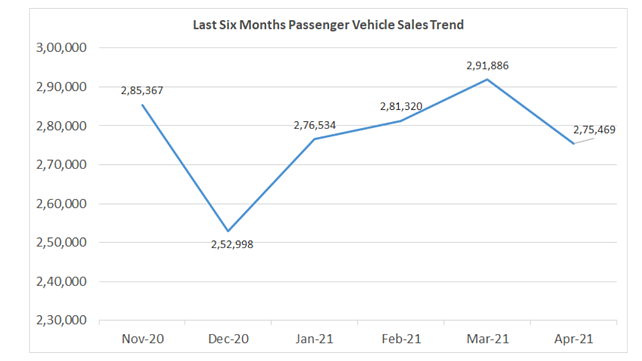

The growth trajectory that the Indian passenger vehicle segment had witnessed in the second half of FY21, has hit a hurdle with the second wave of the deadly COVID-19 pandemic. Although not as disastrous as April 2020, where a national lockdown led to the industry report zero sales, the last month saw passenger vehicle sales decline 7%, when compared to March 2021 sales numbers.

Mobility Outlook has analysed and compared wholesale numbers of carmakers on a month-on-month basis, treating the month of April 2020 as an exemption.

According to Motilal Oswal, demand momentum slowed due to the COVID-19 impact. New bookings declined by 30-50%, while cancellations were ~10%. The waiting period has increased due to supply chain constraints at the OEM level. Dealers currently are holding 10-20 days of inventory.

Source: SIAM

India’s largest carmaker, MSIL reported a decline of 2.6% at 142,454 units last month, when compared to 146,203 units in March 2021. However, the company says there will be minimal to no impact on production due to COVID-19. A couple of days the company had also announced its decision to advance its annual maintenance from June to the first nine days of May.

“Dealer inventory and factory inventory is low, so wholesale will be as per the plan. However, we need to see if there is a shortage of parts and oxygen for the auto parts industry, which might impact production in the long run. There is a lockdown in nine states, which comprises 38% of our sales. So, retail would be affected for the month of April. And if lockdown continues, it will have an impact on May sales as well,” said Shashank Srivastava, Executive Director (Marketing & Sales), MSIL.

| OEMs | April 2021 | March 2021 | % Change |

| Maruti Suzuki | 142,454 | 146,203 | -2.6 |

| Hyundai | 49,002 | 52,600 | -6.8 |

| Tata Motors | 25,095 | 29,655 | -15.4 |

| Mahindra | 18,285 | 16,700 | 9.5 |

| Kia | 16,111 | 19,100 | -15.6 |

| Toyota | 9,622 | 14,997 | -35.8 |

| Honda | 9,072 | 7,103 | 27.7 |

| MG Motors | 2,565 | 5,528 | -53.6 |

| Total* | 272,206 | 291,886 | -6.7 |

Source: Industry Reports

*Six carmakers are yet to release their data.

South Korean car manufacturer, Hyundai sold 49,002 units in April 2021, reporting a single-digit decline of 6.8%, when compared to 52,600 units it sold in March 2021. Similarly, Pune-based Tata Motors sold 25,095 units last month, a drop of 15.4% in domestic sales, when compared to March 2021.

“PV demand momentum has slowed, with people postponing their purchases. Inventory levels for PVs are below normal (less than 20 days), with a waiting period of six to eight weeks in fast-selling models,” said Motilal Oswal in a report.

Only Honda Cars and M&M slid into the green zone on a month on month basis. Veejay Nakra, Chief Executive Officer, Automotive Division, M&M said, “The month of April registered a growth of 9.5% in our passenger vehicles segment as compared to March 2021. With the increase in lockdown restrictions in many parts of the country we foresee continuing supply chain-related production challenges.”

“While demand remains good, there would be some impact in the first quarter as a result of low customer movement and dealership activity due to the lockdown restrictions. In times like these, our focus is the well-being and safety of all our associates and those of our dealers. Our customers will continue to experience unrestricted personalised as well as digital & contactless sales and service support,” he further said.

Disclaimer: Only eight out of 14 carmakers released their sales data till the time of publishing the report.