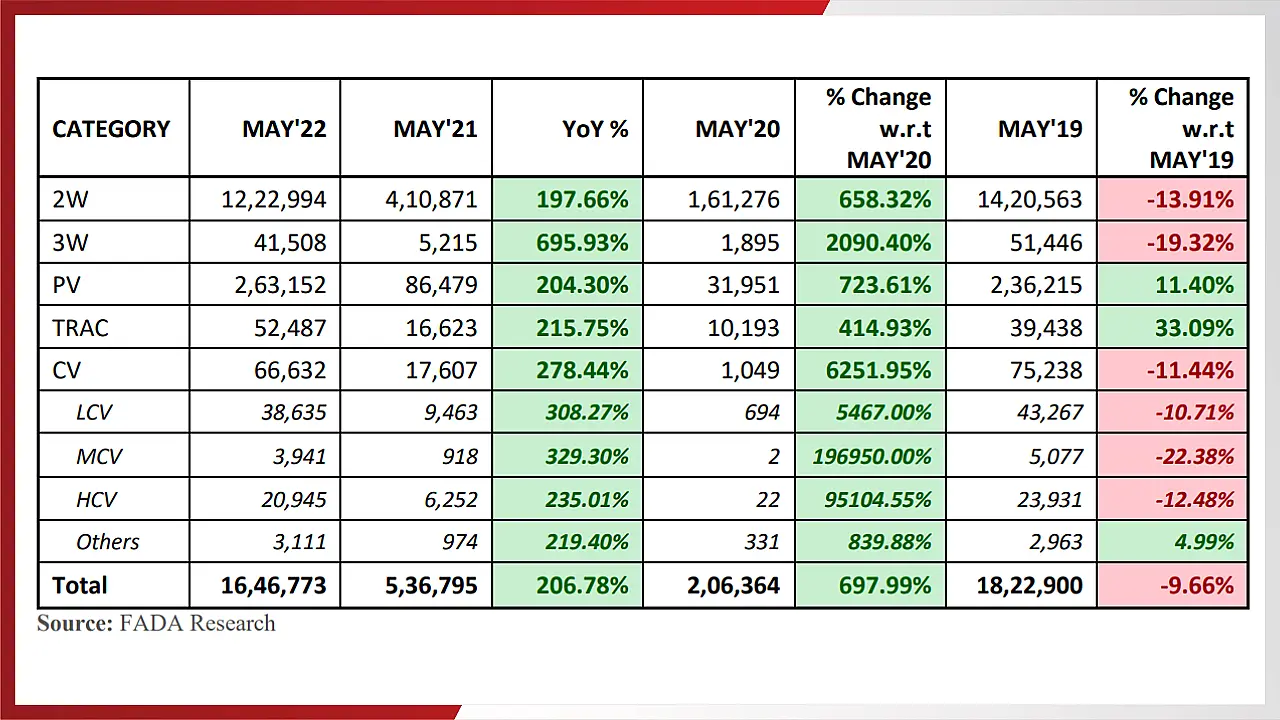

The Indian auto industry showed an exponential growth curve in May 2022, as the FADA report suggests a 206.78% YoY increase in retail sales.

The two-wheeler segment witnessed staggering YoY growth of 197.66% in May 22, with total sales of 12,22,994 units in the month. Compared to May 2020, the data suggest growth of 658.32%.

Similar growth rates can be seen across other vehicle segments, with 3Ws reporting a YoY growth of 695.93% with sales of 41,508 units, while PVs grew by 204.30% YoY with total sales of 2,63,152 units in May compared to 86,479 units sold in the corresponding month last year.

Meanwhile, the FADA report suggested that the CV segment grew by 278.44% YoY to 66,632 units sold in the month against 17,607 units sold in May 21.

The tractor segment also saw year-on-year growth of 215.75% as its sales went up by 35,864 units in May 22 compared to 17,607 units sold in May 21.

However, it must be noted that these figures do not suggest real growth, as, during the last two years, the country witnessed a lockdown due to the pandemic.

The real growth picture can be attained when compared to May 2019, which was a non-pandemic year, Vinkesh Gulati, President, FADA, said.

Compared to May 2019 sales figures, this month’s data suggest that the over vehicle sales have witnessed a downfall of nearly 10%.

Gulati noted, “Indian auto industry during May 2022 continued its flattish run for the third consecutive month. While YoY comparison with May 2021 shows exceptionally healthy growth rate across all categories, it is important to note that both May 2021 and May 2020 were affected by nation-wide lockdown due to COVID thus witnessing.”

The only segments that have seen growth compared to the non-pandemic year are the PV and the tractor segments, suggesting growth of 11.4% and 33.1%, respectively.

According to the press release from the apex body, the PV segment, which has already surpassed May 2019 numbers, is witnessing huge demand, and dealers are not able to fulfil the same due to supply-side issues.

This has led to an increase in the waiting period (ranging from three months to two years) and keeps the customers frustrated, the release added.

“Healthy booking and single digit cancellation shows that demand may stay put even when normal supply resumes in months to come,” Gulati said.

While on the other side, the 2Ws, 3Ws and CVs are yet to show any signs of a healthy run rate compared to the pre-pandemic month as they de-grew by -14%, -19% and 11%, respectively, the FADA president added.

He continued that although Government made a bold decision to cut excise duty on fuel prices, thus reducing inflation and economic distress, the increase in third party insurance premiums will act as a deterrent, especially in the 2W segment.

Speaking of the 2W segment, Gulati said that the 2W segment has seen a slight improvement in overall sales compared with April 2022.

However, the recent fire incidents in the e2W space have put a hold on the segment’s rapid growth.

The fire incidents have created a fear in the customer’s minds, and this coupled with supply chain issues, has decreased e2W sales drastically from last month, the FADA president stated.

Interestingly, he noted that although the CV segment is reporting a downfall, but the segment, especially buses, is showing good demand due to the re-opening of educational institutions.

Crystal Ball Gazing

FADA continues to remain cautious about any further recovery in auto sales in the near term as the number of challenges for the industry has increased over a couple of months.

While the Russia – Ukraine war continues to create a demand-supply mismatch, thus delaying the availability of PVs, RBI has warned of more inflation as the increase in wholesale prices will get passed on to the end consumers. This will result in a lower disposable income, ultimately hamper auto sales, the dealers association noted.

Photo is representational; courtesy: Hyundai Motor India