Backed by positive consumer sentiment and new launches, passenger vehicles recorded 11% growth in domestic sales at 260,399 units in August 2021 compared to 234,623 units in the same month year ago. However, the segment is on a tightrope as numerous challenges are posed on the production of vehicles, such as the rising input cost of raw materials and shortage of semiconductors.

For these reasons, India’s largest carmaker Maruti Suzuki has increased the prices of all its models for the third time this year and cut its production for August.

The carmaker with higher penetration of sales network in the country witnessed a drop in the domestic sales by 8.7% in August 2021 to 103,187 units, compared to 113,033 units in the same month last year.

For September, the company has already announced a production cut. In a statement, the company said it could only produce 40% of its total volume.

Similarly, South Korean carmaker Hyundai Motor India posted a marginal rise of 2.3% in August at 46,866 units compared to 45,809 units in the same month last year. The company has been quite aggressive in its product launch strategy and has been able to maintain momentum. Despite that, the sales grew marginally, which is also evident with long waiting periods of popular models such as Creta, Venue, and Alcazar.

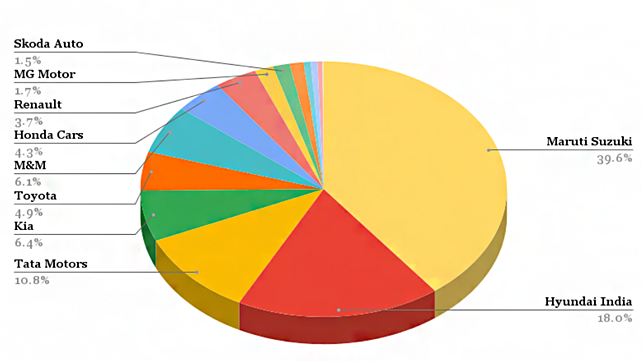

| Manufacturer | Aug-21 | Aug-20 | %Change |

| Maruti Suzuki | 103187 | 113033 | -8.7 |

| Hyundai India | 46866 | 45809 | 2.3 |

| Tata Motors | 28018 | 18583 | 50.8 |

| Kia India | 16750 | 10853 | 54.3 |

| Toyota Kriloskar Motors | 12772 | 5555 | 129.9 |

| Mahindra & Mahindra | 15973 | 13651 | 17.0 |

| Honda Cars India | 11177 | 7509 | 48.8 |

| Renault India | 9703 | 8060 | 20.4 |

| MG Motor | 4315 | 2851 | 51.4 |

| Skoda Auto | 3829 | 1003 | 281.8 |

| Nissan India | 3209 | 810 | 296.2 |

| Volkswagen India | 1631 | 1470 | 11.0 |

| Ford | 1508 | 4731 | -68.1 |

| Jeep | 1173 | 468 | 150.6 |

| Force Motors | 238 | 237 | 0.4 |

| Citreon | 50 | 0 | NA |

| Total | 260399 | 234623 | 11.0 |

Long Waiting Periods

According to our channel checks, Hyundai Creta is on a 24 weeks waiting period, and recently Alcazar is delivered after ten weeks of booking.

Among the top five carmakers, Tata Motors and Kia India registered a strong growth of 50.8% and 54.3%, respectively.

In a press release, Tata Motors said the semiconductor shortage continues to impact the auto industry globally. In addition, the recent lockdowns in East Asia have worsened the supply situation, and hence Tata Motors is forced to moderate production and offtake volumes in the coming months.

“The situation is fluid, and we will continue to work to mitigate the impact of this and aim to meet our customer orders through an agile, multi-pronged approach including close engagement with our extended supply chain partners, procuring chipsets from the open market, using alternate chips and managing our model and trim mix,” it added.

Read Also: Auto Demand Recovery On Track In August, Supply Issues To Affect Festive Sales

The company might be marred with a semi-conductor shortage, but its EV sales crossed a crucial threshold of 1,000 units this month.

“The order book is strong, and we aim to meet the robust demand to the best of our abilities despite the supply challenges,” the company said in a press statement.

Semiconductor shortage derailing demand pick-up

Industry experts believe that the shortage of semiconductors will lead to a falling in inventory before the festive season, and it may lead to a festive demand washout if the challenges are not addressed timely.However, few automakers are buying chips from the open market, but it may take a year to stabilise before orders are placed from the regular supply chain.

On Kia’s strategy to meet festive demand, Tae-Jin Park, Executive Director and Chief Sales and Business Strategy Officer, Kia India, said, “With the festive season around the corner, we are anticipating a further rise in this number. To cater to the pent-up and upcoming demand of our vehicles, we are taking appropriate measures to enhance the production output.”

Mahindra & Mahindra posted a 17% growth in domestic sales of its passenger vehicles at 15,973 units.

Veejay Nakra, Chief Executive Officer, Automotive Division, M&M, said, “Demand across our product portfolio continues to remain strong with Thar, XUV 300 and our recently launched Bolero Neo and our Bolero Pik-up range clocking in impressive booking numbers. However, the supply of semiconductors continues to be a global issue for the auto industry and has been a major area of focus for us.”

In the next few months, a market share that used to be a sales derivative will largely depend upon the ability of the automakers to produce and mitigate the risk of semiconductor shortage. However, September will remain crucial as dealers need to stock up inventory for festive sales.