90% of all wiring and cabling, reducing possible mechanical failures related to cables, harnesses, and connectors. Beyond improved safety and reliability, the systems will also allow for highly accurate remote monitoring throughout the battery lifecycle.

Silicon Carbide (SiC)-based power electronics (PE) architecture, along with powertrain-based domain control units, will support high-performance computing capabilities. Advantages like higher power efficiency, system cost reduction, and range extension will underpin their rising adoption. They will be a key enabler in advancing the “eMobility service platform” concept. SiC is already being embraced by leading semiconductor and EV manufacturers.

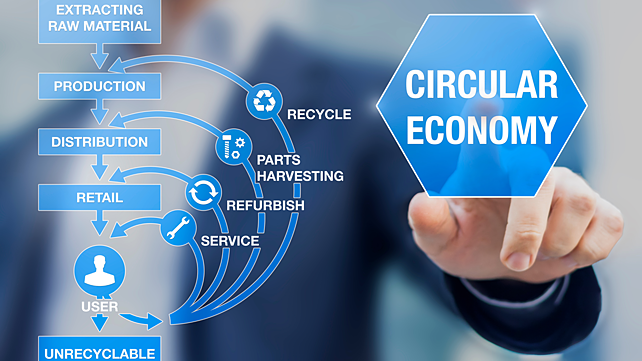

Across the world, but particularly in Europe, there has been impetus to decarbonise and lower emissions. Government incentives and subsidies promoting clean energy alternatives have been accompanied by infrastructure investments, green transport solutions, and circular economy practices. This will spur the development of the EV ecosystem as sustainability trends become embedded across the mobility value chain.

As in many other industries, disruptive technologies will change market dynamics. The need for fast charging has turned the spotlight on battery efficiency as EV automakers increasingly shift from 400V to 800V charging architecture. The transition will start with a few automakers in 2022, followed by a majority migrating to 800V architecture post-2025.

Another major trend that will define EV market prospects is fleet electrification. The transition toward EVs will be accompanied by the growth of new revenue streams, including those focused on fleet operators, such as charging stations and charging cards. Fleet operators will need to maximise existing incentives and subsidies before they are phased out to strengthen their competitive position and expand market share.

Unfortunately, uncertainties related to supply chains and raw materials availability will persist due to political, economic, labour, and regulatory volatility. Critical raw materials like cobalt, lithium, and nickel will continue to be subject to a range of supply chain risks. This will create market pressures, compelling stakeholders to explore more robust alternatives.

Looking Ahead

By 2030, EVs are forecast to comprise about 27.1% of the overall passenger car market. While this implies strong growth, the intervening years will be marked by profound technology-driven disruption. It will require OEMs to strategically reorient to manage a dynamic, ever-evolving landscape.

Technological disruption will be highlighted by the shift to 800V architecture and module-less batteries. The use of 800V in EV charging infrastructure will be associated with faster charging, efficient battery management, and increased range. OEMs will, therefore, have to quickly align with this transition. Meanwhile, although a few OEMs and battery makers have adopted module-less battery technology, mass-market EV manufacturers have lagged. Accordingly, they will need to pick up the pace to stay on top of this trend.

The adoption of wireless battery management systems and the shift toward SiC will also necessitate targeted responses. The use of wBMS – touted to avoid the need for costly, heavy cabling that requires constant maintenance – will enable EV manufacturers to scale EV platforms across different models. Motivated by the prospect of cost savings and improved reliability, EV manufacturers will need to focus on shifting toward SiC in inverters, onboard chargers, and DC-DC converters.

Finally, changes in EV charging infrastructure, such as the adoption of the Chinese ChaoJi standard as a replacement for CHAdeMO in DC/ ultrafast charging and the emergence of ultra-fast charging for BEVs as a standard over the next three years, supported by the 800V architecture, will require appropriate strategies.

These could include developing 800V DC charging stations along with the preferred connector standard, establishing multi-standard charging stations, including ChaoJi and Combined Charging System (CCS2), and ensuring that all BEVs have DC charging capability and optional ultra-fast charging.

References:

[1] https://store.frost.com/global-electric-vehicles-outlook-2022.html

About the Author: Prajyot Sathe is Research Manager, Mobility Practice at Frost & Sullivan.

Also Read:

EV Safety Is More About Finding Right Component For Use Case