Pandemic induced weak consumer sentiment and income loss, especially in the middle-class families, have bulldozed domestic two-wheeler demand. However, as restrictions were removed gradually across the country through June 2021, two-wheeler sales saw a sudden surge in demand, primarily due to the need for personal mobility.

As per the data released by the top five two-wheeler manufacturers, which represents almost 80% of the market, the segment has grown marginally by 3% to 9.87 lakh in June 2021, against 961,748 units in the same month last year.

| Company | June 2021 | June 2020 | %Change |

| Hero Motorcorp | 4,38,514 | 4,30,889 | 2 |

| HMSI | 2,12, 446 | 2,02, 837 | 5 |

| Bajaj | 1,55,640 | 1,46,695 | 6 |

| TVS | 1,45,413 | 1,44,817 | 0.41 |

| Royal Enfiled | 35815 | 36510 | -2 |

Two-wheeler experts term it as a temporary surge due to the pent-up demand of April and May. This could be attributable to some pent-up demand realisation, said Rohan Kanwar Gupta, Vice President & Sector Head, Corporate Ratings, ICRA.

“After a near washout in May 2021 due to production closures to mitigate the spread of the second wave, June 2021 saw a gradual reopening of 2W manufacturers’ operations, due to which a sequential growth in the wholesale volumes is observed. To put this in perspective, at 7.8 lakh units in June 2021, sales were still 30% lower than in June 2019,” he added.

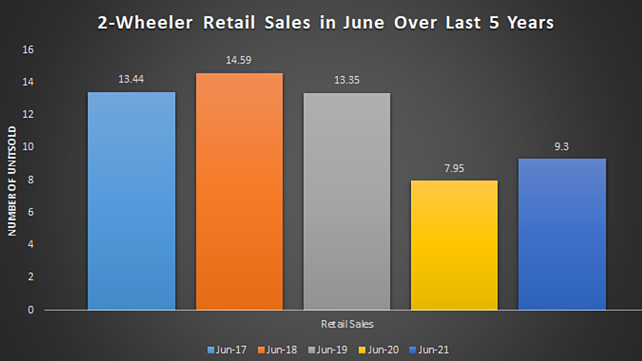

According to Vahan Data, two-wheeler retail sales fell by 36.25% in June 2021 compared to the peak of June 2018. The segment saw sales of 9.3 lakh units in June 2021 compared to 14.59 lakh in June 2018.

“If you compare retail sales of June 2019, which is a pre-pandemic period, with the current sales of June 2021, the two-wheeler segment sales stand nowhere,” said Nikunj Sanghi, Director, JS Fourhweels. The dealership owns Hero MotoCorp and covers remote areas around Alwar in Rajasthan. He highlighted that the over-the-counter retail sales have fallen by 40% in June 2021 compared to 2019.

“Customers are not ready to put in money for two-wheelers as the total cost of ownership and operations both have increased dramatically over the last 15 months,” he added.

Rise in prices

To own a two-wheeler, a customer now needs to pay a 20% premium over April 2020 prices. A two-wheeler that used to cost INR 60,000 is now priced at INR 72,000. This 20% jump in prices is a major hike for a middle-class family looking to own a two-wheeler.

Apart from this, petrol prices have increased dramatically over the last few months, crossing INR 100 per litre in most major cities. According to reports, petrol is retailed at INR 100 in about 46% of the country, which again acts as a dampener for two-wheeler owners.

Few experts say the way two-wheeler and petrol prices have increased in the last one year, and the manner in which the government is increasing subsidy and time frame for FAME II Policy, electric two-wheelers are set to gain as the delta between a conventional two-wheeler and electric two-wheeler has come down.

Experts also indicate that a semantic shift is happening in local businesses in Tier I/II and rural regions as people are ordering more from e-commerce websites and buying less from local shops. This too is impacting a section of people and their disposable incomes.