Even as the second wave of the COVID-19 pandemic led to a steady fall in production and sales in the domestic market in April 2021, exports across segments increased, when looked at a month-on-month (MoM) basis.

While readers would recall how a nationwide lockdown resulted in zero sales in April 2020, the scourge of the coronavirus has once again forced several Indian states to announce lockdowns and curfews, pushing businesses to down shutters. Most OEMs have either brought forward their planned annual maintenance, or have suspended production. Many have taken dedicated measures to help the country fight the pandemic by producing oxygen in their plants.

With half of May lost too, there is little wonder where automobile sales are headed this month. In its latest report, leading provider of automotive forecasting in sales, production and powertrain, LMC Automotive has revised India’s 2021 light vehicle sales outlook to 3.9 million units, down 7.4% from the previous outlook of 4.21 million units. Production forecast for 2021 has also been adjusted to 4.49 million units from its earlier estimate of 4.79 million.

A deeper analysis of data released by the Society of Indian Automobile Manufacturers (SIAM) for the month of April 2021 reveals some interesting findings. Production and domestic sales volumes across passenger vehicles, two- and three-wheeler segments have decreased month-on-month, while exports across all the segments have witnessed increase.

Mobility Outlook studied the SIAM-reported production, domestic sales and exports numbers for the first four months of CY21, and has put together this detailed analysis of the different market segments. It must be noted that the SIAM data doesn’t include numbers reported by BMW, Mercedes-Benz, Tata Motors and Volvo Auto.

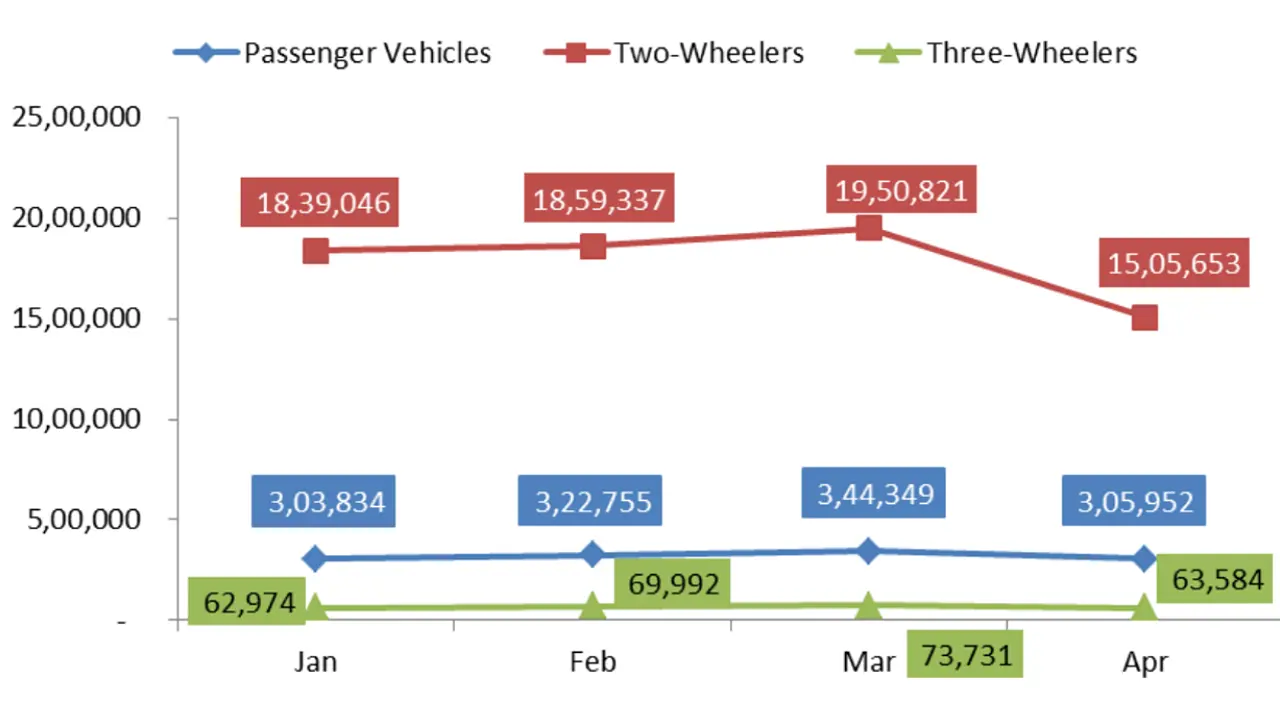

Production

| Segment | Jan | Feb | Mar | Apr |

| Passenger Vehicles | 303,834 | 322,755 | 344,349 | 305,952 |

| Two-Wheelers | 1,839,046 | 1,859,337 | 1,950,821 | 1,505,653 |

| Three-Wheelers | 62,974 | 69,992 | 73,731 | 63,584 |

The revival of the automotive market was visible through the latter part of FY21, with improved numbers being reported across Q3 and Q4.

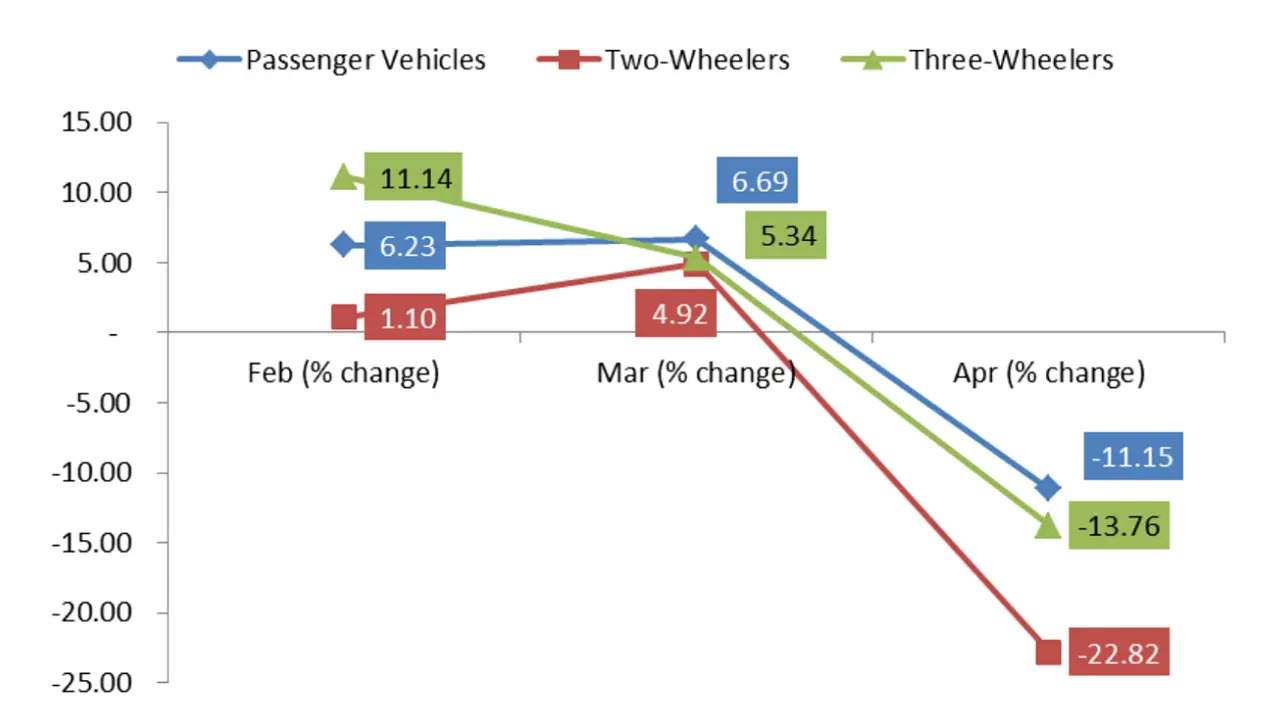

Passenger vehicle production, for instance, had seen a steady MoM growth. February reported a 6.23% growth in production numbers to 322,755 units as against January’s 303,834 units. Similarly, March production numbers grew 6.69% over February to clock 344,349 units. April, however, saw a heavy fall of 11.15% to close at 305,952 units.

The story wasn’t any different in the two-wheeler segment. January and February had seen similar production numbers at 1,839,046 units and 1,859337 units respectively, accounting for a 1.10% growth MoM. Production of two-wheelers grew 4.92% in March to 1,950,821 units, but saw a significant 22.82% drop in April to 1,505,653 units.

Maintaining the trend, the three-wheeler segment witnessed similar movement in production through the four month period we analysed. From the 62,974 units in January, production rose to 73,731 units in March, only to fall to 63,584 units in April. In percentage terms, February saw an 11.14% hike to 69,992 units as compared to January. March production of three-wheelers grew 5.34% over February, but April over March numbers fell 13.76%.

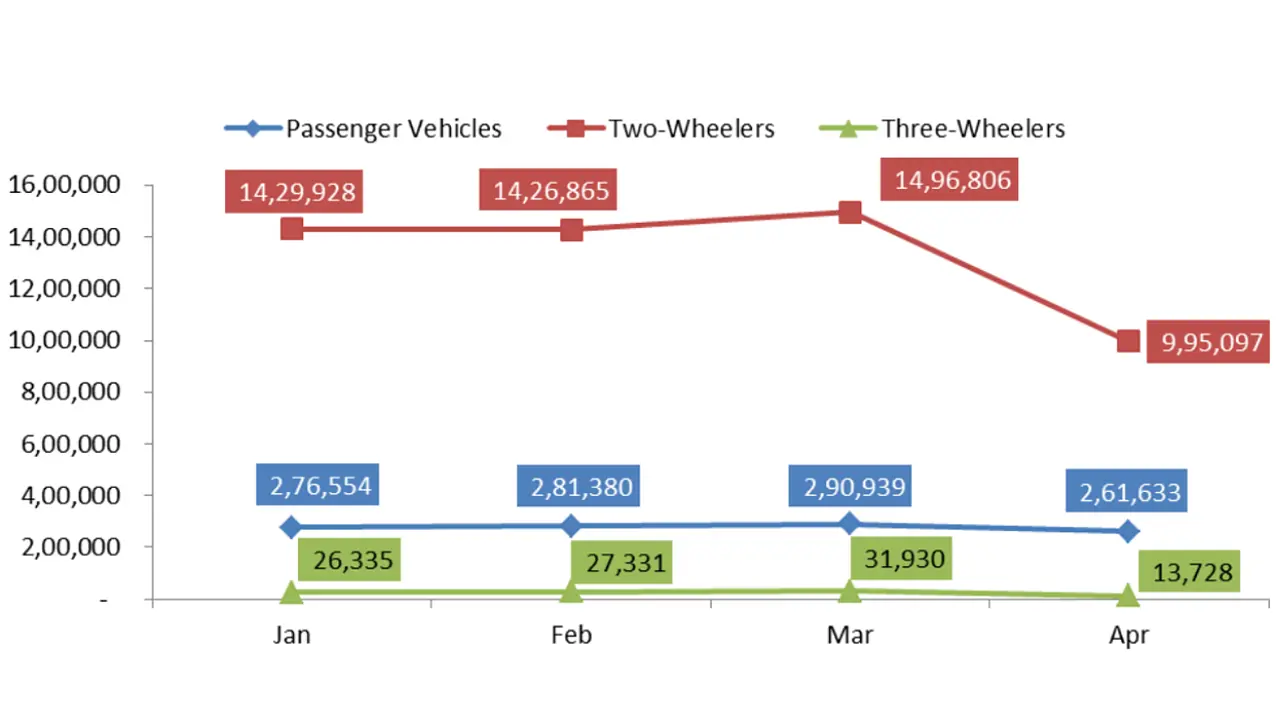

Domestic Sales

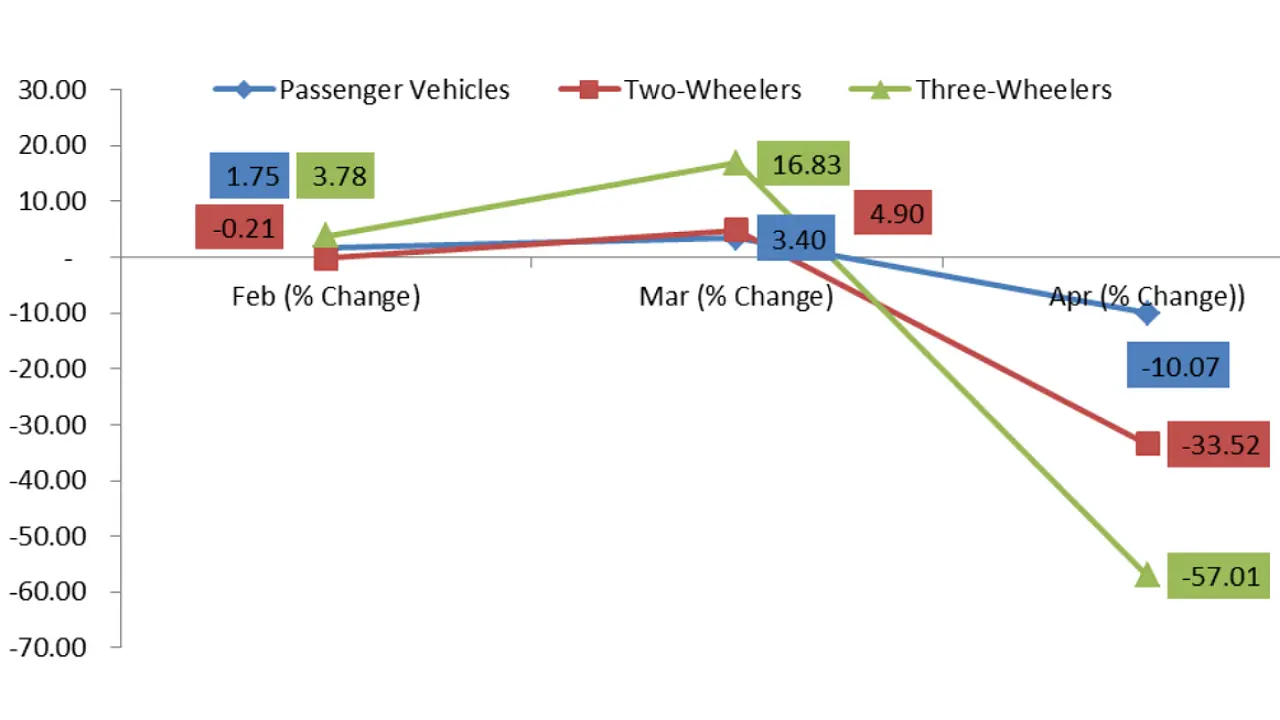

Wholesale dispatches of passenger vehicles in April declined 10.07% to 261,633 units against the high of 290,939 units in March. The segment had seen small yet steady growth in domestic sales through the January to March period this year. The April numbers, in fact, are lower than the January wholesale numbers of 276,554 units. A total of 281,380 units of PVs were sold in February, accounting for a 1.75% growth MoM. In March, the numbers grew a further 3.40% to 290,939 units.

| Segment | Jan | Feb | Mar | Apr |

| Passenger Vehicles | 276,554 | 281,380 | 290,939 | 261,633 |

| Two-Wheelers | 1,429,928 | 1,426,865 | 1,496,806 | 995,097 |

| Three-Wheelers | 26,335 | 27,331 | 31,930 | 13,728 |

The two-wheeler segment has seen the biggest impact – not just in our analysis period, but overall since the pandemic broke out. Wholesale numbers in February at 1,426,865 units were lower compared to January’s 1,429,928 units – a slight drop of 0.21%. March fared better, with sales increasing 4.90% MoM to 1,496,806 units.

With the number of COVID-related incidences increasing nationally, prospective customers decided to stay away from vehicle purchases. This resulted in a heavy 33.52% MoM drop in April sales to close under a million units at 995,097 units.

In the three-wheeler segment, overall wholesale numbers – viewed on a MoM basis – dropped close to 50% between January and April. January had accounted for 26,335 units, which jumped 3.78% to 27,331 units in February and a further 16.83% MoM to 31,930 units in March. In what was the biggest fall in any category and in any segment in the four month period in 2021, three-wheeler sales fell a mammoth 57.01% in April to close at 13,728 units.

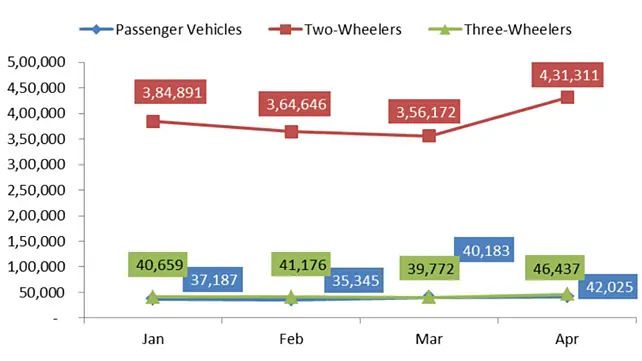

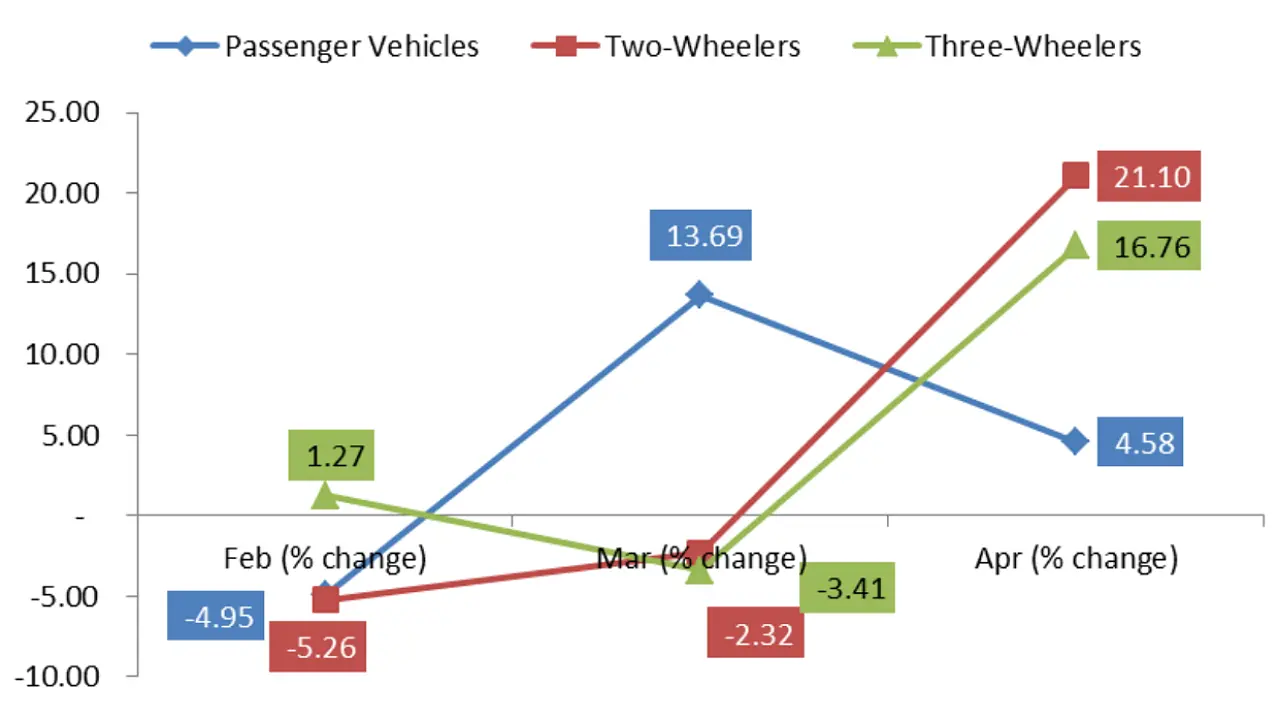

Exports

From a growth perspective, exports are the happy story in this analysis. Despite some hiccups, April returned healthy growth in all the vehicle segments.

| Segment | Jan | Feb | Mar | Apr |

| Passenger Vehicles | 37,187 | 35,345 | 40,183 | 42,025 |

| Two-Wheelers | 384,891 | 364,646 | 356,172 | 431,311 |

| Three-Wheelers | 40,659 | 41,176 | 39,772 | 46,437 |

Passenger vehicles makers exported a total of 42,025 units in April 2021, which is a 4.58% increase from a month-before figure of 40,183 units. March had a slightly better MoM growth of 13.69% over the 35,345 units the industry exported in February. February, on the other hand, was 4.95% lower compared to January’s tally of 37,187 units.

In the two-wheeler segment, a total of 384,891 units were exported in January 2021. A month later, export volumes had fallen 5.26% to 364,646 units, which further fell 2.32% on a MoM basis to 356,172 units in March. Interestingly, unlike with domestic sales – where March to April numbers fell 33.52% MoM – exports in April, as compared to March, grew 21.10% to 431,311 units.

Likewise, in the three-wheeler segment, April recorded a 16.76% MoM growth over March with total exports of 46,437 units against the 40,183 units of March. The segment had started CY21 with exports of 40,659 units in January, which rose to 41,176 units in February, resulting in a 1.27% MoM growth. Exports, however, fell 3.41% in March to 35,345 units.

Conclusion

Considering the current situation in the country, May numbers are likely to be remain in negative territory. But with COVID numbers starting to come down in the major automotive hubs, we can expect production to pick up steam. Domestic sales would, of course, depend on multiple market and economic factors. Exports, on the other hand, is expected to rise, should manufacturers be able to meet the demand by producing enough products.