For the automobile sector in India to pick up pace similar to the 2015-2019 period, the two-wheeler sector will have to perform exceptionally well. Vinkesh Gulati, President, Federation of Automobile Dealers Association (FADA) said, while speaking to Mobility Outlook on the sidelines of the apex dealer body releasing its annual vehicle registration data for FY22.

As per the released data, total automobile sales in India in FY22 stood at 16,375,799 units, with the two-wheeler segment contributing 73% of that with total sales of 11,973,415 vehicles. It was in FY19 that the industry had seen peak sales of 22,467,808 units. Even then, two-wheelers had accounted for 76% of the overall sales with 17,118,332 units.

“Major sales of not just two-wheelers but also consumer durables happen seasonally, based on farm produce. The rural economy not recovering is a big concern for India. I feel the strong numbers that we had showcased during the first lockdown were possible because rural India was strong at that time. The problems that the automobile sector is facing post second lockdown is because rural India hasn’t come back,” said Gulati.

The reasons behind this steep slump in sales, as pointed out by Gulati, vary from COVID-induced lockdowns to BS6 models getting expensive. At the same time, he is sure that unless there is a recovery in two-wheeler sales, the chances of India's automobile economy getting back on track are thin.

2W Contribution In Overall Sales

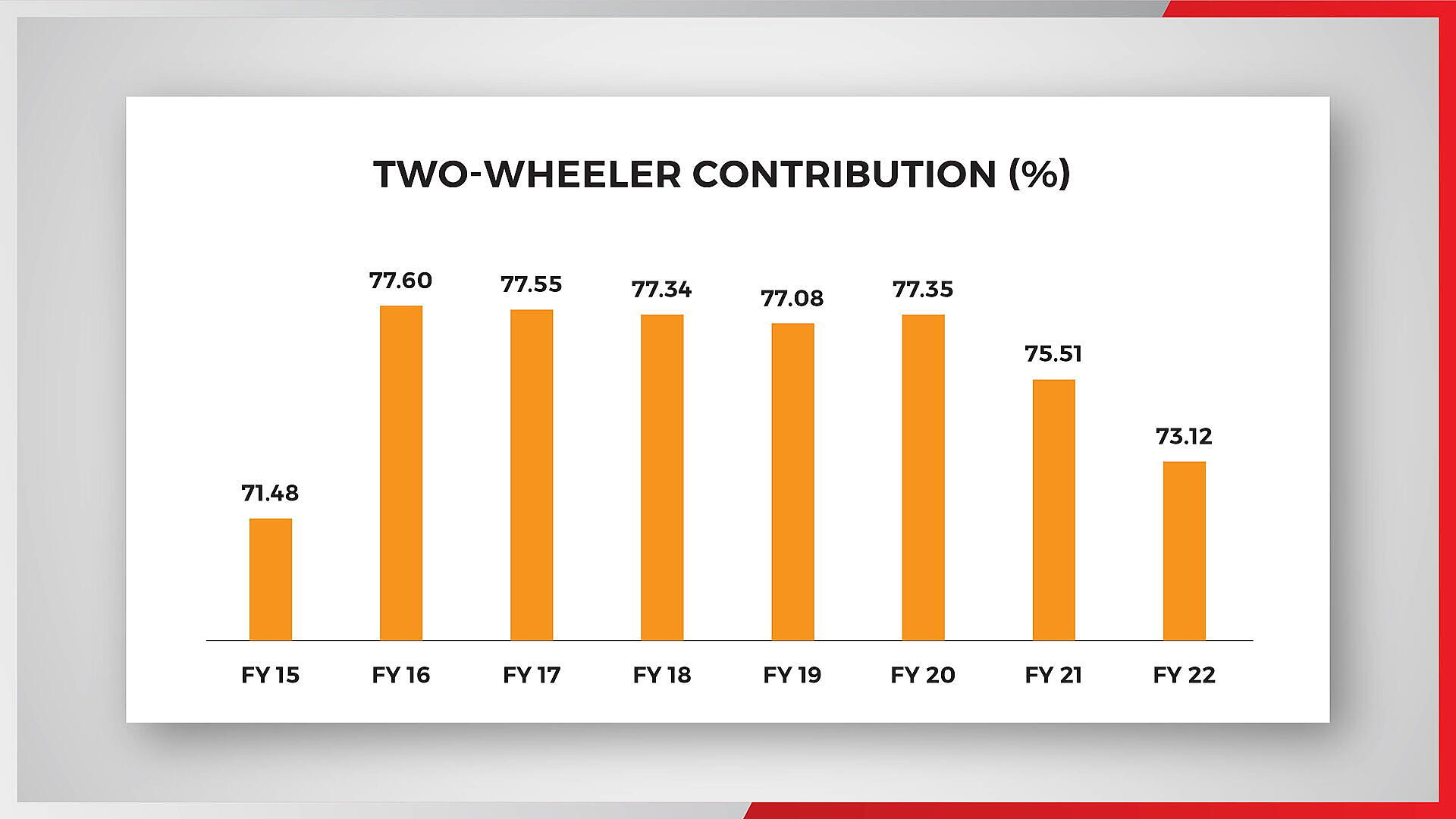

Analysis of the previous eight fiscals show that two-wheelers have always been a significant, and steady contributor to overall automobile sales in the country. Between FY16 and FY20, the contribution of two-wheelers as a percentage remained stable in the range of 77%, with very marginal differences YoY.

| Overall Automobile Sales – FY15 to FY22 | |||

| Fiscal | Overall Sales* | 2W Sales | 2W Contribution (%) |

| FY15 | 1,74,11,356 | 1,24,45,672 | 71.48 |

| FY16 | 1,81,40,258 | 1,40,75,973 | 77.60 |

| FY17 | 1,93,66,919 | 1,50,19,170 | 77.55 |

| FY18 | 2,13,12,005 | 1,64,81,875 | 77.34 |

| FY19 | 2,24,67,808 | 1,73,18,332 | 77.08 |

| FY20 | 2,17,78,574 | 1,68,46,527 | 77.35 |

| FY21 | 1,52,74,314 | 1,15,33,928 | 75.51 |

| FY22 | 1,63,75,799 | 1,19,73,415 | 73.12 |

| Source: FADA. *Note: Includes two-wheeler sales as well. |

The last two fiscals, nonetheless – hit primarily by the COVID pandemic – have seen the two-wheeler share fall. From contributing 77.35% in FY20, two-wheeler contribution fell to 75.51% in FY21, and further fell to 73.12% in the fiscal that just ended. In fact, this is now slightly higher than the segment’s contribution to overall sales in FY15, which was 71.48%.

Concerns About Rural Growth

Rural India contributes a lot to the overall two-wheeler sales in India. Data from FADA shows that two-wheeler sales above 125cc is either stable, or is in the growth stage, while products below 110 cc, also the one that gets sold most in rural India, is worst affected.

“This is the segment that is directly related to the middle and lower middle class. And this is the segment that has been most effected due to COVID. You must have heard about the rich getting richer and poor getting poorer during the COVID period. This has actually happened during the COVID lockdowns in India,” noted Gulati.

The fact that vehicle prices have undergone many an upward revision in the past couple of years hasn’t helped. For instance, the BS4 to BS6 transition has pushed the price of the Hero CD-Dawn from INR 47,000 earlier to INR 61,000 for the BS6 variant. Increasing fuel prices are also adding to the fire.

“There have been a lot of instances when we thought two-wheeler sales would pick up pace in rural India. The government, for instance, has announced major infrastructure plans and when new roads are constructed, these go through villages. The process allows villagers with access to good amounts of cash. We are of view that after what happened during the second lockdown, people in the rural parts of the country are now holding on to their savings,” pointed out Gulati.

The 'unsure future factor' clubbed with job losses that rural Indians had faced are also factors contributing to slowing sales in the rural parts of the country. He further said any amount of digitalisation or phygitialigation will not help the cause as the rural consumer is not in the ‘state of mind’ to invest in buying a new two-wheeler.

“All the parameters are against the growth of the entry level two-wheeler industry. Rural India doing good or bad is a clear indication of how the economy is fairing,” added Gulati.

GST and OEM's Aggressive Role

At 28%, the two-wheeler segment attracts one of the highest GST rates applicable on different verticals in India. OEMs, brands, dealers and industry associations have time and again requested the government to bring down applicable GST rates on entry-level two-wheelers, but to no avail. “FADA has requested the government to bring down GST rates on entry-level two-wheelers. Such type of reduction will definitely help in giving a boost to the automobile industry,” Gulati said.

While FADA is not sure the government will pay attention to the needs of the sector, and subsequently lower the rate of GST, the association does have an alternate plan. This Plan B would revolve around two-wheeler OEMs, said Gulati. FADA has already made suggestions to OEMs about how they can play a role in encouraging rural consumers to buy entry level two wheelers.

Gulati said, “OEMs will have to try to absorb the price-rise. They will have to offer cash benefits to consumers.”

Talking about the margins that OEMs work with, Gulati said vehicle makers generally aim to achieve EBITDA figures of around 20-25%. The present times require OEMs to revisit their strategy and aim for an EBITDA of 10-14%, he said.

“The dealer network usually works on an EBITDA of more than 2-3%. It might be wise for the OEMs to bring down their EBITDA goals by 10% and pass on the cost benefits to end consumers. This will also encourage the dealer network to put in more effort,”

FADA sees a ray of hope in the electric two-wheeler segment. Compared to FY21, FY22 has seen the segment record a growth of over 400% YoY with sales of 231,338 units as against 41,046 units in the previous fiscal.

Considering the recent EV-related fire incidents, Gulati has recommended that electric two-wheeler manufacturers should focus a lot more on educating end-consumers about electric vehicles.

In Conclusion

Gulati believes that every stakeholder in the market has to give their best to uplift rural India because that is the segment – which if not addressed, will make the whole automobile industry feel the heat. “The government, the OEMs, the dealers and the financiers will have to work cohesively to address this problem,” concluded Gulati.