The Government of India has envisioned electric vehicle (EV) sales to account for 30% of private cars, 70% for commercial vehicles and 80% for two- and three-wheelers by 2030. Nitin Gadkari, Union Road Transport & Highways Minister, had recently said that India will be able to save INR 3.5 lakh crore in crude oil consumption if the country's electric vehicles expand to 40% in the two-wheeler and car segments, and 100% for buses by 2030.

The chances of India achieving this feat, despite it being the fourth largest automobile market in the world, appear bleak as overall EV sales in FY22 were only 429,217 units. Though the segment posted 218.36% growth YoY, EV sales represented approximately 2.5% of the total 16,375,799 units of automobiles sold in the country.

Subhabrata Sengupta, Executive Director, Avalon Consulting, in an interaction with Mobility Outlook said, “EVs have significantly gained market acceptance in the last couple of years. The numbers are good now. The automobile market will continue to shift as EVs are gaining more and more acceptance. However, there's a lot that needs to be accomplished in terms of an EV Ecosystem. Charging will remain a key parameter as a lot of Indians live in apartments and it is still not clear on how the charging will be enabled in such spaces.”

These issues, as per Sengupta, will majorly haunt the electric four-wheeler market. The same will not have a big effect on the sales of electric two- or three-wheelers market. Even segments such as small cargo vehicles – both three and four-wheelers – are unlikely to be affected as battery swapping and commercial EV charging infrastructure abilities continue to grow.

Atul Chandel, Director, Autobei Consulting, shared, “I think the focus shared by the government of India are more of political statements. The aim behind sharing such targets is primarily motivating people and the industry. I do not think we will be able to achieve EV adoption to the tune the government of our country has set. The case even in Europe is the same!”

Segment Wise EV Vs ICE Sales

| Segment | FY 22 | FY 21 | YoY (FY 21) | FY 20 | YoY (FY 20) |

| 2W | 1,19,73,415 | 1,15,33,928 | 3.81 | 1,68,46,527 | -28.93 |

| e2W | 2,31,338 | 41,046 | 463.61 | 1,40,684 | 64.44 |

| 3W | 3,88,093 | 2,58,172 | 50.32 | 7,19,643 | -46.07 |

| e3W | 1,77,874 | 88,391 | 101.24 | 1,40,684 | 26.44 |

| PV | 27,26,047 | 23,87,925 | 14.16 | 27,74,340 | -1.74 |

| ePV | 17,802 | 4,984 | 257.18 | 2,280 | 680.79 |

| CV | 2,203 | 400 | 450.75 | 493 | 346.86 |

| eCV | 6,52,125 | 4,49,324 | 45.13 | 8,82,524 | -26.11 |

(Source - FADA)

Commuter e2W

India, thanks to the commuter motorcycle segment, is the largest two-wheeler market in the world. The overall two-wheeler segment, out of 16,375,799 units of automobiles sold in FY22, accounted for more than 73% of the market share selling 11,973,415 units. Of these, only 231,338 were electric two-wheelers.

In terms of growth, while electric two-wheelers increased 463.16% YoY in FY22, the overall two-wheeler market grew by 3.81% YoY. In volume terms though, e2Ws accounted for just 1.9% of the total number of two-wheelers sold in India during the last fiscal.

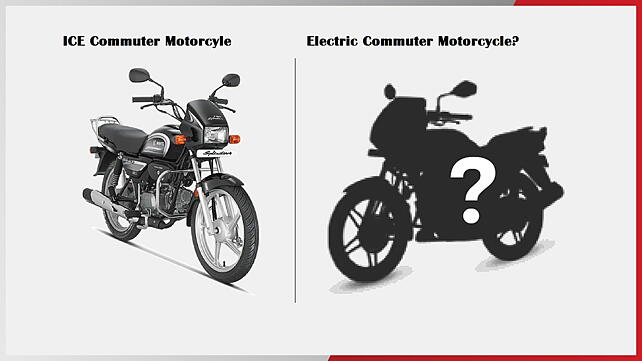

The adoption of e2Ws, as per Sengupta, can increase dramatically if the electric vehicle industry can introduce electric alternatives to the likes of Hero Splendor and other commuter bikes.

“Most of the two-wheeler electric brands are only retailing electric scooters in India but the country's favourite two-wheeler segment is the 100-110 cc motorbikes. Any OEM launching a good alternative to these ICE commuter bikes will not only be able to post good numbers, but it will also help India adapt to more two-wheeler EVs,” explained Sengupta.

Sengupta argued that rural consumers look to invest in heavy products due to the prevailing road conditions in villages and Tier 4 towns. These consumers, he argued, do not perceive scooters as products fit for rural roads and that is why OEMs need to work on introducing electric alternatives to commuter motorcycles.

For the records, Hero MotoCorp sold 234,085 Splendor units in April 2022 to grab the top spot in the two-wheeler market. Honda Activa, on the other hand, had grabbed the second spot with a total sales of 163,357 units during the same month.

Hemal Thakkar, Director, CRISIL, said, “Launch of a commuter e2W motorcycle will, and should, help in increasing the adoption of EV in the 2W market. The only player in the market right now is Revolt. There are a few launches slated like the Kratos. Things are pretty naive from an electric commuter motorcycle segment but we feel there will be action.”

Thakkar said sales in the electric 2W segment, till 2026, are going to be dominated by electric scooters. The performance motorcycle segment will also benefit a lot if electric versions of performance 2Ws are launched in the country.

“I think the price differential between the ICE and electric versions of the performance motorcycles is going to be very low and that is going to increase the adoption in the segment. The price differential in case of commuter bikes is going to be very important. A lot will hesitate in shelling out INR 130,000 for an alternative to a commuter motorcycle priced at INR 65,000,” he said.

Three-Wheeler, The Second Favourite

Electric three-wheelers are India's second most preferred type of electric mobility solutions. Data sourced from FADA points out that the country sold a total of 388,093 three-wheelers in FY22, of which electric three-wheelers accounted for more than 45% (177,874 units).

While the e3W segment grew by over 101% YoY in FY22, collectively – with ICE and EVs put together – the 3W segment grew by 50.32% YoY. Notably, e3Ws were also the second most selling EV segment in India in FY22.

“The e3W market is mainly e-rickshaws. It is very difficult to predict what will happen in the e-rickshaws segment as there are some cities which allow e-rickshaw and there are some which do not allow the same. The regulatory space will need to come up with clear answers or the e-rickshaws sales will hit a ceiling,” shared Sengupta.

The government's upcoming policy around battery swap might further aid the segment by mandating battery swap options in the electric three-wheeler industry. Honda, one of the mobility giants of India, has already entered the segment and started pilot runs of three-wheeler battery swapping in Bangalore. The OEM has plans to expand to more than 10 metro cities in India by the end of 2022. Moreover, Charge-up, a start-up Mobility Outlook recently spoke to said it had already set up 120 battery swap stations for two- and three-wheelers in Delhi.

“Goods-carrying e3Ws would be a more interesting place to be in. This segment will heat up with launches from the likes of Piaggio, Bajaj, Atul and other players. I would rather club this space with small electric four-wheeler cargo vehicles,” said Sengupta.

E-rickshaws, as Thakkar pointed out, are lead-acid battery dominated, and are meant for short travels. He argued that it would not be fair to compare these to ICE autos and three-wheelers as e-rickshaws are largely replacing conventional rickshaws driven using human labour.

“Most of these are sold in states like UP and Bihar, where the rickshaw pullers are replacing these with the e-rickshaws. I don't think the government will allow e-rickshaws in cities like Bangalore because there is no space available and they will be more prone to accidents,” said Thakkar.

EV Fires, Finance A Concern

Chandel argued that the recent EV fire incidents will also create short-, mid- and long-term impacts in the EV industry. “I see EV two-wheeler sales going down by at least 20% in the short-term, and if these accidents continue to occur, we will see a huge blow being delivered to the e2W industry on a long-term basis as well,” he said.

Electric scooters from start-ups including Ola Electric and Jeetendra EV have made news recently.There were fire incidents reported around electric scooters from Okinawa as well. Chandel noted that the OEMs and the government will have to work together to introduce safe products to increase adoption of 2W EVs in India.

“The OEMs need to make extra efforts to educate people about how to safely use a 2W EV. Not that ICE vehicles do not catch or have not caught fire in the past, but the EV industry is in its early adoption phase and OEMs will need to be careful of all product launches. Early perceptions created in the mind of consumers stay there for a long time,” explained Chandel.

EV finance, on the other hand, continues to be a big challenge as well, highlighted Thakkar. A lot of NBFCs and auto loan lending firms have not yet started financing EVs in the country. “Financing of EVs is going to be a critical aspect. If the government takes right directions on the financing front then we could have better penetration,” he said.

Sorting the finance challenges, Thakkar explained, would positively affect the EV buses and electric 3W verticals as both these depend a lot on getting the automobiles financed.

Conclusion

Sengupta is of the view that sales of ICE vehicles would continue to account for a lion's share till 2027. The 2W and 3W segments will continue to dominate sales in the EV industry. The growth in the e4W segment depends on the choices the end consumers have in the market. Presently, only a few models of e4Ws are available in India.

“The penetration of e2Ws will increase to at least 30% by 2027-2030. These numbers can go up to 70% if the right policies and infrastructure are developed in India. Penetration of 4Ws will continue to be in the single-digit ratio, while electric commercial vehicles will gather better response than the electric PV segment,” shared Sengupta.

Thakkar feels that the electric 2W penetration would also be the highest in India by 2030 (50-60%). It would be followed closely by electric three-wheelers, while the PV segment would not go beyond 20% EV penetration by that time.

Though the number of two-wheelers selling in India, whether ICE or EV, will always be much higher than the passenger cars, the value creation by the latter, as per Sengupta, will always mean more wealth creation for the Indian automobile industry.

“The e2W market in India is much bigger than the e4W market. But in terms of value, the 4W market is larger than the 2W market,” noted Sengupta.

The e4W segment would create more value for the automobile sector once the subsidies announced by the Central and state governments are done away with, as the same would mean more cash flow for OEMs and other parties involved in selling electric cars.

It is worth mentioning here that the Central Government is currently offering a subsidy of INR 10,000 per kWh of battery size on an electric car. These subsidies amount to much higher discounts when clubbed with EV subsidies offered by different states. Moreover, there are states which also offer free registrations on EV purchases.