With the ease of lockdown restrictions and OEMs restarting the factories in June, the auto sector wholesales (vehicles dispatched from factories to dealerships) rebounded to 3,180,039 in Q1FY22, recording a triple-digit growth of 113% when compared to 1,492,612 units of the same quarter last year recovering from the lost volumes of April and May, according to Society of Indian Automobile Manufacturers Association (SIAM)

However, the industry is nowhere near the pre-pandemic year when it sold a total of 6,084,478 units in Q1FY20. When compared to this, the Q1FY22 sales are down by 47.73%.

According to the Centre for Monitoring the Indian Economy (CMIE), about 15 million people lost their jobs in May alone because of the second wave that emerged in mid-April 2021 and lasted till the end of May.

Industry experts say that though there is some revival when looking at the comparative numbers, the actual health of the auto sector is very grim. On the supply side, there is a shortage of semiconductors and rising commodity prices that eventually will increase the prices of vehicles. These will affect the overall consumer affordability factor, which will impact demand badly in the coming months. Moreover, most of the current demand is the carryover from the previous months.

These will affect the overall consumer affordability factor, which will impact demand badly in the coming months. Most of the current demand is the carryover from the previous months.

The notable point is that the Indian economy shrunk by 7.3% last year, affecting the lower and middle-class incomes. According to a study by Azim Premji University, the daily wage has dropped below INR 375. Moreover, there has been a decline in food consumption due to the lockdown.

This is mainly because the two-wheeler sales have not picked up after the first lockdown as the major buyers of the segment face huge income losses.

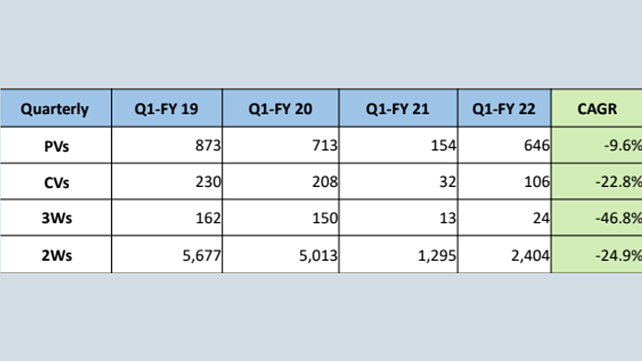

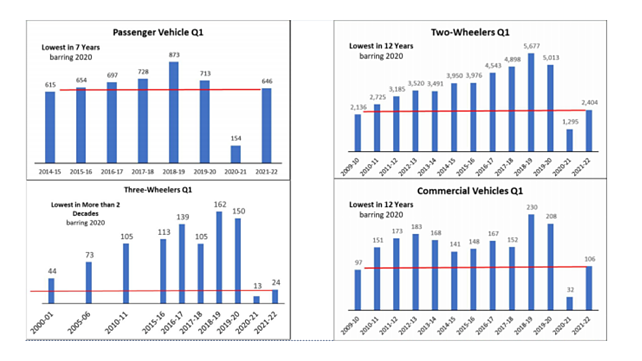

The two-wheeler segment sold only 2,403,591 units in Q1FY22, a 12-year low, barring the first quarter of FY21. Even in CAGR terms, the two-wheeler segment has declined by 24.9% over the last four years.

Similarly, the factory shutdowns and work and study from home have impacted the three-wheeler segment, which also saw a steep decline of 46.8% in the last four years. In absolute numbers, the three-wheeler segment could sell only 24,376 units in Q1FY22.

Industry leaders indicate that the three-wheeler as a segment is also undergoing a transition as most of the cargo or load carrier segment is now being driven by electric vehicle startups.

Only the passenger vehicle segment has shown a strong rebound in sales as people prefer personal mobility to public transportation.

Rajesh Menon, Director General, SIAM, said, in Q1FY21, the Indian automobile industry had less sales because of the nationwide lockdown induced by the first wave of the pandemic. This year too, in Q1FY22, sales were subdued due to the impact of COVID second wave.

Highlights: Sales of all segments were lower in the past several years, barring Q1FY21.

- PV segment registered sales of 6.46 lakh vehicles in this quarter, which is the lowest in the past seven years, barring Q1FY21

- Sales of 1.06 lakh units for the commercial vehicle segment and 24.04 lakh units for the two-wheeler segment were lowest in the past 12 years, barring Q1FY21.

- The three-wheeler segment was the worst hit with sales of just about 24,000 units, which has been lowest in more than two decades, barring Q1FY21.