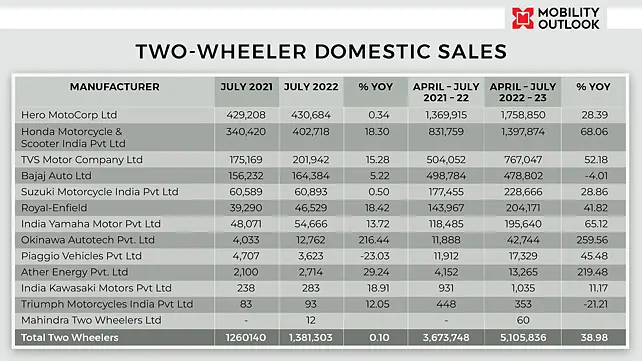

Honda Motorcycle & Scooters India (HMSI) sold 340,420 two-wheelers (motorcycles+scooters) in India during July 2021. Hero MotoCorp, with 429,208 unit sales the month, was the top-selling OEM selling two-wheelers in the country.

Come July 2022, HMSI has sold 402,718 motorcycles and scooters in India, whereas Hero MotoCorp has sold 430,684. The former has been able to shrink the gap between itself and the largest two-wheeler OEM in India, from around 90,000 units in July 2021 to less than 28,000 units in July 2022.

In terms of growth, HMSI grew 18.30% YoY in July 2022. Hero MotoCorp, on the other hand, grew 0.34%. Subhabrata Sengupta, Executive Director, Avalon Consulting, noted that HMSI has done well in its new two-wheeler launches in India.

“HMSI has gained percentage points in terms of market share but keep in mind that it is mainly because of the scooter market bouncing back this year,” Sengupta explained.

Increase In HMSI’s Market Share

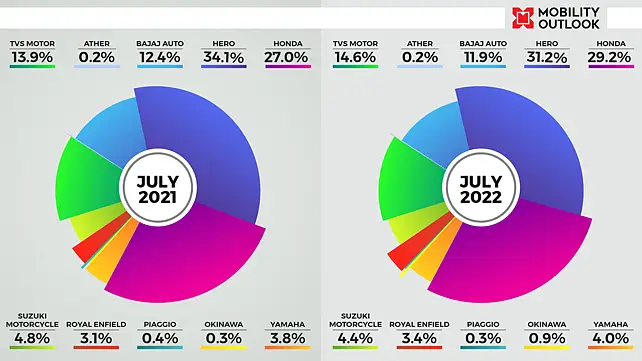

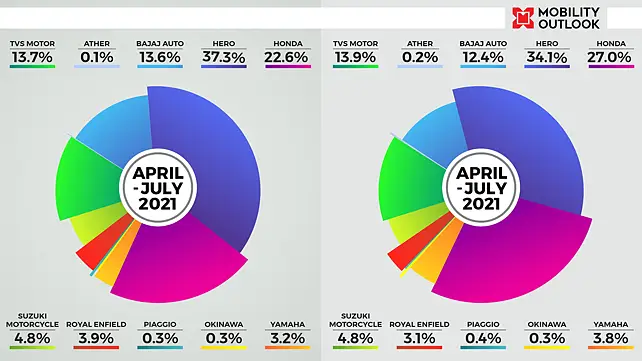

The Japanese OEM selling 402,718 two-wheeler units in India in July 2022 has also resulted in its increasing its market share from 27% in July 2021 to 29.2% in July 2022. Moreover, when looking at the sales figures during April-July figures for 2021 and 2022, the share of HMSI has grown to 27.2% in 2022 from 22.6% in 2021.

HMSI’s presence in the above 250cc segment seems to have helped the OEM capture a bigger share of the overall two-wheeler market in India. Rajagopal Padmanaban, Operating Officer, Premium Motorcycle Business, HMSI, on the sidelines of the OEM’s latest CB300F launch, noted that the company was able to retail over 60,000 premium motorcycles in India during the last 18 months despite COVID-19.

Hero MotoCorp, on the other hand, is not present in India's above 250cc motorcycle market. Notably, HMSI is also targeting to increase its market share in the premium motorcycle category to 25% and has aggressive plans to launch bigger bikes in India.

“I think Hero MotoCorp has chosen to focus on other segments and not the above 250cc segment in India. It’s true that the above 250cc segment is growing, but it is also true that it will never be able to match (even in the next ten years) the numbers of the entry-level segment,” feels Sengupta.

Entry Into 100cc Segment

Hero Splendor, one of the largest entry-level selling motorcycles in India, will soon have competition from HMSI, as the latter had revealed its plans to enter the 100 cc segment in a conversation with Mobility Outlook earlier this year.

“There is a large potential in the 100cc motorcycle market in India. We are somehow missing the right product portfolio. With this new development and the price point which we are targeting, in addition to the brand power, trust, and durability of Honda, I am sure we will get a fair share of this market. It is not about disruption but is about the volume which this segment provides,” one of the leaders from the HMSI team had told the publication.

Numbers sourced from the Society of Indian Automobile Manufacturers (SIAM) report indicate that against 356,173 motorcycles sold by Hero MotoCorp in India in July 2022, HMSI was only able to retail 25,757 units (>75cc but <110cc). However, HMSI outnumbered Hero MotoCorp in scooter sales as it retailed 293,687 units of scooters in India in July 2022, as against Hero MotoCorp’s 22,134 scooter units.

While HMSI has gained market share in scooters, Hero MotoCorp has also gained market share in motorcycles, noted Sengupta. He said, “Bajaj Auto has lost its share in both the markets. It is well known that scooters from Hero MotoCorp have not been received well by the consumers in the country.”

Will Electric Vehicles Make A Difference

Neither Hero MotoCorp nor HMSI has so far introduced an electric scooter or an electric motorcycle in India. Nonetheless, both OEMs have confirmed their electric vehicle plans for India.

While Hero MotoCorp has already unveiled its electric vehicle brand Vida, it is yet to launch an electric two-wheeler under the new brand. HMSI, on the other hand, already has various electric scooters sold in international markets, including Japan. Therefore, it might be easier for the OEM to launch one in India.

Moreover, HMSI has also revealed its battery swap plans for the Indian market and has created a new entity named Honda Power Pack Energy. As the Government of India pushes the OEMs towards battery swap capabilities, HMSI might find it a tad easier to encourage consumers to buy electric two-wheelers launched by the company in the country.

SIAM numbers also reveal that TVS Motor, Suzuki Motorcycles India, Yamaha India, and Royal Enfield have gained tremendous market share in the two-wheeler segment in the country. Bajaj Auto is the sole two-wheeler OEM to have lost market share YoY during April-July 2022 period. As against 498,784 two-wheeler units Bajaj Auto sold in April-July 2021, it managed to retail only 478,802 units during the same period in 2022, leading to a 4% YoY decline.