The Indian two-wheeler industry continues on its downward slide, and after two successive years of tumbling sales – 13.2% in FY21 and 17.2% in FY20 – the segment is unlikely to return to positive territory this fiscal.

In the first month of the calendar year 2022, two-wheeler sales were the most hit, with domestic volumes witnessing a 21% drop YoY. The situation isn’t different in the April-January period of the current fiscal, with overall two-wheeler sales falling 7.81%.

Though the country experienced normal monsoons last year, the scourge of the COVID pandemic has had a telling effect on income levels, particularly in the rural areas, which severely constrained offtake in two-wheeler sales. The festive season remained damp, leaving manufacturers and dealers sitting on huge inventory.

There is clearly a demand issue for two-wheelers due to lower rural off-take of entry level models, said Rajesh Menon, Director General, SIAM while releasing the data for January 2022. Overall sales in the industry declined YoY, he said, due to both Omicron-related concerns and semi-conductor shortages.

Overall Sales

All three core sub-segments in the two-wheeler industry – scooters, motorcycles and mopeds – performed poorly, both in January 2022 and over the April-January FY22 period. The data used in this analysis piece is from the Society of Indian Automobile Manufacturers (SIAM).

| Two Wheelers | Domestic Sales | Change (%) | Exports | Change (%) | ||

| Jan-21 | Jan-22 | Jan-21 | Jan-22 | |||

| Scooter/ Scooterettee | 4,54,556 | 3,48,704 | -23.29 | 25,595 | 33,369 | 30.37 |

| Motorcycle/Step-Throughs | 9,16,365 | 7,43,804 | -18.83 | 3,58,784 | 3,41,453 | -4.83 |

| Mopeds | 59,007 | 35,785 | -39.35 | 480 | 144 | -70.00 |

| Total Two Wheelers | 14,29,928 | 11,28,293 | -21.09 | 3,84,859 | 3,74,966 | -2.57 |

Moped sales were the hardest hit, with January witnessing a 39.35% drop in domestic sales on a YoY basis, while exports fell a massive 70% with total exports of only 144 units. Domestic sales of mopeds in the first 10 months of the fiscal also dropped 23.31% from a year earlier. Exports, however, in the said period grew 22.64%.

| Two Wheelers | Domestic Sales | Change (%) | Exports | Change (%) | ||

| Apr-Jan FY22 | Apr-Jan FY22 | Apr-Jan FY22 | Apr-Jan FY22 | |||

| Scooter/ Scooterettee | 35,59,086 | 33,04,857 | -7.14 | 1,75,250 | 3,03,658 | 73.27 |

| Motorcycle/Step-Throughs | 81,16,912 | 75,39,698 | -7.11 | 23,79,699 | 34,03,822 | 43.04 |

| Mopeds | 5,21,114 | 3,99,653 | -23.31 | 7,019 | 8,608 | 22.64 |

| Total Two Wheelers | 1,21,97,112 | 1,12,44,208 | -7.81 | 25,61,968 | 37,16,088 | 45.05 |

Likewise, motorcycle sales in January 2022 fell 18.83% to 743,804 units from the 916,365 units the industry accounted for in January 2021. The YTD numbers for motorcycles stood at 7,539,698 units at the end of January, which is 7.11% lower than the same time period a year back. Exports of motorcycles in the April-January FY22 period grew 43.04%, but standalone exports in January were down 4.83% on a YoY basis.

Domestic sales of scooters fell 23.29% in January compared to a year earlier, while the 10-month sales volume in FY22 dropped 7.14%. Scooter exports, however, report positive growth both in January 2022 (30.37%) and in the April-January FY22 period (73.27%).

Honda Leads The Scooter Pack

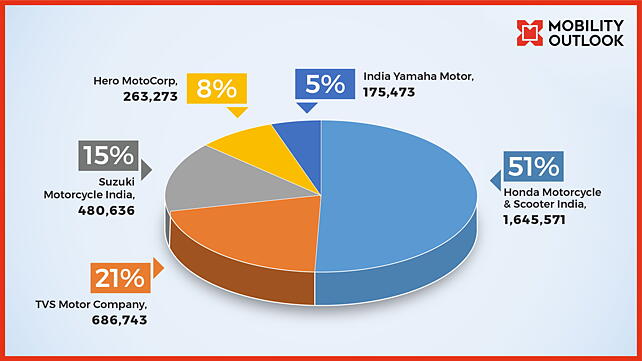

For this particular analytical piece, we focus on scooters. The scooter segment in India is led by Honda Motorcycle & Scooter India (HMSI) with close to 50% share of the market. In the April-January timeframe, HMSI sold 1,645,571 scooters, which gives the company a 49.92% share in the scooter segment, followed by TVS Motor with 20.83% share (686,743 units).

Suzuki Motorcycle India (480,636 units, 14.58%), Hero MotoCorp (263,273 units, 7.99%) and India Yamaha Motor (175,473 units, 5.32%) make up the top five in the Indian scooter market. Piaggio Vehicles with 43,035 units (1.31%) and Bajaj Auto with 1,996 units (0.06%) were the other players in the scooter segment.

In the analysed period, it must be noted that Bajaj Auto reported scooter sales only in the months of December 2021 (728 units) and January 2022 (1,268 units).

Among the top five scooter players, HMSI had a share of 51%, followed by TVS Motor with 21%, SMI with 15% and HMC and IYM with 8% and 5% respectively.

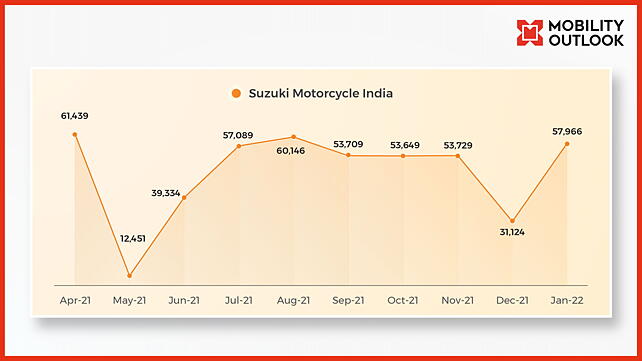

A deeper look at the numbers indicate that most manufacturers lost significant volumes in May 2021 due to the closure of plant operations, as the spread of the Coronavirus wreaked havoc across the country. Readers would also recollect that the country was under a national lockdown in May 2020 due to the virus outbreak.

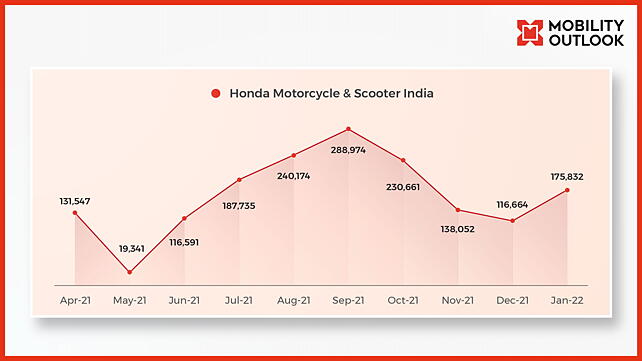

Barring the month of May, where it sold 19,341 scooters, HMSI sold over one lakh scooters consistently every month in the current fiscal. Its highest sales came in the month of September, where it dispatched 288,974 units. In fact, HMSI also dispatched over two lakh scooters in August (240,174 units) and October (230,661 units).

Interestingly, in the 10 month period, HMSI retained over half the scooter market in four months – July (51.25%), August (53.13%), September (55.86%) and January 2022 (50.43%). It marginally missed the 50% mark in October with a share of 49.37%.

When analysed on a month-on-month (MoM) basis, January saw most OEMs return to a growth trajectory after two to three months of fall in domestic sales. Most manufacturers had posted positive growth starting June 2021, after the disastrous performance in May, where collective scooter sales stood at 50,294 units.

In June, sales rose to 241,689 units, which further grew to 366,292 units in July 2021. The momentum continued until September, when cumulative sales of scooters touched 517,239 units, only to drop again in October by a margin of close to 10%.

The spread of the Omicron variant around the time further dampened the spirit of the market, and sales continued to fall until December. From the high of 517,239 units in September, scooter sales dropped to 246,080 units in December 2021 – a fall of 271,159 units, or over 52%.

Although overall sales continued to slide, the New Year seems to have brought some cheer to the scooter makers. Sales in January for the scooter segment saw a growth of close to 42% MoM over the previous month.

Barring India Yamaha Motor, which saw its scooter sales drop about 7% to close at 13,251 units, all other OEMs posted positive growth. Suzuki Motorcycle India saw the biggest jump in sales in percentage terms, growing 86.24% to close the month with 57,966 units. HMSI too grew a handsome 50.72%, while Hero MotoCorp’s scooter sales jumped 25.74%.

TVS with 19.22%, Piaggio with 15.01% and Bajaj with 74.18% – albeit on a small base – also experienced MoM growth.

In Conclusion

Analysts tracking the sector expects this growth trend to continue in the coming months, notwithstanding the uncertainty with regards to the evolving pandemic situation. The industry hoped for some interventions by the government to ease the pressure it is in currently with specific announcements in the budget, but that was not to be. In such a situation, one can only hope there is a positive shift in customer sentiment and income levels over the next couple of months, especially in the rural markets, which will see a strong resurge in two-wheelers in the country.