Despite the continuous efforts of OEMs to mitigate the risk of the semiconductor shortage, passenger vehicles continue to remain in the doldrums as the segment recorded a 22.03% decline in October 2021 wholesales, as per the reports from the industry.

However, the situation is improving on a MoM basis as the segment recovered by 39% in dispatches to dealers. As a result, the segment witnessed sales of 2,60,163 units in October 2021 compared to the previous month's wholesale 1,85,953 units.

Being a festive period, retail volumes are likely to be higher than the wholesale volumes by over 10% as per Emkay global estimates.

Industry experts have indicated that the only factor holding back the passenger vehicle segment is the chip shortage as there is a long waiting period of up to one year on popular products. This time no other factor such as high fuel prices or affordability is playing a role here.

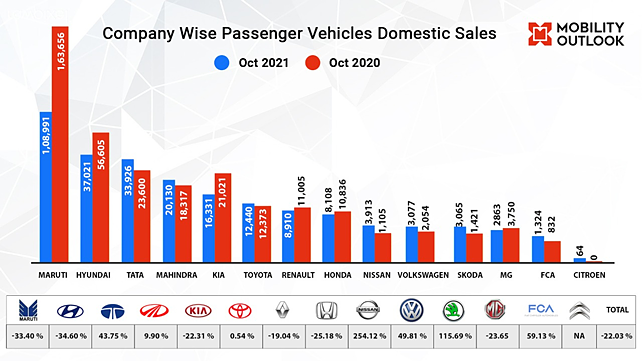

India's largest carmaker, Maruti Suzuki, recorded a decline of 33.40% at 1,08,991 units in October 2021 compared to 1,63,656 units in the same period last year.

The carmaker had already indicated the production of up to 40% at the starting of October month. Due to which the market share has been sliced by 7.16 basis points.

Similarly, Hyundai Motor India's market share declined by 14.23% at 37,021 units in October, recording one of its steepest declines. On the other hand, Tata Motors recorded growth in double digits of 43.75% in October by selling 33,926 units inching closer to Hyundai Motor India.

This is also Tata's highest ever sales in a decade at a time when OEMs are struggling to produce enough cars to meet the demand. As a result, the carmaker market share zoomed to 13.04% in Oct 2021 compared to a 7.07% market share in the same month last year.

Gaurav Vangaal, Associate Director, IHS Markit, said Tata Motors managed well in monitoring the semiconductor supply while vocal for a local statement by the Honourable Prime Minister also helped them. 'Secondly, Tata has well captured the white space of safer cars while market leaders are still struggling to tradeoff safer cars with fuel-efficient vehicles., he added.

According to Ravi G Bhatia, President & Director, Jato Dynamics, said there are two factors at play; one is production constraint caused by supply chain disruption for some OEMs due to which they are not able to produce optimally, and on the other hand, there are OEMs who have managed the new product launch cadence of launching new products and are getting traction.

This is the sole reason of Czech automaker Skoda Auto India sales jumped by 115.69% in October 2021 on the back of its recently launched SUV, Kushaq. Similarly, its sister company Volkswagen India sales bounced by 49.81% in the same month after the launch of Taigun.

Analysts tracking the industry have indicated that chip shortage will lead to a subdued festive season. However, this is the major concern for the dealers as 40% of the annual sales come from the ongoing festive season.