The past few months have been difficult for manufacturers and consumers alike, with the scourge of COVID-19 returning to force shutdowns, ruin consumer sentiments and bust-up sales. Amid the uncertainty that prevails, Mobility Outlook looks at how manufacturers in the passenger vehicles segment fared in April 2021.

The analysis is based on the data released by the Society of Indian Automobile Manufacturers (SIAM), and doesn’t include sales data from BMW, Mercedes, Tata Motors & Volvo Auto.

Overall industry-wide domestic vehicle wholesales in April stood at 1,270,458 units, with the passenger vehicle segment contributing 261,633 units or 20.59% of the market. Two-wheelers accounted for a majority 78.33% with 995,097 units, while the three-wheeler segment contributed the remaining 1.08% (13,728 units).

In this analysis, we focus on the passenger vehicle segment.

Of the total sales of 261,633 passenger vehicles in April, passenger cars contributed bulk of the numbers with 53.97% or 141,194 units, while utility vehicles accounted for 108,871 units, or 41.61% of the total segment volume. Vans, a small composition of the overall passenger vehicles segment, filled up the remaining 4.42% with sales of 11,568 units.

What drove volumes in the passenger cars segment?

The passenger car segment in the Indian market is divided into five sub-segments – mini, compact, mid-size, executive and premium. The compact car segment is the largest among all passenger car segments, with a 73.80% market share followed by the mini segment, which contributed 20.03% to the segment in April 2021. The mid-size, premium and executive segments completed the remaining share in the market with 6.06%, 0.07% and 0.04% respectively.

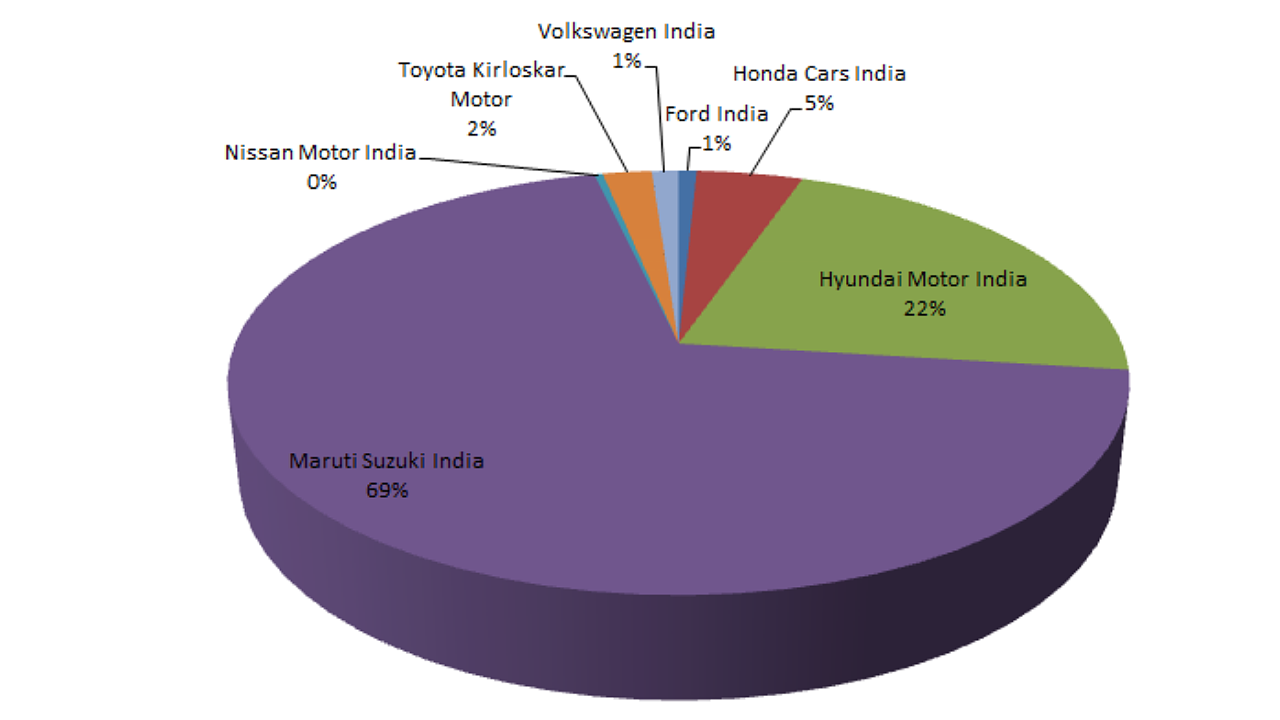

Within the compact segment, Maruti Suzuki India, with 69.40% market share was the clear leader, followed by Hyundai with 21.66% of the segment. Collectively, the two leading players dominated the compact segment, selling a total of 94,890 units of the total segment volume of 104,204 units – accounting for a massive 91%.

Honda Cars India with its Amaza and Jazz models was placed third with 4,750 units, or 4.56% of the segment. Toyota Kirloskar Motors sold 2,182 units of the Glanza hatchback to come fourth with a share of 2.09%. VW India (1.15%), Ford India (0.78%) and Nissan Motor India (0.36%) were the other players in this segment.

With 28,277 units, the mini segment was the second largest contributor to overall PV volumes in April 2021, with the Alto and Spresso models from the Maruti Suzuki stable accumulating 88.56% of the segment. Renault India’s Kwid contributed the remaining 11.44% with 3,236 units.

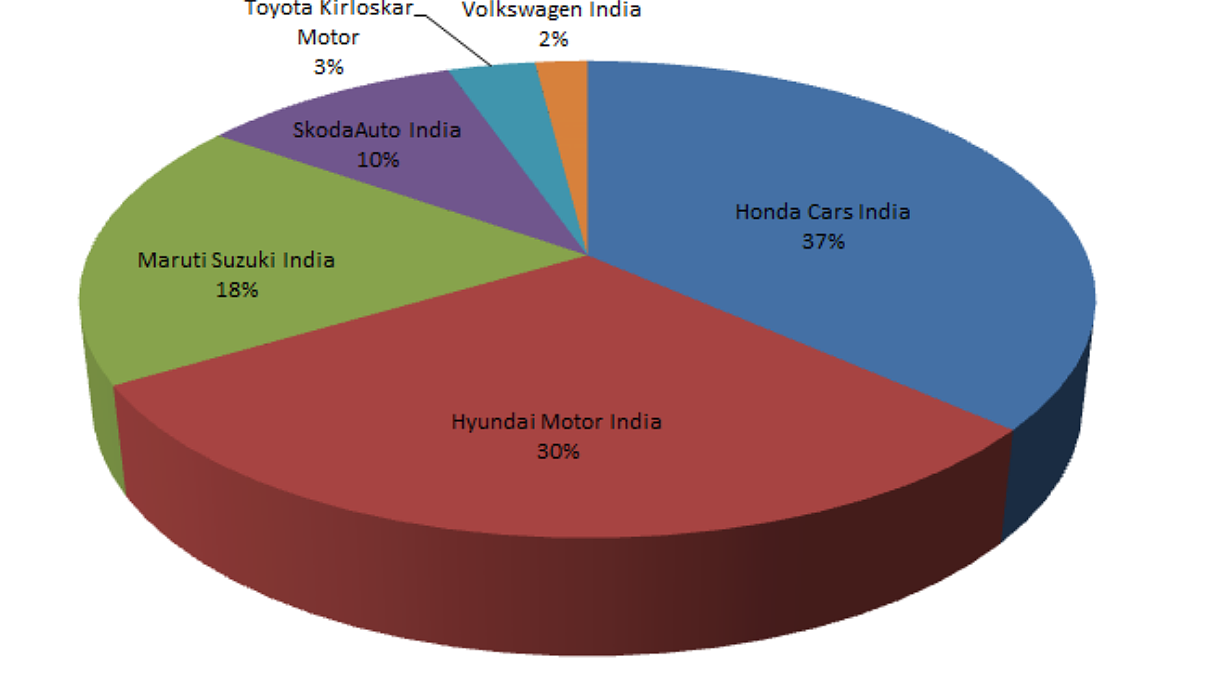

The Honda City continues to bring in the volumes for Honda Cars India. In the mid-size segment, the company remained the top seller with 3,128 units, capturing 36.58% of the segment. Hyundai Motor India followed with the Verna, selling 2,552 units to account for 29.85% of the segment. Having dominated the mini and compact hatchback sub-segments, Maruti was relegated to the third spot with the Ciaz selling 1,567 units in April, capturing 18.33% of the segment sales.

The other significant performer in the segment was SkodaAuto. Its Rapid sedan accounted for 848 units, which is a decent 9.92% of the segment. The other two players – Toyota (Yaris) and VW (Vento) – accounted for 285 units (3.33%) and 170 units (1.99%) in the mid-size segment.

Volumes in the executive and premium segments are rather small. Interestingly, the premium segment – represented by the Skoda Superb – outgrew the executive segment in numbers. While Skoda sold 105 units of the Superb premium sedan, the Hyundai Elantra (53 units, 91.38%) and Skoda Octavia (5 units, 8.62%) collectively accounted for 58 units in the executive segment.

What Makes The UV Segment Most Exciting?

The UV segment, particularly the sub-compact and compact SUV segments, has been the most exciting in the Indian auto segment in the past couple of years. While every manufacturer in the passenger vehicle segment doesn’t have a passenger car model, each one of them has presence in the utility vehicle segment.

Collectively, a total of 108,871 UVs were sold last month, with 54.36% of them being compact UVs, which is categorized by SIAM as vehicles with length under 4,000 mm and priceunder INR 20 Lakh. The next segment, UV1 with length between 4,000-4,400 mm and price under INR 20 Lakh, saw total sales of 31,844 units, which was 29.25% of the total UV segment.

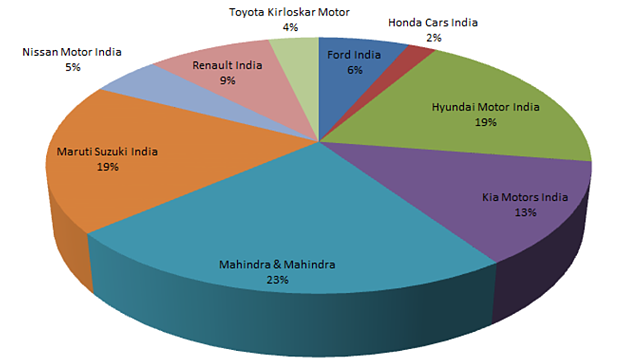

In the UVC segment, Mahindra had the largest share of 23.16%, with the Bolero Power Plus, KUV100, Thar, TUV300 and XUV300 models combining to sell 13,707 units in total. The difference between second placed Hyundai and third-placed Maruti was that of a mere 25 units. The Hyundai Venue alone sold 11,245 units (19%) compared to Maruti combined tally of 11,220 units of the Gypsy and Vitara Brezza, which gave the company a share of 18.96%.

The Kia Sonet accounted for 7,724 units to capture 13.05% of the segment. Renault’s Kiger and Triber totaled 5,226 units, which gave the company an 8.83% share of the segment. Ford’s Ecosport, Nissan’s GO+ and Magnite, Toyota’s Urban Cruiser and Honda’s WR-V made up for the remainder of the segment volumes with 3,820 units (6.45%), 2,935 units (4.96%), 2,115 units (3.57%) and 1,194 units (2.02%) respectively.

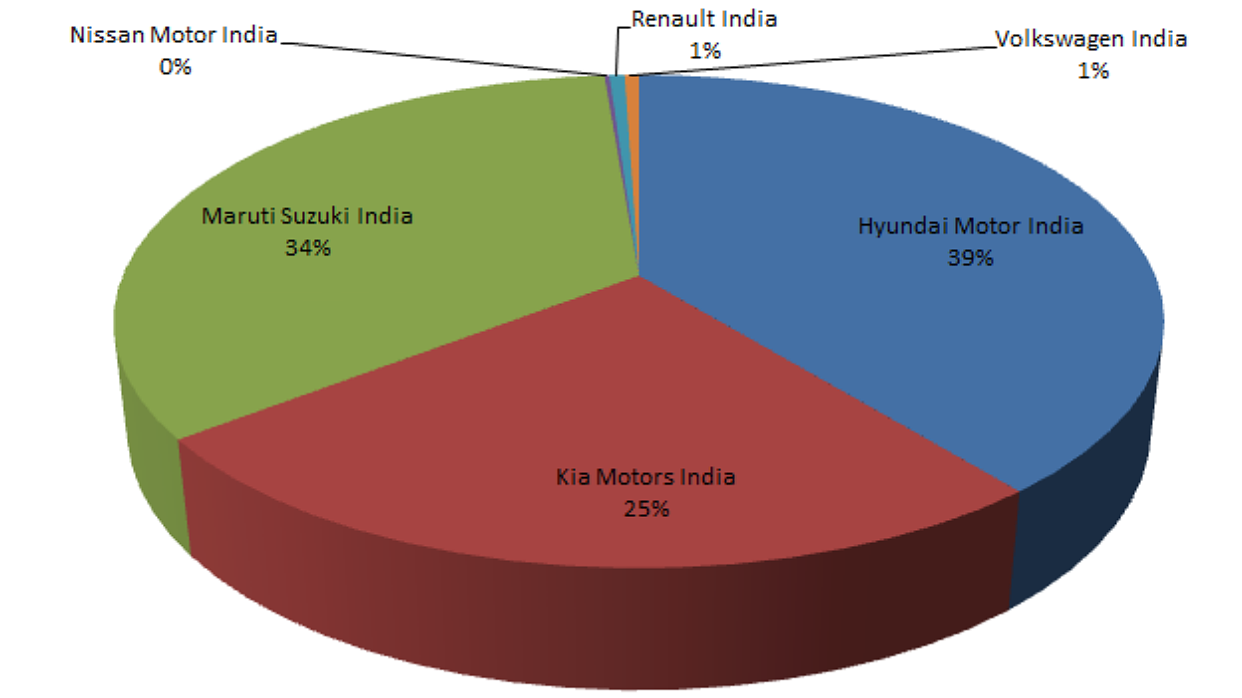

The UV 1 segment essentially saw three companies take out the majority of the segment share. Hyundai, led by the Creta SUV, sold 12,463 units, cornering 39.14% of the segment. In second place was Maruti, selling 10,891 units of the Ertiga and S-Cross models. The Kia Seltos maintained a steady sales volume of 8,086 units, giving the Korean company a 25.39% segment share.

The other four sub-segments in the UV category collectively accounted for 16.39% of the segment. Mahindra led the UV2 segment with 4,455 units of Marazzo, Scorpio and XUV500 combined, giving it a 44.84% segment share. Maruti sold 3,373 units of its XL6 and MG sold 2,107 units of its Hector SUV.

Toyota captured almost the entire UV3 market (98.77%) selling 3,600 units of the Innova Crysta, while the Isuzu V-Cross accounted for just 45 units.

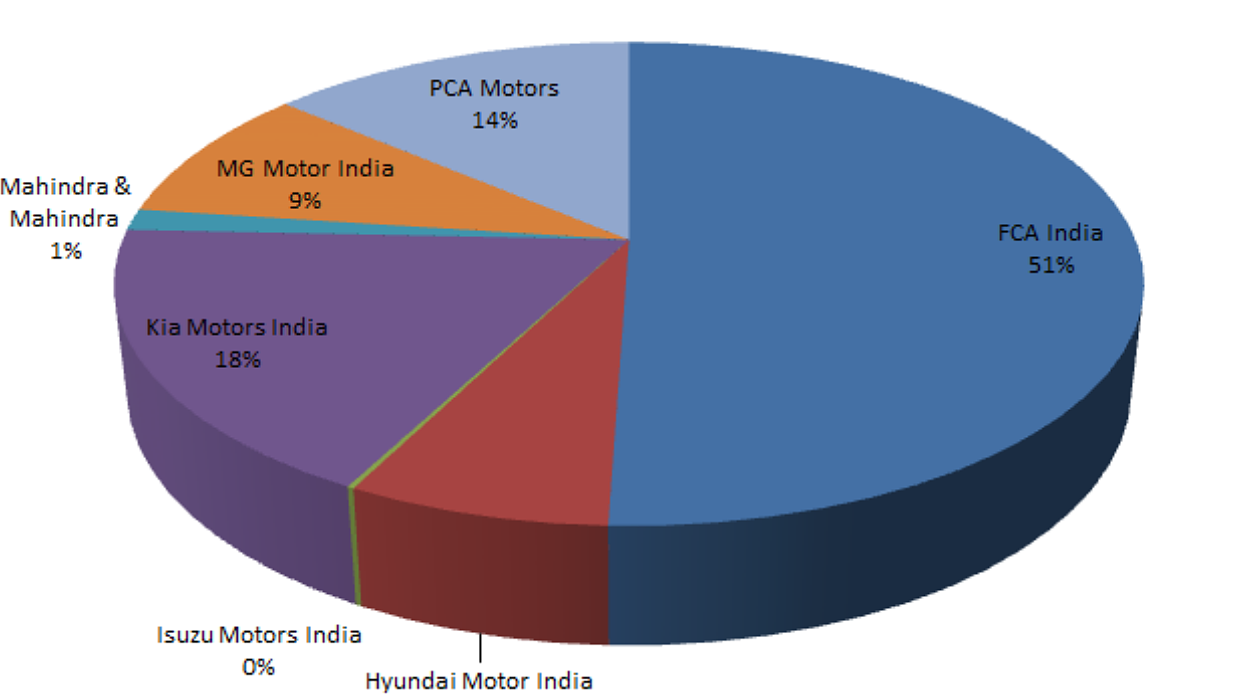

The Jeep Compass led the UV4 segment with 50.54% share, selling 846 units in April. The UV4 segment is defined in terms of price, marked by vehicles in between INR 20-30 lakh. Kia sold 301 units of its Carnival, which gave it a 17.98% share in the segment. New entrant Citroen India’s first model in India, the C5 Aircross, sold 230 units in its first month, giving the debutant a 13.74% share.

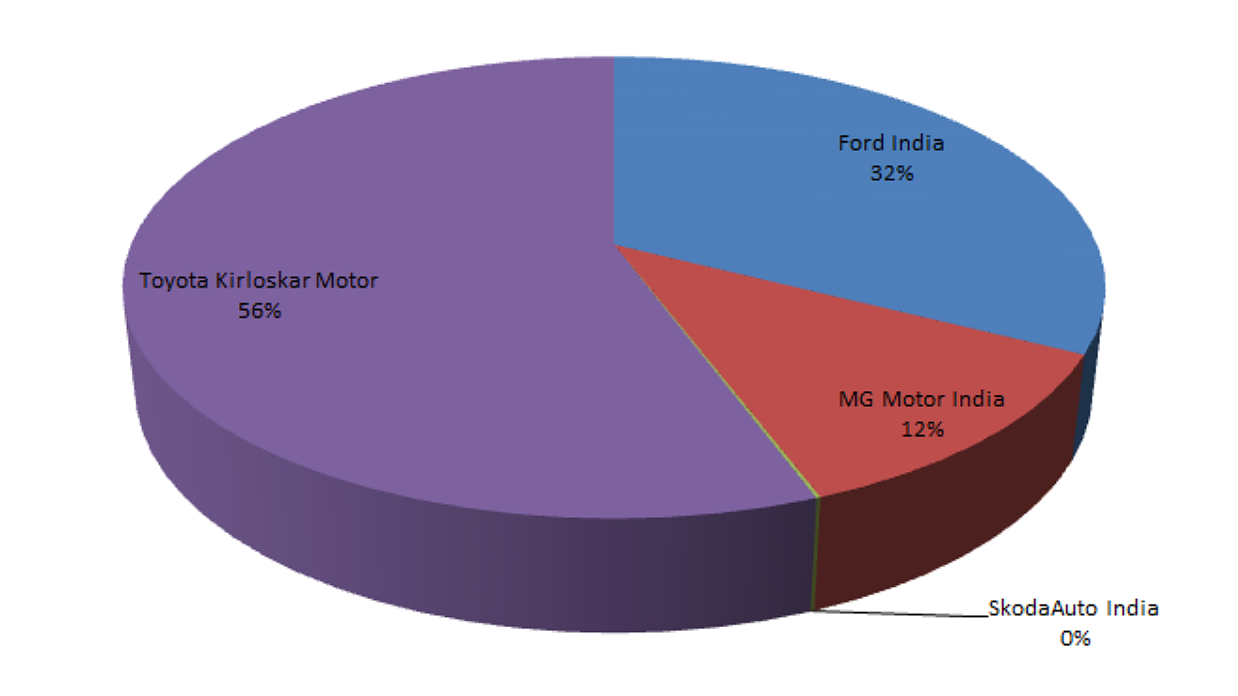

The UV5 segment, represented by vehicles priced above INR 30 lakh, saw total sales of 2,587 units – a healthy 913 units higher than the UV4 segment. In this segment, buoyed by the popularity of the Fortuner and Vellfire, Toyota captured 55.62% of the segment selling a total of 1,439 units. Ford sold 840 units of the Endeavour, and MG Motor sold 305 units of the Gloster SUV, giving the two companies segment share of 32.47% and 11.79% respectively. Skoda sold just three units of the Kodiaq in April.

Not many fans of vans

Vans are a small sub-segment in the overall PV segment, contributing just 4.42% of the total volumes. Within that, almost the entire volume (99.14%) comes from Maruti’s Omni and Eeco models, and the rest comes from Mahindra’s Maxximo and Supro models.

Round-up

In FY21, the PV segment totaled 2,711,457 units with Maruti Suzuki leading the lot with a market share of 47.72%. Utility vehicles were a significant contributor to the overall sales last year with 39.12% share. Interestingly, Maruti Suzuki also led the UV segment with a share of 21.60%, closely followed by Hyundai Motor India with 20.19%. With 17% of the overall PV segment, Hyundai was also placed second overall.

Tata Motors was third in overall standings with a share of 8.27%. Although relatively new, Kia Motors cornered a significant share of the market with 5.74%, only marginally behind Mahindra’s 5.80% share.