The global auto sector has been beset by a semiconductor shortage for a couple of years now. The Indian automobile sector was not exempt either.

With the exception of a few months, the industry has had negative growth across all segments since 2020. However, the worst-hit segment was the sedans. The chip crisis added to the downfall in popularity not just in India but globally, from 2016 onwards, has made the body style hit its all-time low in terms of sales.

Gaurav Vangaal, Associate Director, IHS Markit, stated that at this point, except for the SUV segment, every other segment of PV lies in an unstable condition.

As per the available data, the sedan constitutes about 12-15% of the entire sales in the Indian market. As a result, the industry has seen a limited number of new sedans introduced in the last couple of years.

Vinkesh Gulati, President, FADA, noted that due to the low availability of the sedans, the customers started shifting towards other segments, especially the compact SUVs.

“Slowly and steadily, sedan availability declined. The Corolla was removed from the market and replaced with no new launches, leaving the market with very few options. Customers shifted to compact SUVs as a result,” he added.

However, 2022 has broken the jinx. During the first quarter of the calendar year, the Indian auto industry has seen the global launch of two new sedans in the mid-size sedan segment, the Skoda Slavia and the Volkswagen Virtus.

Will The New Sedans Make A Mark On The Falling Sedan Segment?

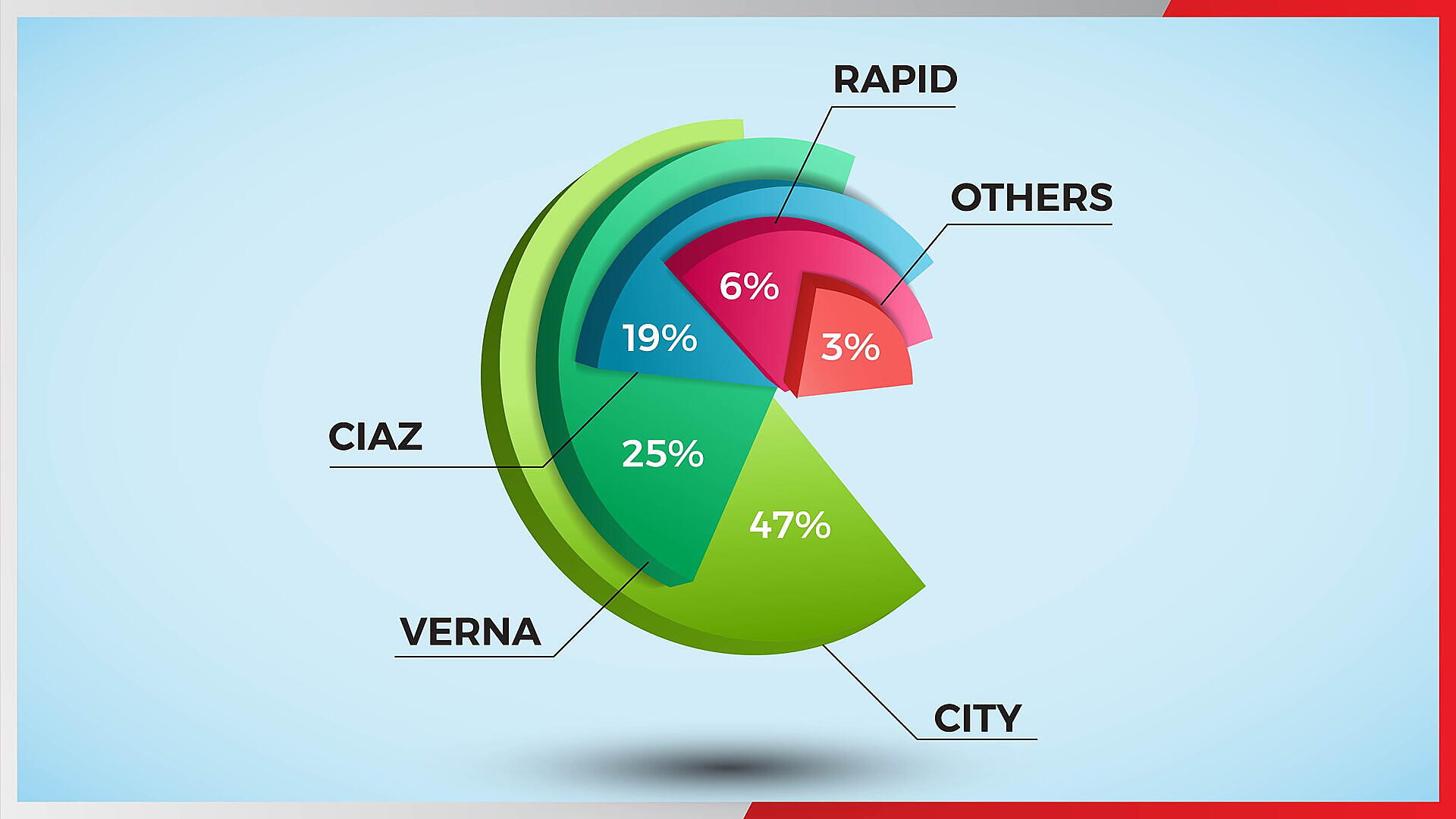

The last new mid-size sedan launched in India was the fifth-gen Honda City back in 2020. It currently constitutes about 47% of the market share in the segment. The carmaker has sold 33,912 units of this model from April 2021 to February 2022. In comparison, the second best selling product in the segment, the Hyundai Verna, has only managed to sell 18,466 units during the period, while the Maruti Suzuki Ciaz had to do with 14,035 units.

But with the new launches from the VW group, things might change. Rajesh Menon, Director General, SIAM, said that with regard to new entrants, the auto industry in India is poised to grow.

He further stated that growth could only be achieved if all segments of the auto industry, including passenger vehicles and mid-size car segments, continue to do well. Hence, the new entrant in this segment would provide additional choices in the market, ultimately benefiting the consumer, he added.

Gulati observed that with a low base, the new entrants are surely capable of making the segment grow. However, percentage-wise, it will be a massive double-digit growth, but it will be a slight growth in terms of numbers. The FADA president stated that both new sedans might take up about 50% of the market share in the segment. This translates to a monthly average sales of 3,299 units (50% of the market share of the mid-size sedan market per month on an average) combined, given the sales record of the current fiscal year.

On the contrary, Vangaal noted that the new entrants can take volumes from the competitors but might not help the overall segment grow.

He further added that it will be difficult for the VW group sedans to compete with the segment leader Honda City as it poses a good fan base because of its good overall package.

Was It The Right Time To Launch A Sedan?

Menon stated that the mid-size car segment has posted a growth in domestic sales by about 10.8% in the last 11 months, from April 2021 to February 2022, while the overall passenger car segment saw a de-growth of about -3.5% in this period.

Exports of the mid-size car segment also grew by 26.6% in FYTD. Hence, there seems to be a good demand for this segment of vehicles, he added.

Gulati further noted that given the scarcity of options in the mid-size sedan segment, every new entrant is bound to generate buzz. But this segment won’t fetch big numbers for the VW group, he added.

Vangaal said that the VW group has taken the right step at the right time with the launches. Launched back in February 2022, the Slavia has brought a novelty factor to the segment.

By the time Virtus is launched sometime in May 2022, the novelty factor of the Slavia will start to decline, and the Virtus will benefit, keeping the customer base within the VW group only, he noted.

Furthermore, the VW Group, with its SUVs, the Taigun and the Kushaq, will experience a good increase in numbers as the other competitors in the class begin to have a longer waiting period, he concluded.